SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

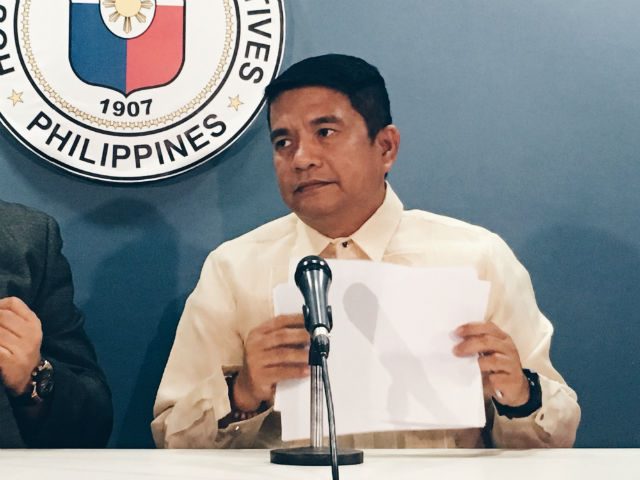

MANILA, Philippines – House committee on cooperative development chairperson Rico Geron warned loan interest rates would increase by 5% to 6% if the value-added tax (VAT) exemptions for cooperatives are lifted.

The Agricultural Sector Alliance of the Philippines representative was asked to react to the provision under the proposed tax reform package removing the VAT exemptions for cooperatives, except those selling raw agricultural produce. (READ: Duterte’s tax reform: More take-home pay, higher fuel and auto taxes)

“So imagine mo kung ang coop ay nagpapahiram ng puhunan lalo na sa mga maliliit na negosyante na naghahanap-buhay na pinapatawan lamang natin ng increase na very minimal and it’s only the coops doing that. Around 5% to 6% ang idadagdag doon sa sisingilin,” said Geron.

(So imagine if the coop lends capital to small business owners and only imposes upon them a very minimal increase, and it’s only the coops doing that. Around 5% to 6% will be added to their interest rates.)

“We have different rates. Kung tayo ay nagpapautang sa kasalukuyan ng 12% to 16%, eh dagdagan pa ‘yan ng 5% to 6%, maaaring umabot pa ‘yan ng more than 20%,” he added.

(If we’re lending with rates between 12% and 16% and then you add 5% to 6%, then it may increase to more than 20%.)

The first package of tax reforms proposed by the Department of Finance (DOF) includes the lowering of personal income tax rates and the reduction of VAT exemptions for some sectors like cooperatives to counter revenue loss.

The DOF estimates around P5 billion in government revenue will be generated by lifting the VAT exemptions for cooperatives.

While some groups and lawmakers dubbed the tax reform package “anti-poor,” the House ways and means committee already approved House Bill (HB) Number 5636. Ways and means panel chairperson Dakila Cua is expected to sponsor the bill for 2nd reading this week.

Geron, who is representing a cooperative, said he is generally supportive of the tax reform package. But what will happen if the removal of the VAT exemptions for cooperatives will remain in HB 5636?

“Well, being the chair of the committee on coop, I have no option but to go against the bill,” said Geron.

Aside from Geron, two other lawmakers are representing cooperatives – Cooperative NATCCO Network Party Representatives Anthony Bravo and Sabiniano Canama.

Party-list coalition mulling to abstain

The 47 lawmakers of the House party-list coalition are also against the proposal to remove the VAT exemptions for cooperatives.

“These are social enterprises designed to make the income more inclusive, meaning to say, to help its members,” said Batocabe. “So if you’re going to impose taxes, especially for small and medium-sized cooperatives, they will die a natural death.”

He added that one of the compromises the party-list coalition is trying to make with the rest of their colleagues and the DOF is just to continue taxing larger cooperatives.

Batocabe said the party-list lawmakers are also considering abstaining from voting on HB 5636 if VAT exemptions for cooperatives are removed. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.