SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

AT A GLANCE:

- Flashy infrastructure projects and anything free will be hard for the next president to pull, given the massive borrowings during the Duterte administration.

- Despite the threat of a credit downgrade, some presidential candidates are even proposing tax cuts.

- Economists say the next president must look for new revenue sources and face the most unpopular topic of all: taxes.

MANILA, Philippines – Did your presidential bet promise ambitious infrastructure, cash dole outs, free housing, or other similar projects with a hefty price tag?

Pleasant to the ears, indeed, but can the Philippines afford all of it? Voters should be mindful of the country’s debt levels and the budget deficit, as these are key determinants of whether or not candidates can fulfill their promises.

As of November 2021, the Philippines’ debt stood at P11.93 trillion, as the administration of President Rodrigo Duterte continued to borrow more to fund budgetary requirements amid falling revenues due to the coronavirus pandemic.

The Bureau of the Treasury has projected debt to reach P13.4 trillion in 2022.

Meanwhile, the debt-to-GDP (gross domestic product) ratio, which shows the level of debt relative to the size of the economy, is currently at 63%, already breaching the internationally accepted threshold of 60%.

This level is closely monitored by debt watchers. A downgrade in credit ratings will force the next administration to take in more debt with higher interest rates.

The Department of Finance projects debt-to-GDP to go down below 60% by 2025, or halfway through the next president’s term.

“This year’s winner will inherit a challenging fiscal situation and will be hard pressed [to] consolidate debt. The next [president] will definitely need to address the debt issue given our susceptibility to a credit rating downgrade,” said Nicholas Mapa, ING Bank Manila’s senior economist.

To bring the debt level to around 40% of GDP, the Philippines will need to grow 6% to 6.5% per year, according to Finance Secretary Carlos Dominguez III.

“That is the main challenge of the next administration,” Dominguez said.

Meanwhile, the fiscal deficit, or the amount where expenses exceed revenues, swelled to P1.2 trillion as of October 2021, or an increase of 27.9% from the same period in 2020. This means that the next administration must find a way to lower the deficit by looking for new revenue sources, while growing the economy amid the ongoing coronavirus crisis.

Debt is not ‘bad’

It’s easy to raise alarm about the historically large amounts of debt. “But if current borrowing is used productively, this debt burden is actually not necessarily unmanageable,” said Sonny Africa of the think tank IBON Foundation.

“Deficits and debt are medium- and long-term problems. These can be mitigated by substantial short-term government spending that stimulates growth and revenue generation,” he added.

Simply put, spending taxpayers’ money effectively is key. Moreover, paying off the debt is not the issue, but the priority expenses of the upcoming administration.

“For instance, public spending can be wielded to create multiplier effects that causes output to expand. More rapid recovery will also mean improved revenue generation down the line to pay for this. This also means that in effect rolling over this debt by borrowing more domestically should not be a problem,” Africa said.

What should the next president do?

According to Rizal Commercial Banking Corporation chief economist Michael Ricafort, the next president may face unpopular decisions, particularly those pertaining to taxes.

Those decision may include “intensified tax collections and other fiscal reform measures to structurally increase the government’s recurring tax collections,” as these “are usually taken positively by the credit rating agencies.”

Ricafort also said the next president should prevent financial leakages that may likely occur during his or her term to “structurally reduce the growth in the country’s debt stock/debt-to-GDP ratio.” Among the measures include eradicating corruption, a tall order for any administration.

In Africa’s view, the government can create the fiscal leg room that it needs by increasing public revenues “not just to repay debt but also to invest in social and economic development.”

Africa, however, noted that the next president needs to veer away from current policies, including the controversial Tax Reform for Acceleration and Inclusion or TRAIN law and the Corporate Recovery and Tax Incentives for Enterprises or CREATE law. The next leader may also need to slap higher taxes on billionaires.

“The tax system has to be reoriented away from indirect consumption taxes, which are an excessive burden on poor and middle-class Filipinos with so little incomes to begin with, especially so after the debacle of lockdowns and economic collapse since the onset of the pandemic,” Africa said.

Here’s what the candidates have said so far about their plans for the economy and businesses, based on the most recent interviews, as well as pronouncements made in 2021:

Leni Robredo

So far, Vice President Leni Robredo’s comments on debt are the most in line with what experts have recommended.

“I will honor the [loan] commitments because the integrity of our country depends on it, but I’ll make sure that what we learn – especially in the last few years when our debt really piled on – I’ll make sure that the money we loaned went to the things that they were supposed to, and that the return to us is a thousand-fold, because if we loan and the return is not that big, why did we even loan? It’s not bad to loan if you really need it and the returns are greater than what we borrowed,” Robredo said in her interview with Boy Abunda on January 26.

