SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

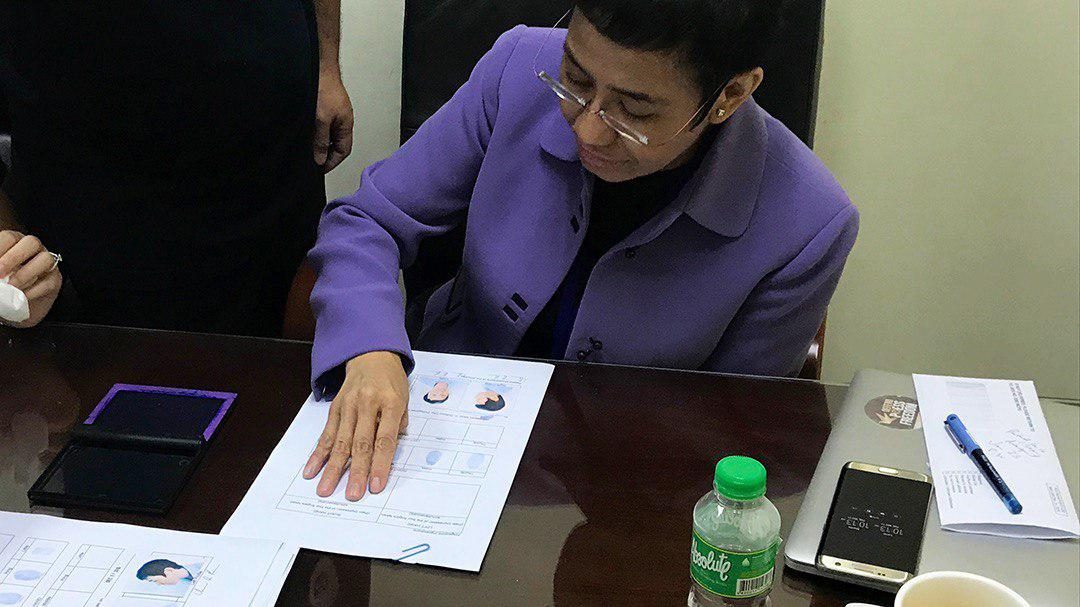

MANILA, Philippines – The Department of Justice (DOJ) has denied the motion of Rappler Holdings Corporation and its president Maria Ressa to reconsider its decision to file 4 counts of alleged failure to supply correct information in the tax returns, and one count of tax evasion.

“For now, they must contend with the fact that truly, the required quantum of proof – probable cause, is hereby satisfied. We must therefore deny the motions,” Assistant State Prosecutor Zenamar Machacon-Caparros said in her resolution dated November 29, but received only by Rappler’s lawyers on Tuesday, January 15.

This means that the charges will proceed in court.

Ressa’s supposed arraignment on January 23 is not pushing through following her lawyers’ motion for the court to rule first on an earlier plea to dismiss the case outright.

The 5th charge against Ressa was separately filed before the Pasig Regional Trial Court (RTC), where she has a pending motion to quash.

Ressa has paid bail in both courts.

PDRs

The DOJ maintained that Rappler should be categorized as a securities dealer “within the contemplation of the Tax Code” for issuing Philippine Depositary Receipts (PDRs) to foreign investors.

“Surely, complainant Bureau of Internal Revenue (BIR), for tax purposes, has the power to come in and properly classify a taxpayer’s transactions, and neither is it bound by terminologies of the parties, or how they hold themselves out to be in their government registrations and compliances,” Prosecutor Caparros said, approved by Senior Deputy State Prosecutor Miguel Gudio Jr and Acting Prosecutor General Richard Fadullon.

PDRs are financial mechanisms used by several other media organizations, such as network giants ABS-CBN and GMA, to receive investments without violating the constitutional rule that media companies should be 100% Filipino-owned.

The government, through the Securities and Exchange Commission (SEC), first attacked the PDRs by declaring that it violated the 100% Filipino ownership rule, and subsequently tried to close down Rappler.

In its July 2018 ruling, the Court of Appeals (CA) stopped the closure, acknowledged that Rappler is not foreign-owned, but said that a clause in one of its PDRs was “tantamount to some foreign control.” (READ: What you should know about the Court of Appeals decision on Rappler)

The CA however said that the flaw was deemed corrected when Omidyar Network donated its PDRs to Rappler’s Filipino managers.

Failing the SEC route, the government through the DOJ interpreted the PDRs as tax violations, giving Rappler a dealer status and interpreting the PDR issuances as taxable income.

Rappler is not a dealer in securities. (EXPLAINER: Dealer in Securities ba ang Rappler?)

The DOJ also denied the appeal of Rappler’s accountant Noel Baladiang, who was also charged for certifying “false” returns.

The taxes allegedly evaded are worth P162,412,783.67 (approximately $3.095 million), which they computed by subtracting Rappler’s P19.25 million ($362,588) worth of aggregate book value of underlying stocks from the P181.658 million (approximately $3.462 million) alleged taxable income from PDRs.

Two more complaints against Rappler are pending with the DOJ – one for alleged violation of the Anti-Dummy Law, and one for cyberlibel. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.