SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – The Department of Justice (DOJ) approved the filing of tax evasion charges against the daughter of alleged pork barrel scam mastermind Janet Lim Napoles.

In a phone interview with Rappler on Thursday, September 11, prosecutor-general Claro Arellano said the justice department found probable cause to indict Jeane Napoles for her tax liabilities.

Jeane will be charged before the Court of Tax Appeals with two counts of attempt to evade tax and two counts of failure to file an income tax return for over P17.88 million (about $407,194) in unpaid taxes.

While her whereabouts are unknown, Jeane’s counter-affidavit dated January 24, 2014, was sworn to in London.

The Bureau of Internal Revenue (BIR) filed the complaint before the DOJ against Jeane on October 13, 2013. (READ: Jeane Napoles charged with tax evasion)

Senior Assistant State Prosecutor Edna Valenzuela said the DOJ approved a P17-million tax evasion case – instead of a P32-million tax case as indicated in the original BIR complaint – based on Jeane’s “basic tax liability.”

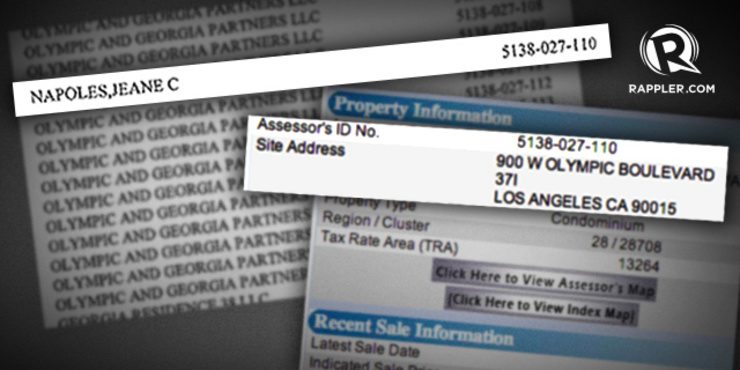

The amount was based on Jeane’s ownership of a luxurious apartment in Los Angeles, California, worth P54.73 million (about $1.2 million) and co-ownership of two farm lots in Pangasinan worth P1.49 million (about $35,000).

The BIR alleged Jeane failed to file any income tax return from 2011-2012 that would show her capacity to buy the properties.

Jeane likewise failed to declare the properties as gifts, the bureau claimed. (READ: Napoles daughter owns P80-M LA property)

Jeane’s parents already defended her before the justice department through their joint affidavit, saying they were de facto owners of these properties. (READ: Napoles couple on tax evasion: Blame us, not Jeane)

But the 8-page resolution of the DOJ said the BIR “has established proof that respondent willfully attempted to evade or defeat her tax liability.”

“As gathered from the evidence submitted, respondent Jeane Catherine L. Napoles was able to acquire properties of expensive value directly under her name, but she kept mum about it and did not report any income despite her being able to buy and fully pay the said properties as borne out by documents,” the DOJ resolution said.

‘No documentary evidence’

The DOJ junked Napoles’ arguments that the said properties were bought and paid by her parents, and that she merely held them in trust. It said that there is “no clear and convincing” evidence to prove her claim.

“The joint affidavit of respondent’s parents (Jaime and Janet Lim Napoles) was offered to prove the alleged existence of an implied trust. However, said joint affidavit, aside from being biased, is wanting with clear and convincing evidence to show that spouses Jaime and Janet Napoles are the real buyers and true owners of the properties in question and that respondent, Jeane Catherine L. Napoles, is merely a trustee,” the resolution said.

The DOJ resolved that Jeane’s claim was “empty or hollow,” as she failed to offer documentary evidence needed to substantiate her assertion.

“The burden of proving the existence of a trust is on the party asserting its existence, and such proof must be clear and should not be made to rest on loose, indefinite declarations,” the DOJ resolved.

The resolution was signed by Valenzuela, who chairs the DOJ Task Force on BIR Cases. It was approved by Arellano. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.