SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

Is it true that the prices of automobiles are affected by the Tax Reform for Acceleration and Inclusion (TRAIN) law?

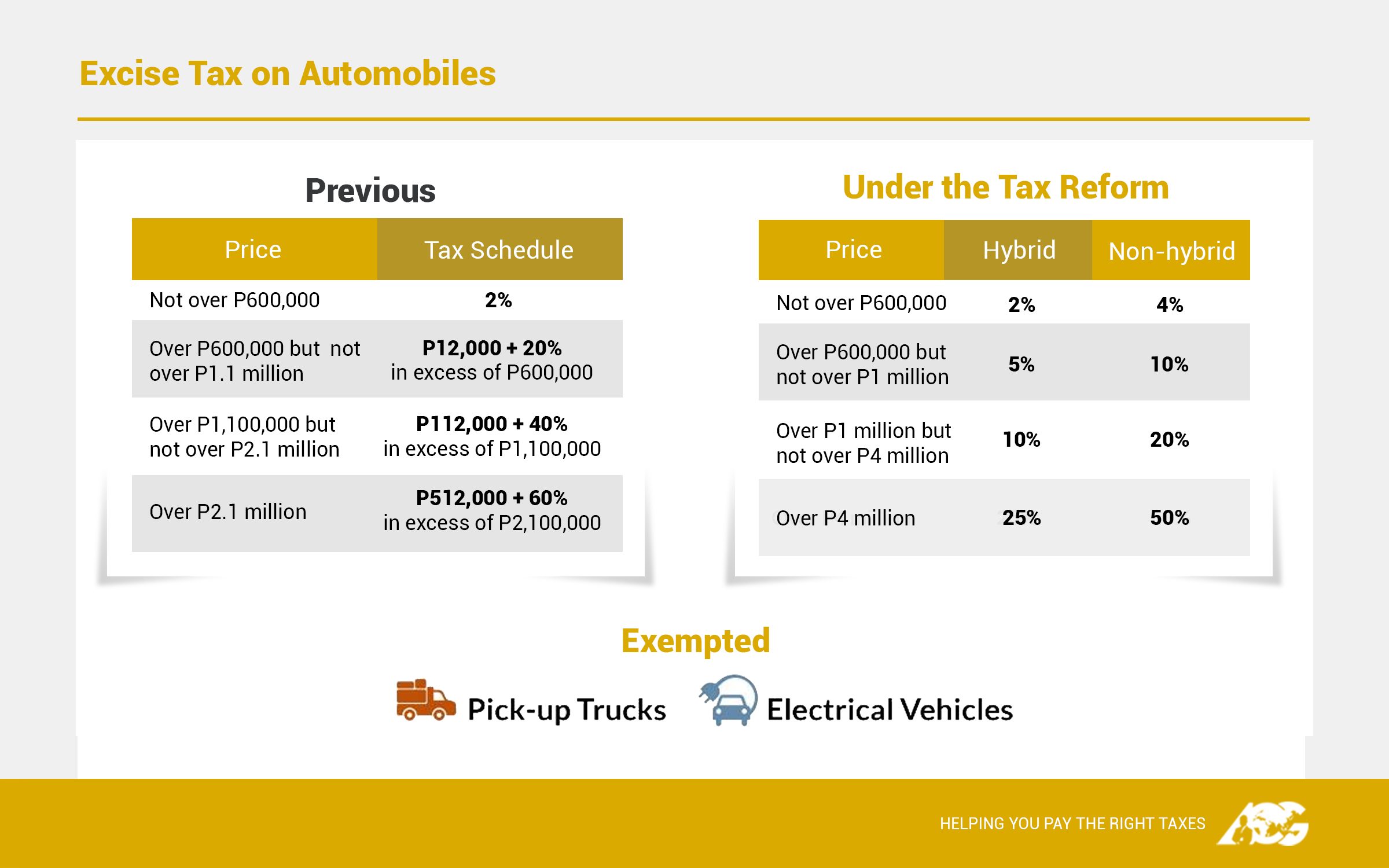

Yes. In general, the excise tax on automobiles is now higher. Previously, there were also no exceptions for the excise tax on automobiles. However, under the TRAIN law, pick-up trucks and electrical vehicles are classified as excise tax-exempt. Hybrid vehicles are subject to only half of the regular tax rates. The new excise tax rates are as follows:

If I want to buy a Toyota Vios or Honda City, how much will be the price now considering the higher excise tax under the TRAIN law?

