SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

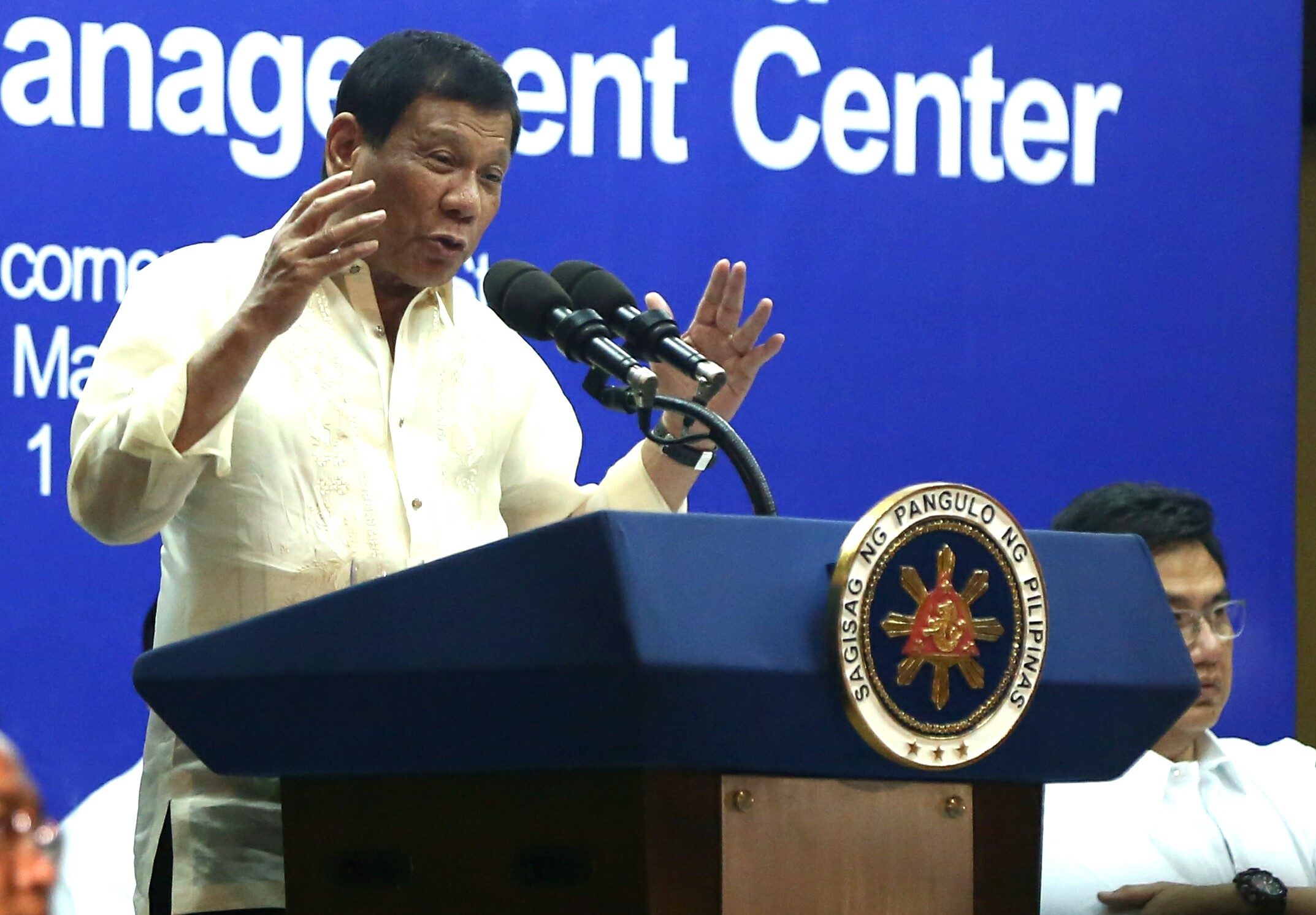

MANILA, Philippines – President Rodrigo Duterte on Saturday, May 13, said that the additional P3 million he accumulated in the last 6 months since he assumed the presidency was from excess campaign donations.

“Sobra iyan na dumating, wala na ang purpose ng pera (That’s excess donated money, it has no purpose anymore),” he told reporters after meeting with the Filipino community in Hong Kong.

Based on his latest Statement of Assets, Net Worth, and Liabilities (SALN) released by the Office of the Ombudsman on Friday, May 12, Duterte’s net worth stood at P27,428,862.44 as of December 31, 2016.

It is P3,348,768.4 higher than the P24,080,094.04 he recorded as of June 30, 2016.

According to Duterte, he included the excess campaign donations in his SALN because he did not know who to give them back to. He added that he paid taxes for it.

“Hindi ko na malaman kung sino-sino,” he said. “Iyan ang dineclare ko na income, eh iyan ang nasa kamay ko eh.”

(I don’t know anymore who gave it. That’s what I declared as income because that’s what’s on hand.)

Duterte’s Statement of Contributions and Expenditures (SOCE) submitted to the Commission on Elections (Comelec) showed that he used P371,461,480.23 of the P375,009,474.90 worth of contributions he received for his campaign.

Most donations came from top businessmen in Davao City and Manila. (READ: Who’s who in Duterte’s poll contributors list)

But what should be done with unspent campaign money?

The Bureau of Internal Revenue (BIR) has urged candidates, whether losers or winners, to return unspent campaign funds to donors.

If it is not possible, unused campaign contributions are then considered as income and therefore subject to tax.

According to Section 2 of Revenue Regulation No. 7-2011: “unutilized/excess campaign funds, that is, campaign contributions net of the candidate’s campaign expenditures, shall be considered as subject to income tax, and as such, must be included in the candidate’s taxable income as stated in his/her Income Tax Return (ITR) filed for the subject taxable year.”

Senate Bill No. 296, filed by Senator Aquilino Pimentel III in July 2016, meanwhile, aims to implement a uniform tax for excess campaign contributions. The bill is still pending at the committee level. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.