SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

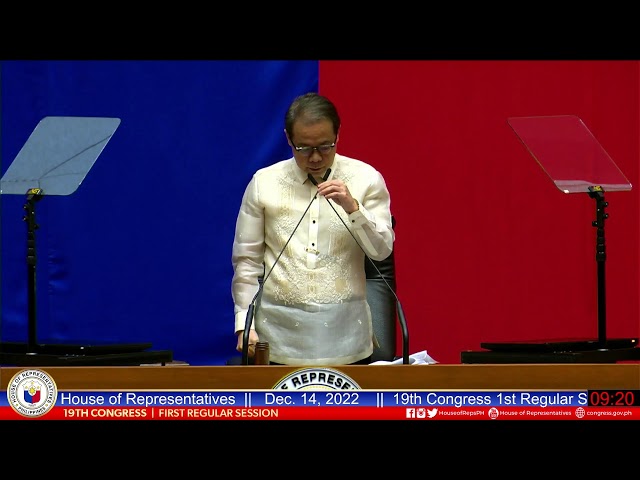

MANILA, Philippines – House opposition lawmaker Edcel Lagman spent two hours in the plenary debating with sponsors of the Maharlika Investment Fund (MIF) bill, and pleaded that the lower chamber wait until after the holidays to pass the controversial measure.

With 251 out of 312 lawmakers signifying their intent to be listed as co-authors of the bill, there is no doubt that the proposal will easily hurdle the House of Representatives should a call for voting be made.

The question, however, is whether it will be passed on second reading before Congress goes on a holiday break beginning December 17, or on third reading even, should President Ferdinand Marcos Jr. certify the bill as urgent.

“I beg the leadership, that since we are going to a Christmas break, to afford members of the House to consult with their constituents about the pros and cons of Maharlika bill, and we could most probably come back after the break to decide whether or not to pass the bill on second reading,” Lagman said.

Enduring concerns

Lagman, who also heads the Liberal Party, quizzed banks panel chairperson Irwin Tieng and vice chairperson Joey Salceda, as the two took turns in defending the proposal.

Lagman reiterated concerns that have been raised numerous times since the bill captured national attention: from the challenging economic environment to start a sovereign wealth fund, to the fears that corruption would later hound it.

“The Philippines does not have revenue surplus, but it has a surfeit of negative economic indicators, which should remind us that most probably, it’s not yet the time for us to create the Maharlika Investment Fund, because whatever amounts we have should be devoted to infrastructure and human development,” he said, citing the Philippines’ poverty rate, trade deficit, and debt service, among others, during the course of his hours-long interpellation.

A budget surplus is not a requisite in some countries before they established a sovereign wealth fund.

Salceda also insisted that from 2018 to 2021, government-owned and controlled corporations – which will be used for the MIF – were in a surplus.

“New Zealand’s is not based on any resource. Australia’s is not based on any resource or excess funds or any budget surplus. If there are investible funds, and they are pooled and invested in investments that are intergenerational in character, they are classified as sovereign wealth funds,” Salceda explained.

Lagman also asked whether international companies or agencies have committed to invest in MIF, similar to the experience of the Indonesian Investment Authority (INA) before its launch.

Proponents have cited Indonesia Investment Authority (INA) as model of the Maharlika Investment Fund.

“[No commitments] yet, but the President is marketing the fund ahead of this legislation,” Salceda told Lagman.

‘Not a slush fund’

Lagman also argued that the public’s apprehension stems from the history of anomalous practices in the government, but Salceda insisted the amended proposal has sufficient shields against fraudulent actors.

“These funds, especially invested with public interest, are not directly managed by politicians. Instead, there is a board which selects a management, and that management will have a risk management unit. I have 46 pages of safeguards to ensure that this will not be slush fund of non-owners of this fund,” Salceda said.

First introduced by House leaders in late November, the Maharlika Investment Fund bill has undergone numerous investments, such as dropping pension funds as contributors, making the finance secretary the board chairperson, raising the number of independent directors in the board, and adding jail time for offenders.

The latest version of the proposal pegs the seed capital at P110 billion, which will come from the dividends of the Bangko Sentral ng Pilipinas, and investible funds from Land Bank of the Philippines and Development Bank of the Philippines.

Should Marcos certify the bill as urgent, the House would be able to pass the measure on the same day.

However, the Senate has yet to come up with its version of the proposal, which means that the legislative journey of the MIF is far from over. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.