SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

On top of allegations of graft and favoritism from the budget department, Pharmally Pharmaceutical Corporation now faced the challenge of defending itself against suspected tax evasion after senators raised a series of potential liabilities in the company’s records and financial statements.

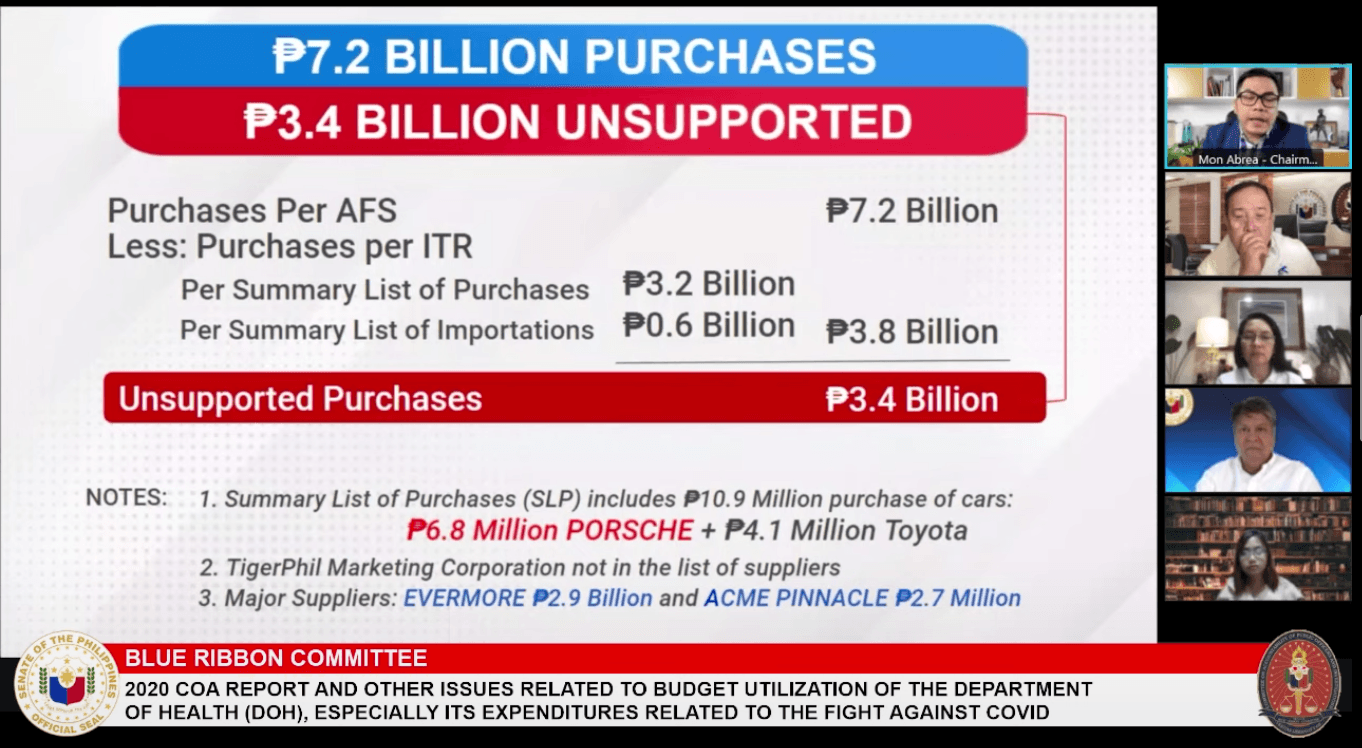

An analysis of the firm’s tax records revealed alleged questionable findings that included some P3.4 billion in purchases in 2020 lacking documentation or proof. The amount was nearly half of the P7.2 billion purchases Pharmally declared in its audited financial statement, but was missing in income tax returns filed with the Bureau of Internal Revenue (BIR).

To senators, the large amount raised more questions on the nature of the company’s transactions, which have been the subject of marathon hearings on the alleged corruption in the Duterte administration’s pandemic response.

For one, Senate blue ribbon committee chair Richard Gordon said the amount could mean that Pharmally had ghost purchases.

“Anong pwedeng panggalingan yan? Pwedeng namemeke sila na nag supply sila, binayaran sila para lang makuha yung pera pero wala talagang dinelvier?” Gordon said.

(Where could that have come from? Could it be that they faked they supplied [items], were paid and made money, but nothing was really delivered?)

The Senate panel’s resource person, tax expert Mon Abrea, conceded it was possible and said it was difficult to pinpoint what the P3.4 billion amount was since it was not covered in Pharmally’s summary list of purchases.