Robredo, an economics graduate of the University of the Philippines, also displayed knowledge of the debt-to-GDP ratio and its implications to governance.

“[I]f we look at the debt-to-GDP ratio, we started pre-pandemic at 44%. That meant we still had elbow room to loan. So, because we needed a lot of money during the pandemic, it was okay to loan, but now, if we look at the debt-to-GDP ratio, it’s at 60% already – wala na tayong elbow room. More than 60%, delikado na tayo na baka hindi natin mabayaran (We don’t have elbow room anymore. More than 60% is already dangerous and we may no longer be able to pay up.)”

To improve the fiscal position of the next government, she told GMA-7’s Jessica Soho that fixing institutions would be key.

“Ipi-fix natin ‘yung ating institutions, ima-maximize natin ‘yung opportunities ng mga local industries, sisiguraduhin natin ‘yung kapakanan ng ating mga workers, sisiguraduhin natin na kung saan tayo may opportunities, magagamit natin,” Robredo said.

(We will fix our institutions, maximize opportunities for the local industries, ensure the welfare of workers, ensure that we will make use of opportunities.)

On her website, Robredo proposes a public employment program, where government will give climate jobs to mitigate the impact of climate change while providing work. She also proposes an unemployment insurance program, which covers those who lose their work for reasons outside their control.

For small businesses, Robredo proposes an improvement of the government procurement law, which would open doors to small businesses and social enterprises.

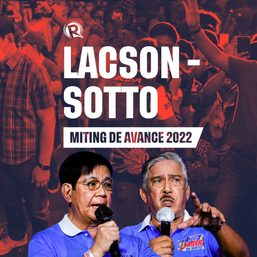

Panfilo Lacson

In the interview with Soho on January 22, Senator Panfilo Lacson said he would prioritize budget reform.

“‘Yung misused mas malaki pa ‘yun, lalo na ‘yung abused, kasi alam naman natin kapag pinasok, in-insert at wala po sa plano, eh ang mangyayari diyan mali ‘yung paggastos, mali ‘yung pag-implementa,” Lacson said.

(The misused funds are huge, the abused funds even more so. Because we know that when a project that’s not part of the original plan is inserted, there would be misspending. There will also be problems in the implementation.)

In a virtual forum with business leaders in October 2021, Lacson bared his “future-proof strategy,” which includes the funding of the “high-cost” requirement of the Universal Healthcare Act to cover all barangays and providing subsidies for all indirect contributory populations.

He also pushed for targeted fiscal stimulus packages to aid our businesses in reopening and staying afloat amid the pandemic.

Lacson also wants to provide a social safety net, particularly reinventing the Conditional Cash Transfer programs “with the overarching principle that every Filipino should bridge the poverty line with a sustainable livelihood or employment opportunities.”

Manny Pacquiao

Senator Manny Pacquiao told Soho on January 22 that strengthening the economy and giving jobs would be his top priority if he wins the presidency.

He also promised free housing.

“Hindi ‘yung libreng pabahay pero may babayaran ka monthly,” he said. (Not the type that is supposedly free housing project but you still have to pay monthly fees.)

In past interviews, Pacquiao said he would not run a deficit should be become president. This means that the government’s borrowings will not exceed income.

To do this, Pacquiao said that the government needs to strengthen non-tax collections. Non-tax revenue could be collected from dividend payments from government-owned and controlled corporations (GOCCs) or from state resources, such as the Malampaya gas field.

“Bakit natin pinapayagan na mas malaki ‘yung ginagastos natin annually kaysa kinikita ng ating gobyerno taon-taon?” Pacquao told ABS-CBN in December 2021.

(Why do we allow the government to spend more than what we are earning annually?)

He also said he would push for even lower corporate income taxes. Just this year, Duterte signed into law the CREATE law, which lowered corporate income tax from 30% to 25% for large corporations and 20% for small businesses.

In making his case, the boxing champion-turned-politician said that Singapore’s corporate income taxes stood at 17% while other peers in the region are at 20%.

He also said he would harness his global fame to woo foreign investors.

Isko Moreno

Manila Mayor Isko Moreno told Soho on January 22 that should he become the next president, he would continue President Rodrigo Duterte’s Build, Build, Build program.

“‘Yung Build, Build, Build, we will continue that kasi bayad na ng buwis ng tao ‘yan eh (We will continue that Build, Build, Build program because that’s already been paid for by taxpayers’ money.). But in our case, we will continue to build, but, build more schools, hospitals, housing to generate more jobs,” Moreno said.

