SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

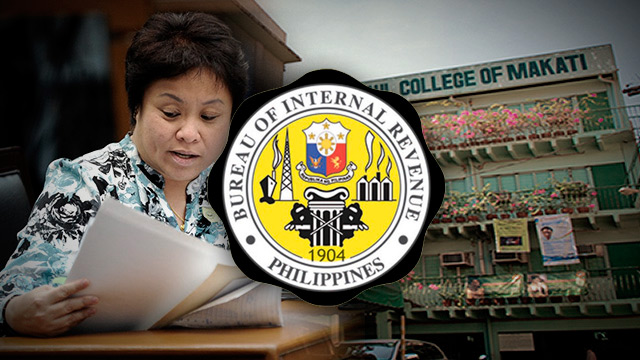

MANILA, Philippines – The ongoing legal battle between a Catholic school and the Bureau of Internal Revenue (BIR) over a memorandum that requires educational institutions to apply for tax exemption underscores the lingering suspicion that some are defrauding government of its lifeblood.

This was admitted as much by the Office of the Solicitor General (OSG), representing BIR Commissioner Kim Henares, in the Makati court case filed by St Paul College-Makati. The school is seeking an injunction on the memorandum and wants it to be declared unconstitutional.

In its opposition to the petition for a temporary restraining order before Makati judge Maximo de Leon, the OSG maintained that Revenue Memorandum Order (RMO) No. 20-2013 sought to minimize tax leakages “by ensuring that those enjoying the tax exemption are indeed entitled to it.”

The Constitution has vested tax immunity on non-profit and non-stock educational institutions – provided that the income they derived from their operations are plowed back and used “actually, directly, and exclusively for educational purposes.”

But as with most exemptions, this can be vulnerable to abuse.

The OSG argued that the challenged BIR memo targets incomes of schools “which are earned not actually, directly and exclusively for educational purposes but are nonetheless not taxed because of the guise of exemption.”

Common sense, the OSG said, “dictates that those claiming exemption must be inspected and watched vigilantly.”

No absolute immunity

Judge De Leon has issued a 15-day TRO on the BIR memo, giving schools a reprieve in applying for tax certificate exemption. (READ: Catholic school wins Round 1 vs BIR’s Henares)

St Paul College-Makati, in its petition, argued that the requirement effectively gives Henares the power of legislation as it unilaterally lifts the tax exemption of those schools that failed to comply.

The memo orders schools to make an annual accounting of their income and expenses and states that tax exemption certificates issued before June 30, 2012, will expire on Dec 30, 2013. Certificates issued after June 30, 2012, will have a validity of 3 years.

Without the TRO, thousands of private schools nationwide would have lost their tax immunity by Jan 1, 2014. The TRO was issued on Dec 27, 2013, the last working day for the year.

In defending RMO 20-2013, the OSG argued that tax exemption granted under the Constitution is not absolute but conditional.

To be exempted, a school seeking tax immunity must prove that it is a non-stock, non-profit educational institution by showing that its income was used exclusively for educational purposes, the OSG said.

The National Internal Revenue Code (NIRC) of 1997 further expounded on the conditional exemption by stating that any activities or operations of tax-exempted institutions that are for profit should be taxed.

As for the burden on institutions to prove themselves qualified for tax exemption, the OSG referred to a previous Supreme Court ruling which found the Young Men’s Christian Association liable for tax because it failed to prove that some of its businesses were not for profit.

No absolute exemption

While the OSG maintains that tax exemption is not absolute, it argued however that the taxing power of the government is encompassing and that no court has the power to stop the collection of taxes.

Citing earlier SC rulings, the OSG said that the High Court has ruled on the regularity of tax collection and only in cases of disputes, when the interests of aggrieved parties will be jeopardized, can it be suspended by the Court.

Even in disputed tax cases, what the aggrieved party can resort to is filing a civil action and seeking a refund claim as stated in the NIRC – and not a TRO.

In the instant case, the OSG said St Paul-College “failed to show the existence of extreme urgency necessitating the issuance of the TRO to prevent serious damage to it.” On the other hand, it is the government that stood to suffer “grave and irreparable damage” with the issuance of a TRO.

Pork barrel ripple effect?

The memo, issued on July 22, 2013, has been anathema to hundreds of schools which have long been spared from filing tax exemption certificates with the BIR. They however are required to file annual financial statements with the Securities and Exchange Commission and file a report of their income to the Department of Finance, if required.

Serving as backdrop to the memo is also the pork barrel scandal that sent the reputation of foundations and non-governmental organizations down the drain. Alleged pork barrel queen Janet Lim Napoles, in collusion with lawmakers, purportedly used tax-exempt NGOs to skim hundreds of millions of pesos. (READ: Pork Tales: A story of corruption) The memo covered all non-stock, non-profit corporations and associations.

But even before the case reached the court, a source familiar with the case said Henares is hell-bent on digging into the financial records of some affluent schools on suspicion that some have been skirting taxable profit.

Word has reached the BIR head that some schools have abused the privilege of tax immunity.

Feisty nuns

While other schools preferred to keep silent, the nuns of St Paul College-Makati refused to back down. On November 25, a special meeting was held by the board of trustees of the school to challenge the memo in court.

The school’s directress, Sister Teresita Bayona, in an affidavit seeking the TRO, argued that the memo is in violation of the school’s constitutional and statutory rights. She asked the court to declare the memo null and void.

She said the memo, if implemented, would pose “grave injustice to the petitioner and many other similarly-situated institutions.”

Bayona said that requiring schools to secure Tax Exemption Rulings from the BIR runs counter to the earlier ruling of former BIR commissioner Jose Mario Bunag that frees schools from filing proof of tax exemption on an annual basis.

Bayona referred to the St Paul School of Aparri case, where Bunag, then deputy commissioner for the BIR legal and inspection group, said Sec. 338 of the NIRC relieves tax-exempt corporations from filing returns and that failure to observe the requirement is not a waiver of the right to enjoy the exemption.

“To hold otherwise is tantamount to incorporating into our tax laws some legislative matter by administration regulation,” Bunag said. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.