SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – When it comes to providing social security, the government has recently made strides in ensuring the welfare of senior citizens.

President Rodrigo Duterte, last January, granted the P1,000 pension hike for Social Security System (SSS) beneficiaries. The Department of Social Welfare and Development (DSWD) also has a larger budget for social pension for indigent seniors, effectively doubling the target coverage from 1.3 million elderly in 2016 to 2.8 million this year. (READ: EXPLAINER: Are SSS pension funds in peril?)

Despite these, a study by the Coalition of Services of the Elderly (COSE), in partnership with HelpAge International, showed that 38% of senior citizens will still not be provided with social pension. It also said 34% of SSS members receive less than P2,000 every month. Majority of the workers are also in the informal sector, unable to sustain their SSS membership.

COSE and HelpAge International are pushing the government to make universal pension a priority policy. Universal pension would cover all senior citizens in the country, not only the indigents and those enrolled with the SSS or the Government Service Insurance System (GSIS).

The DSWD, through its Social Pension Program for Indigent Senior Citizens (SPISC), grants P500 monthly pension for the elderly living in poverty.

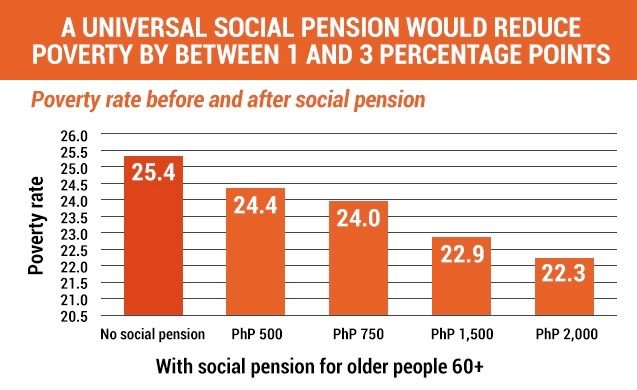

Using data from the Annual Poverty Indicators Survey (APIS) released in 2013, the study did a simulation that shows the poverty rate would be reduced from 25.4% to 22.3% if a P2,000 universal social pension is provided. This is equivalent to around 3 million Filipinos that would be lifted out of poverty.

Retaining the P500 social pension, the simulation showed, will only result in a one percentage point decrease of 24.4% or equivalent to 1 million Filipinos.

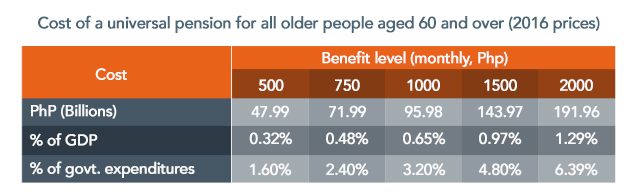

The study said the government, realistically, could increase the amount of social pension to P1,500 monthly. This would cost P143.97 billion or 0.97% of the country’s gross domestic product (GDP) and 4.80% of its expenditures.

Affordable?

COSE noted that the budget allocated for retired soldiers, police officers, and judges under the Pension Gratuity Fund has increased from P110 billion in 2016 to P142.3 billion in 2017. The budget for the SPISC also doubled from P8.7 billion last year to P17.9 billion this year.

“In the short term, the P32.3 billion increase in PGF and the current 2017 budget of P18 billion for social pension, if summed up, would be more than sufficient to fund a universal pension of P500 for all older people, closing the coverage gap while gradually increasing to P1,500,” said COSE executive director Emily Beridico.

The study also suggested that institutionalizing social pension may be a replacement for the value-added tax exemption senior citizens are currently receiving.

Republic Act 9994 or the Expanded Senior Citizens Act of 2010 exempts senior citizens from VAT when paying for medicines, public transportation, domestic airfare, hotels, restaurants, recreation centers, and funeral expenses. (READ: FAST FACTS: What benefits are senior citizens entitled to?)

According to the study’s analysis of the Family Income and Expenditure Survey 2012, this exemption benefits more well-off seniors than the poorer ones. The sruvey showed that richer households headed by older people spend 13% of their income for the products or services stated in RA 9994 while poorer households only spend 7%.

“[This suggests] that for the richest 5% of older people, these VAT exemptions result in a cash transfer of around P435 additional income per month, while for the poorest 5% [only has an additional income of] P7,” said the study.

A universal pension of P1,500, the study added, “would be [the] far more progressive and pro-poor option.”

The Department of Finance (DOF) earlier eyed the removal of VAT exemptions for senior citizens to offset the effects of lowering personal income tax, but this plan has since been junked.

The DOF instead plans to impose excise tax on petroleum products, which is still seen to affect the poor since it could lead to increases in the prices of other goods. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.