SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

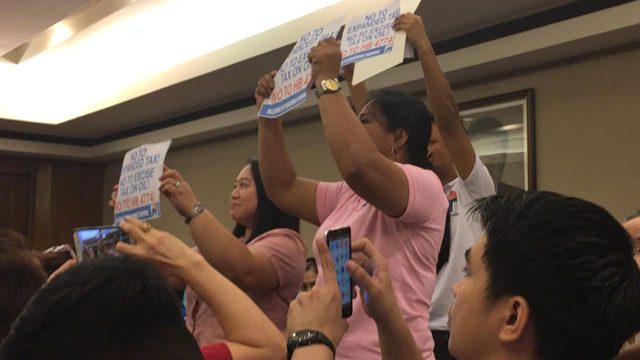

MANILA, Philippines – Three teachers disrupted the House and Ways Committee hearing on Wednesday, February 1, to oppose the Department of Finance’s (DOF) tax reform package.

Finance Undersecretary Karl Chua had just finished his presentation before congressmen when 3 members of the Alliance of Concerned Teachers (ACT) National Capital Region (NCR) Union stood up and starting shouting, “No to e-vat! No to excise tax! Tax the rich, not the poor!”

Another member of their group immediately snatched away their signs and asked them to keep quiet. Security personnel from the House then escorted them out of the Rolando Andaya Hall.

Joy Martinez, one of the protesters, argued that the first batch of tax reforms proposed by the Department of Finance is detrimental to the poor.

Security personnel from the House immediately took their signs and asked them to sit

“Pagdating ng sweldo namin, ‘yung tax, bawas na eh. So itong excise tax na e-VAT na ‘to, another kind of tax na naman ‘to na kami na naman ang maapektuhan nito. Ano ba ‘yung ita-tax ng excise tax? Mga langis! Eh alam naman natin eh ‘yung direct hit nito ay ‘yung mga mahihirap,” said Martinez.

(By the time we get our salary, it’s already reduced. This excise tax and e-VAT will surely affect us. The excise tax will be imposed where? On fuel! We know the poor will have a direct hit.)

The DOF’s first batch of proposed tax reforms included the restructuring of the personal income tax system and the expansion of the value added tax (VAT) base by reducing the coverage of its exemptions.

The maximum rate of personal income tax will be reduced over time from the current 32% to 25%, except for high income earners.

But the DOF is proposing an increase on fuel excise tax and the restructuring of the excise tax on automobiles, except for buses, trucks, cargo vans, jeeps, jeepney substitutes, and special purpose vehicles.

The tax reform package also includes a proposal to exempt those earning less than P250,000 from tax payment.

Critics in and out of government have since argued that the tax reforms are “anti-poor,” prompting the DOF to submit a revised proposal on January 17.

Under the new proposal, the government will no longer tax employees’ 13th month pay and other bonuses amounting to P82,000 and below. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.