SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – There was still no direct answer from the camp of presumptive president Ferdinand “Bongbong” Marcos Jr. on the issue of their family’s unpaid estate tax, originally pegged at P23 billion but has potentially ballooned to P203 billion.

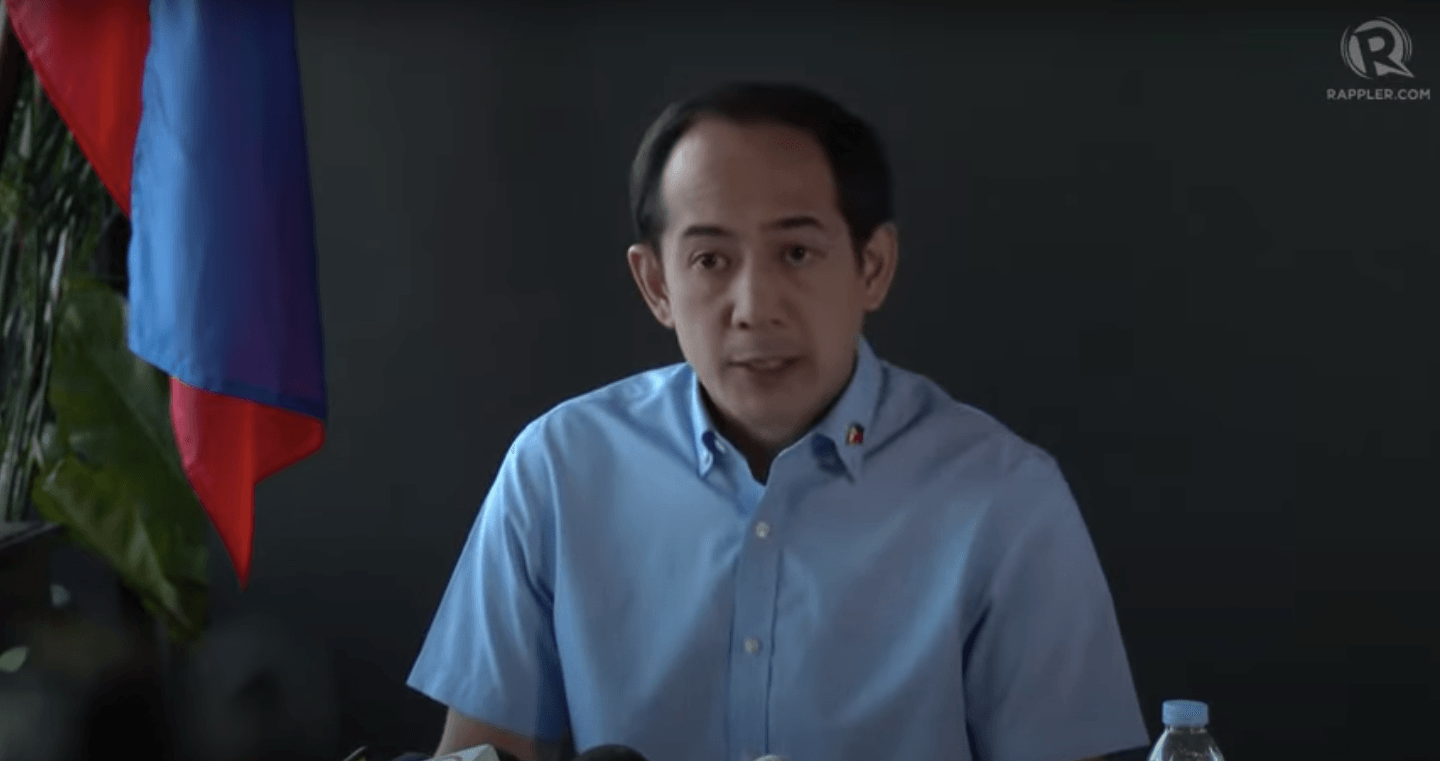

“What about the estate tax? We’ve answered that many times,” Marcos spokesperson Vic Rodriguez said in a press conference Friday, May 13.

The question was how Marcos would settle the issue of his family’s estate tax, now that he was about to assume the presidency.

“The president-elect Bongbong, once he is president and even before he assumes officially as president siya ay manunumpa sa ating Saligang Batas, siya ay manunumpa sa ating watawat. So susundin niya, bilang chief executive officer, ipapatupad niya ang batas at tutupdin niya ang isinasaad ng ating Saligang Batas at ‘yung mga batas na naaayon doon sa ating Konstitusyon,” said Rodriguez.

(President-elect Bongbong, once he is president and even before he assumes officially as president, he will take an oath to the Constitution and the flag. As chief executive, he will implement the law and will follow what is stated in our Constitution, and all laws pursuant to our Constitution.)

Rodriguez had been insisting that the legal issue on the tax evasion case is not final yet. However, an entry of judgment from the Supreme Court shows that the 1997 decision had become final and executory in 1999.

The 1997 decision of the Supreme Court ordered the Marcoses to pay P23 billion in estate tax. No less than the Bureau of Internal Revenue and the Department of Finance (DOF) confirmed that it remained unpaid, and that the last demand letter was sent in December 2021.

Plus interest and surcharges, a group that challenged Marcos’ candidacy estimated that the P23 billion had ballooned to P203 billion.

Marcos had not been willing to address the issue himself, while his supporters spread false claims about the Philippines’ taxation law.

This had been a sensitive issue for Marcos. He walked out on the question once during the campaign, and a rare one-on-one interview with CNN Philippines skipped this issue altogether.

It became a focal point of critics during the campaign, saying that P203 billion can be the source of financial aid to people affected most by the pandemic.

The presumptive president is the court-approved executor of the estate of his late father, the ousted dictator Ferdinand Marcos. As such, he is directly liable to pay the estate tax.

– Rappler.com

Add a comment

How does this make you feel?

![[Just Saying] Marcos: A flat response, a missed opportunity](https://www.rappler.com/tachyon/2024/04/tl-marcos-flat-response-april-16-2024.jpg?resize=257%2C257&crop=277px%2C0px%2C720px%2C720px)

There are no comments yet. Add your comment to start the conversation.