In October 2021, Moreno promised to cut excise taxes on oil and electricity by 50% if he is elected president, a move he said would ease the burden on poor Filipinos, including farmers and jeepney drivers whose livelihood depend on oil prices.

“If given a chance, palarin ako, ang unang-una kong gagawin is babawasan ko nang 50% ang buwis ng langis,” Moreno said on last October 21, in a dialogue with some 50 farmers in Barangay Banaba, Tarlac.

(If given a chance, if I get lucky, the first thing I’d do is reduce the tax on oil by 50%.)

Leody de Guzman

Leody de Guzman was not included in GMA 7’s interviews, as the network only considered the top five candidates based on surveys.

In past interviews, De Guzman proposed a wealth tax. He intends to roll out a P125-billion stimulus for small businesses.

The labor leader also intends to establish a $50-billion (P2.5 trillion) people’s social welfare fund, which will be sourced from the Bangko Sentral ng Pilipinas’ gross international reserves.

“Puhunanan natin ang mga ‘working class enterprises’ imbes na ginagamit ang ating reserbang dolyar para proteksiyonan lamang ang palitan ng piso at ang interes ng mga malalaking mga importer,” De Guzman said.

(We must invest in “working class enterprises” instead of using our dollar reserves to protect the foreign exchange rates and the interests of big importers.)

Ferdinand Marcos Jr.

Ferdinand “Bongbong” Marcos Jr. has downplayed the current debt levels – part of which were incurred during his father’s term. He has noted that some African countries have more debt than their economy’s size. (READ: [ANALYSIS] Marcos debt: Ano ang katotohanan?)

“If you compare this with other countries, we are doing better than they are,” Marcos said in a briefing with select media outlets on January 25. He reiterated the same point in an interview with Abunda.

In past interviews, Marcos said he wanted more infrastructure and improve the country’s sea and airports, as well as railway systems, to turn the country into a major logistics hub in Asia.

To fund this, he is looking at a private-public partnership and foreign investors, particularly for “capital intensive” businesses and projects.

Marcos has refused Soho’s invitation for interview, accusing the veteran and multi-awarded journalist of being impartial. GMA 7 has since refuted Marcos’ claims. – Rappler.com

Add a comment

How does this make you feel?

![[ANALYSIS] Debt is rising fast, but worry more about Duterte’s spending](https://www.rappler.com/tachyon/2021/03/ballooning-debt-march-26-2021-sq.jpg?fit=449%2C449)

![[Newspoint] Improbable vote](https://www.rappler.com/tachyon/2023/03/Newspoint-improbable-vote-March-24-2023.jpg?resize=257%2C257&crop=339px%2C0px%2C720px%2C720px)

![[Newspoint] 19 million reasons](https://www.rappler.com/tachyon/2022/12/Newspoint-19-million-reasons-December-31-2022.jpg?resize=257%2C257&crop=181px%2C0px%2C900px%2C900px)

![[OPINION] Sara Duterte: Will she do a Binay or a Robredo?](https://www.rappler.com/tachyon/2024/03/tl-sara-duterte-will-do-binay-or-robredo-March-15-2024.jpg?resize=257%2C257&crop_strategy=attention)

![[New School] Tama na kayo](https://www.rappler.com/tachyon/2024/02/new-school-tama-na-kayo-feb-6-2024.jpg?resize=257%2C257&crop=290px%2C0px%2C720px%2C720px)

![[ANALYSIS] A new advocacy in race to financial literacy](https://www.rappler.com/tachyon/2024/04/advocacy-race-financial-literacy-April-19-2024.jpg?resize=257%2C257&crop_strategy=attention)

![[In This Economy] Can the PH become an upper-middle income country within this lifetime?](https://www.rappler.com/tachyon/2024/04/tl-ph-upper-income-country-04052024.jpg?resize=257%2C257&crop=295px%2C0px%2C720px%2C720px)

![[Ask The Tax Whiz] How to file annual income tax returns for 2023](https://www.rappler.com/tachyon/2022/11/tax-papers-hand-shutterstock.jpg?resize=257%2C257&crop_strategy=attention)

![[Ask The Tax Whiz] Are cross-border services taxed in the Philippines?](https://www.rappler.com/tachyon/2024/02/bpo-workers.png?resize=257%2C257&crop=72px%2C0px%2C785px%2C785px)

![[Ask the Tax Whiz] Ease of paying taxes law: What you need to know](https://www.rappler.com/tachyon/2023/02/calculate-february-22-2023.jpg?resize=257%2C257&crop_strategy=attention)

There are no comments yet. Add your comment to start the conversation.