SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – As of end-2021, the Philippines’ debt stood at P11.7 trillion, 20% higher than in 2020, as pandemic-related expenses ballooned and government revenues fell.

Experts said the next president will not have much elbow room to borrow, as lenders are closely looking at how fast economic recovery will be.

President Rodrigo Duterte is expected to leave the next administration with a total of P13 trillion in debt.

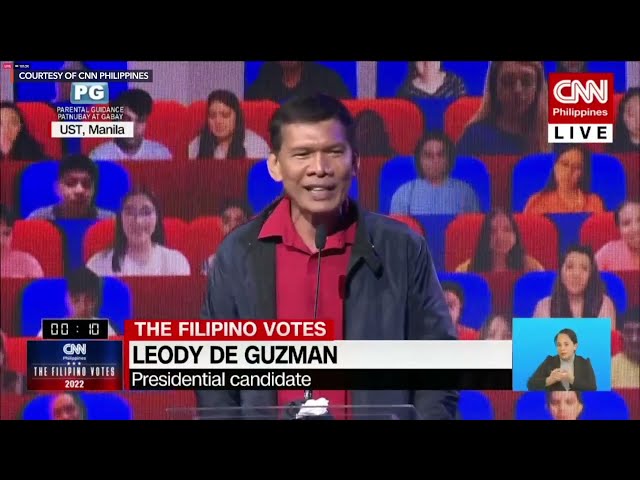

Candidates who attended the CNN Philippines presidential debate on Sunday, February 27, weighed in on the issue.

The lone candidate who was absent from the debate, Ferdinand Marcos Jr., is the son and namesake of dictator Ferdinand Marcos, whose regime sank the economy by borrowing $23.5 billion. A bulk of the funds were either pocketed by the family or given to cronies.

Here’s what the candidates had to say during the debate:

Vice President Leni Robredo

Robredo said debt is not bad per se, but noted that the return on investments must be much greater than borrowings.

“Naiintindihan natin na during the pandemic, talagang malaki ‘yung ating kinakailangan na pera, pero ito ay hindi magiging makatarungan kung ‘yung ating inutang ay napunta pa sa korupsiyon. Kaya ito sinisiguro natin na ‘pag tayo naupo bilang pangulo, titignan natin kung saan ito ginastos at sisiguraduhin natin na babayaran natin ‘yung utang, sisiguraduhin natin na mapapupunta siya sa dapat mapuntahan kasi luging-lugi ‘yung taumbayan kung nagbabayad siya ng utang na iba naman ‘yung nakinabang,” Robredo said.

(We understand that we need to borrow big during the pandemic, but it will not be justified if the money would go to corruption. If I become president, I would ensure that we will be able to track where the money went, we will pay our debts, ensure that it will go to where it is supposed to go because it will be a disservice to the public if it ends up in other people’s pockets when they are the ones who will be paying.)

Senator Panfilo Lacson

Lacson reiterated his stand that the national budget must be balanced and stripped of non-essentials.

“Kasi ang pag-aaral nga ng dating deputy ombudsman [Cyril] Ramos, ang nawawala sa ating national budget taon-taon ay P700 billion, at ang unutilized natin, for the past 10 years…P328 billion on the average from 2010 to 2020. So, kailangan mayroon tayong judicious spending.”

(Based on a study by former deputy ombudsman Ramos, P700 billion from our national budget is lost each year due to corruption, and our unutilized funds, for the past 10 years, reached P328 billion on the average from 2010 to 2020. So, we need to have judicious spending.)

Lacson also questioned the policies of President Rodrigo Duterte’s economic team, particularly the budget deficit.