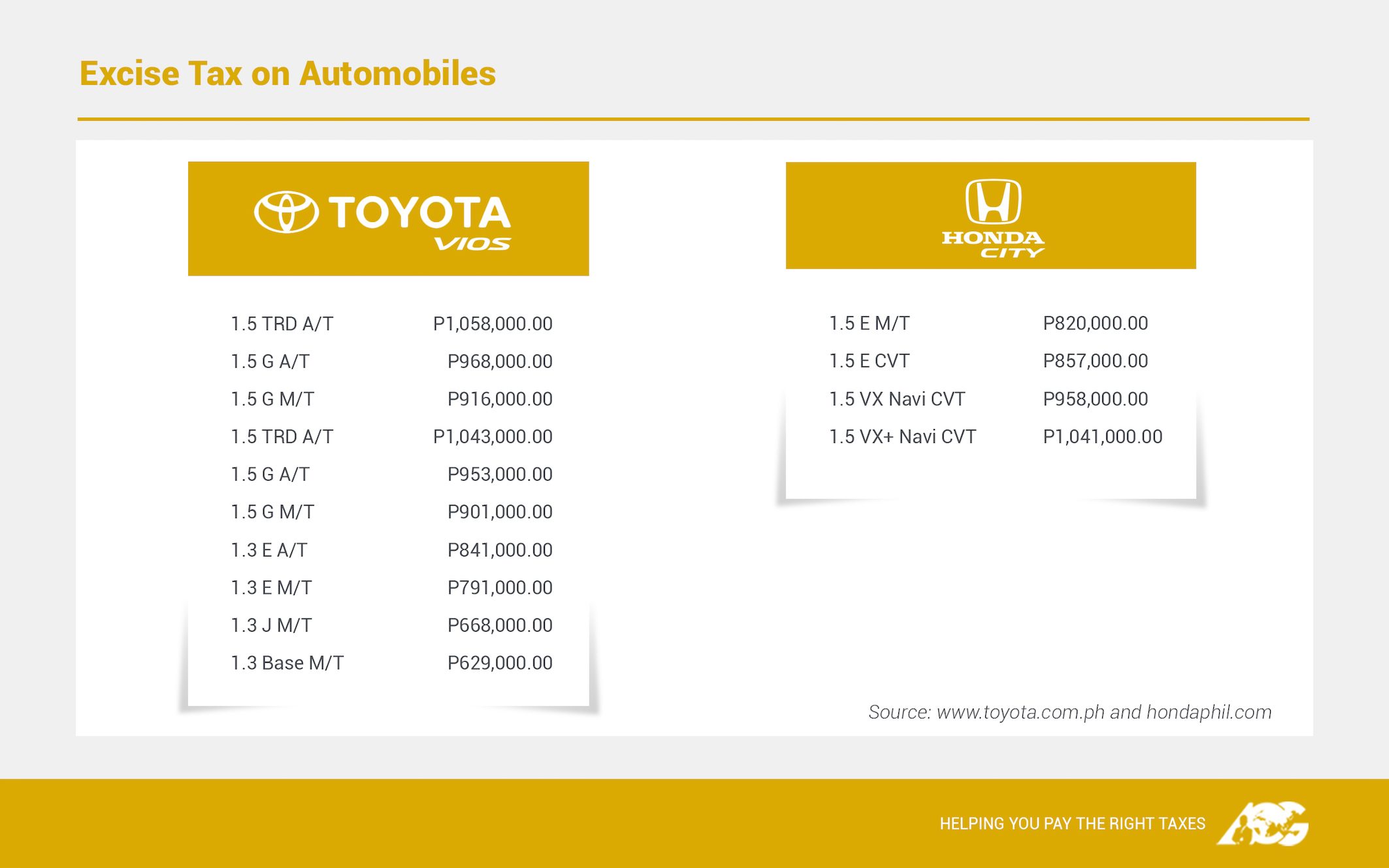

Since the Toyota Vios and the Honda City are not pick-up trucks, electrical vehicles, or hybrid vehicles, they are subject to the full excise tax rates as shown above. Currently, the suggested retail prices for the Toyota Vios and the Honda City are as follows:

If you have more questions about TRAIN or simply have concerns about anything tax-related, just Ask the Tax Whiz! Visit our Facebook page, The Philippine Tax Whiz, and send us your queries.

The Tax Whiz Academy of the Asian Consulting Group also conducts seminars on taxes as well as basic finance and accounting. In addition to that, you can approach us for speaking engagements about the TRAIN law. For more information about the Tax Whiz Academy, visit www.acg.ph, email us at taxacademy@acg.ph, or call (02) 622-7720. – Rappler.com

Mon Abrea, popularly known as the Philippine Tax Whiz, is one of the 2017 Outstanding Persons of the World, a Move Awards 2016 Digital Mover, one of the 2015 The Outstanding Young Men of the Philippines (TOYM), an Asia CEO Young Leader of the Year, and founding president of the Asian Consulting Group (ACG) as well as the Center for Strategic Reforms of the Philippines (CSR Philippines). You may email him at consult@acg.ph or visit www.acg.ph for tax-related concerns.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.