SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

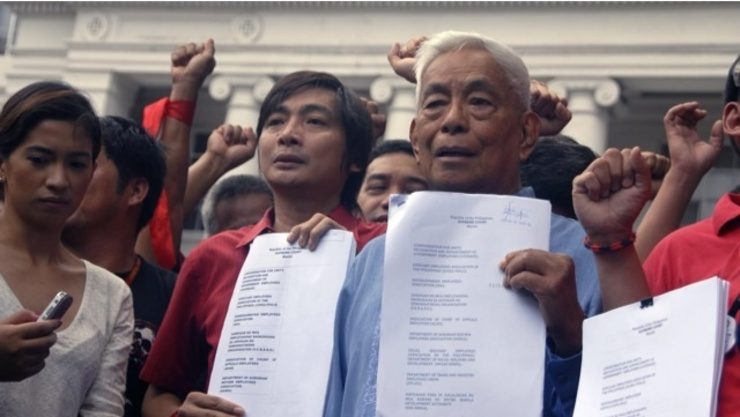

A petition for prohibition and mandamus filed by union groups through lawyer and former Senator Aquilino “Nene” Pimentel Jr alleged that the Bureau of Internal Revenue (BIR) erred in taxing previously tax-free bonuses, allowances, and benefits of government employees.

By issuing Revenue Memorandum Order (RMO) 23-2014, BIR Commissioner Kim Henares allegedly usurped Congress’ power to legislate.

Petitioners alleged that respondents Henares and Department of Finance (DOF) Secretary Cesar Purisma, in their official capacities as public officers, “do not have power to tax unless they are empowered by law.”

“The issuance of the RMO complained of thus appears to be an over-stretched exercise of power and authority by the Respondents (or, at least by the Respondent Commissioner) of what is justifiable under law,” the petition read.

Government employees asked the SC to stop the implementation of RMO 23-2014 through a temporary restraining order, while the court decides on their petition.

Petitioners were led by the Confederation for Unity, Recognition and Advancement of Government Employees (Courage) and the Judiciary Employees Association of the Philippines (Judea-Phils).

Listed as co-petitioners were employee union groups from across the 3 branches of government. They include employee associations from the Senate, Court of Appeals, the Sandiganbayan, Department of Agrarian Reform, Department of Trade and Industry, Metropolitan Manila Development Authority, National Housing Authority, Quezon City local government, and water districts nationwide.

Minimal benefits

Members of Judea and Courage earlier protested against the revenue order, saying the subject benefits are mere “barya-barya” (spare change) that does not warrant taxation. (READ: Court employees hit Aquino’s rampage vs judiciary)

In their SC petition, government employees alleged that the BIR order “diminish, arbitrarily, it seems, even the concept of the de minimis benefits.”

“To clarify, the de minimis benefits are those allotted to government personnel at their most minimal level, and which, even now, are being enjoyed by them tax free,” explained the petition.

Courage president Ferdinand Gaite slammed the administration of President Benigno Aquino III for what he regarded as a desperate attempt to steal employees’ benefits.

“Di katanggap-tanggap na kaming maliliit na kawani ang binubuwisan ng labis-labis samantalang napakaraming tax exemptions, insentibo at holidays ang ibinibigay sa malalaking lokal at dayuhang negosyo,” he said.

(It is unacceptable that rank-and-file employees are taxed overwhelmingly, while there are so many tax exemptions, incentives, and holidays provided to large local and foreign businesses.)

Raise the ceiling

Prior to the implementation of the RMO 23-2014, government employees’ benefits were not taxed except for their 13th month pay exceeding P30,000 and loyalty pay.

In their petition, the union groups asked the SC to order the DOF to raise the current P30,000 ceiling of taxable pay.

Gaite explained that the P30,000 ceiling was set in 1997 and must be raised to accomodate economic inflation over the years. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.