Discrepancies in Pharmally purchases could also mean that the firm overstated its expenses to lower the amount of taxes it owed the government, Abrea added. Pharmally has so far managed to secure over P10 billion in pandemic deals, P8 billion of which were awarded in 2020.

“Posible, Mr. Chairman. Normally po pagka talaga walang supporting documents either nilagay lang po nila para mapababa ang buwis or hindi po talaga totoo ang purchase,” Abrea said.

(It’s possible, Mr. Chairman. Normally, if there are no supporting documents, it is either they stated that amount to lessen their taxes or those purchases are not true.)

Abrea made the analysis after the committee shared with him documents it provided by the Bureau of Internal Revenue.

Abrea’s analysis of Pharmally’s tax returns to the BIR showed only P3.2 billion in purchases were declared to the BIR out of the P7.2 billion it cited in audited financial statements. Aside from this, about P600 million were cited in its tax returns to the BIR under its summary list of importations.

“It is really not reported in the summary list of purchases so we don’t know where this came from or who may have supplied for P3.4 billion,” Abrea said in Filipino.

‘Cheating Filipinos’

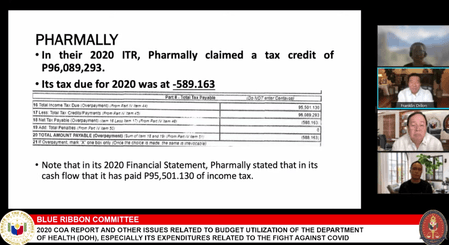

Aside from the P3.4 billion in unsupported purchases, Abrea said several material misstatements were also found in Pharmally’s financial records. The misstatements can be found in the photo below:

Minority leader Senator Franklin Drilon drilled into the findings, saying it could put Pharmally officials at risk of criminal prosecution because “these can be considered as false entries; at least a prima facie case of false entries.”

Under Section 257 of the National Internal Revenue Code of 1997, false entries are punishable by imprisonment of anywhere from 2 years to 6 years. Foreigners found guilty of such could also face “immediate deportation.”

“Ibig sabihin dinadaya po nila ang income taxes, dinadaya nila ang taumbayan. Ang laki na nga ng nakuhang negosyo…dadayain pa apart from possible overpricing, kikita pa sa pandaraya sa buwis,” Drilon said.

(This means to say that they are cheating their taxes, and they are cheating the public. They earned so much from this business….apart from overpricing, they cheat their taxes.)

Throughout several hearings, Drilon has attempted to secure source documents on the cost of sales of Pharmally. But the firm’s officials, including Pharmally corporate secretary Mohit Dargani and co-owner Twinkle Dargani have repeatedly refused to share these, citing privacy laws.

On Thursday, after being presented with Abrea’s findings, the senator cast doubt on Pharmally’s declaration of P7.2 billion in purchases saying it could also be bloated to hide possible commissions paid.

Confronted with these findings, Pharmally director Linconn Ong later told senators during the hearing that he was not familiar with the company’s accounting. Ong said Pharmally was also being probed by the BIR.

“As to kung paano yung accounting, hindi ko talaga kabisado (As to the accounting, I’m really not familiar with this). I cannot comment on it, we are also under investigation by the BIR,” Ong said.

After back-to-back hearings have seen government officials fend off allegations of graft and use the Bayanihan Law to shield themselves from procurement lapses, the Senate has ramped up scrutiny of financial transactions to find other ways to prove liability.

Gordon likened it to the downfall of American mobster Al Capone, who was found guilty of tax evasion and thrown into jail.

“Kung di mo siya mahuli sa kanyang kalokohan, huhuliin mo siya sa BIR, sa internal revenue correct? (If you can’t catch them in their wronging, you catch them through the BIR, the internal revenue, correct?)” Gordon said. – Rappler.com

Add a comment

How does this make you feel?

![[Ask The Tax Whiz] How to file annual income tax returns for 2023](https://www.rappler.com/tachyon/2022/11/tax-papers-hand-shutterstock.jpg?resize=257%2C257&crop_strategy=attention)

![[Ask The Tax Whiz] Are cross-border services taxed in the Philippines?](https://www.rappler.com/tachyon/2024/02/bpo-workers.png?resize=257%2C257&crop=72px%2C0px%2C785px%2C785px)

![[Ask the Tax Whiz] Ease of paying taxes law: What you need to know](https://www.rappler.com/tachyon/2023/02/calculate-february-22-2023.jpg?resize=257%2C257&crop_strategy=attention)

There are no comments yet. Add your comment to start the conversation.