“Bakit ang ating projected deficit sa susunod na taon, P650 billion, bakit palaging inuutang natin ay doble – P1.3 trillion? Tatlong taon, tatlong budget deliberations, ‘yan ang lagi kong tinatanong pero hindi sinasagot. Bakit? ‘Di ba ‘pag pangangailangan natin, ang suweldo ng padre de pamilya P10,000 at ang gastusin P12,000, ‘di ba uutang ka lang ng P2,000 or uutang ka ng P5,000 para may pang-invest ka para umasenso ang buhay mo? Pero ito doble,” Lacson said.

(Why is our projected deficit for next year P650 billion, but we will borrow double of that – P1.3 trillion? For three years, three budget deliberations, that has always been my question but there has been no response. Here’s a scenario: The father or man of the house has an income of P10,000 but expenses are P12,000. You’re only supposed to borrow P2,000 or borrow P5,000 so you have some money for investments and to improve your lives. But this one is double.)

Senator Manny Pacquiao

Pacquiao said borrowing is only good for investments, but not to fund expenses.

“Kung nangutang tayo dahil sa expenses natin taon-taon ay ‘yun po ay talagang masasabi ko mismanaged ang bansa natin. Kaya naman po kailangan nating magising. Kailangan natin magising dahil tulad ng isang bahay, kung nangungutang ka dahil sa gastusin ‘nyo buwan-buwan ay mahirap po ‘yun,” Pacquiao said.

(If we borrow for our expenses yearly, I can really say that we are a mismanaged country. We need to wake up. We need to wake up because for example, in a household, if you borrow for expenses monthly, that would be difficult.)

Manila Mayor Isko Moreno

Moreno described the country’s debt as “challenging.”

He said he wants to dispose of non-performing or underperforming assets to offset debt servicing.

“So that, mga kababayan, ‘wag naman sa inyo nang sa inyo ‘yung pasa ng utang (my fellow Filipinos, debt must not always be passed on to you). Kumbaga ang gobyerno (In a government), sometimes you have to let go of these liabilities of the state to address a particular problem. And this will be the next challenging task of the next president,” Moreno said.

Leody de Guzman

De Guzman emphasized the Marcos regime’s role in the country’s debt levels.

He said that while borrowing is needed, an audit should be done.

“’Yung pag-utang, tama ‘yun, kung matino ang gobyerno, puwede natin gamitin, gamitin natin sa maayos. Pero kinakailangang ayusin natin ‘yung ating sistema ng ekonomiya. Kung ang sistema ng ating ekonomiya ay import-dependent, export-oriented na lagi tayong lugi sa pag-e-export, mababa ang presyo, mataas ang presyo ng pag-i-import, talagang mangungutang tayo lagi. Kaya paunlarin natin ang ating sariling industriya,” De Guzman said.

(Borrowing would be right, if the government is honest, we would be able to use the funds well. But we should fix the systems of our economy. If our economic systems are import-dependent, export-oriented, we would always be on the losing end. If we have low prices of exports, high prices of imports, we would really need to always borrow. So we have to develop our own industries.) – Rappler.com

Add a comment

How does this make you feel?

![[Newspoint] Improbable vote](https://www.rappler.com/tachyon/2023/03/Newspoint-improbable-vote-March-24-2023.jpg?resize=257%2C257&crop=339px%2C0px%2C720px%2C720px)

![[Newspoint] 19 million reasons](https://www.rappler.com/tachyon/2022/12/Newspoint-19-million-reasons-December-31-2022.jpg?resize=257%2C257&crop=181px%2C0px%2C900px%2C900px)

![[OPINION] Fossil fuel debts are illegitimate and must be canceled](https://www.rappler.com/tachyon/2024/04/IMHO-fossil-fuel-debt-cancelled-April-16-2024.jpg?resize=257%2C257&crop_strategy=attention)

![[In This Economy] Brace yourselves for more deficits, debt](https://www.rappler.com/tachyon/2023/09/TL-Brace-yourselves-deficit-debt-September-29-2023.jpg?resize=257%2C257&crop=241px%2C0px%2C720px%2C720px)

There are no comments yet. Add your comment to start the conversation.