SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines– President Rodrigo Duterte’s economic team is pushing hard for the approval of the 2nd tranche of the Tax Reform for Acceleration and Inclusion (TRAIN) law amid strong opposition.

The Department of Finance (DOF) is proposing to cut corporate income tax and modernize fiscal incentives. These reforms, said economic managers, are necessary.

But the 2nd TRAIN package has very few champions and many opponents.

While the deliberations at the House of Representatives are moving, the Senate is wary. Senate President Vicente Sotto III said his colleagues fear the proposal would bring another wave of inflation.

Two of the country’s top promotion investment agencies have spoken out against the measure as well. Several businesses have raised concerns, too.

Corporate income tax

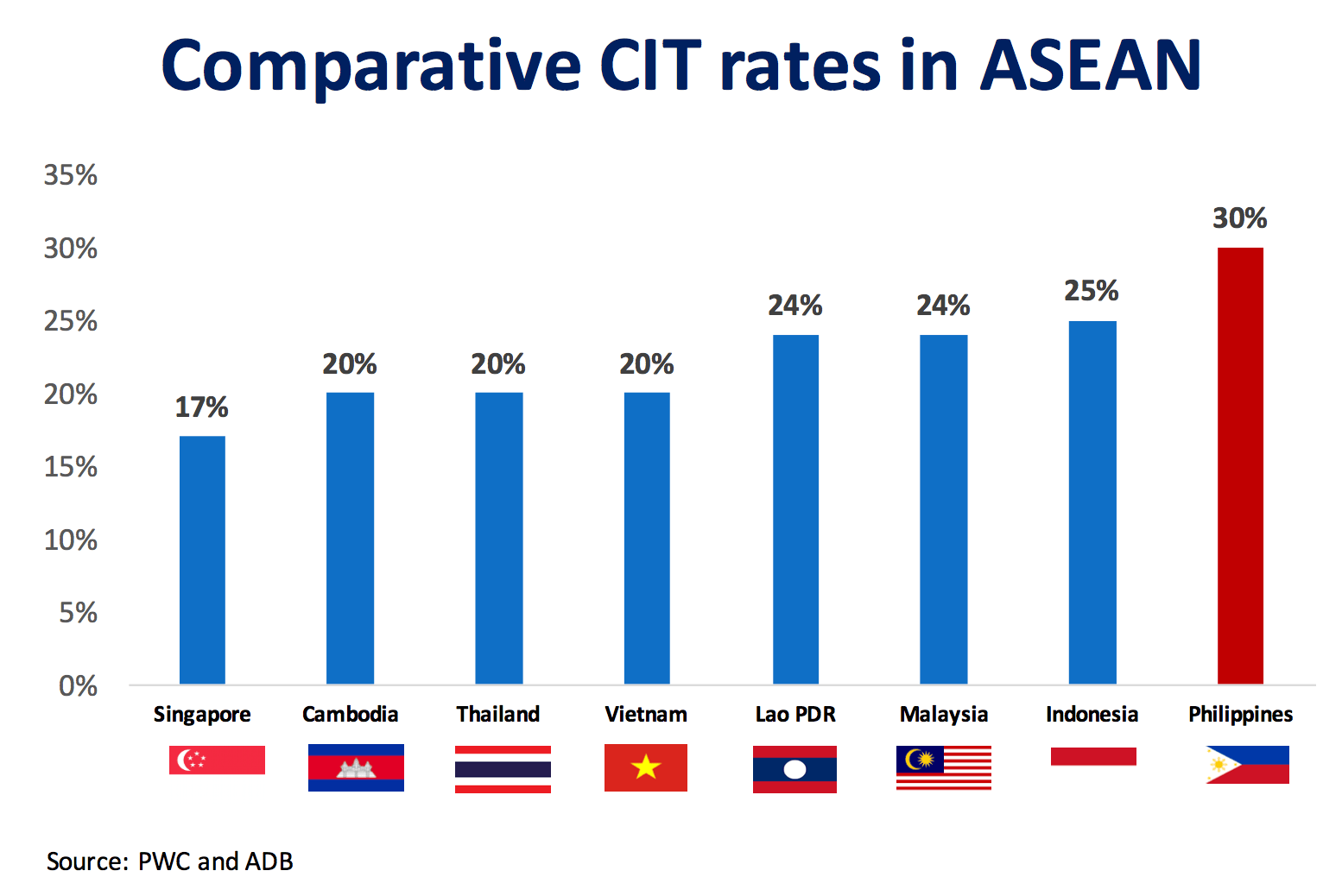

The Philippines has the highest corporate income tax (CIT) in Southeast Asia at 30%. Neighboring Indonesia and Malaysia have 25% and 24%, respectively. Singapore has the lowest CIT in the region at 17%.

The goal is to reduce the CIT rate from 30% to 25% by 2022.

This is perhaps the least contentious feature of the 2nd TRAIN package.

At least 6 big businesses and civil society organizations have expressed their support for the proposed reforms, according to the DOF.

The Management Association of the Philippines (MAP), in a letter to Finance Secretary Carlos Dominguez III, said, “We agree with the need to rationalize and modernize the tax incentive system to make incentives time-bound, performance-based, and not excessively complex with far too many different, even overlapping laws, rules, and regulations.”

Dominguez said the measure is “pro-business, pro-investments, and pro-incentives.”

While the country has the highest CIT in the region, it doesn’t mean there’s no sweet spot for businesses here.

Fiscal incentives

There are 14 investment promotion agencies in the Philippines which are authorized to grant tax incentives under their respective charters.

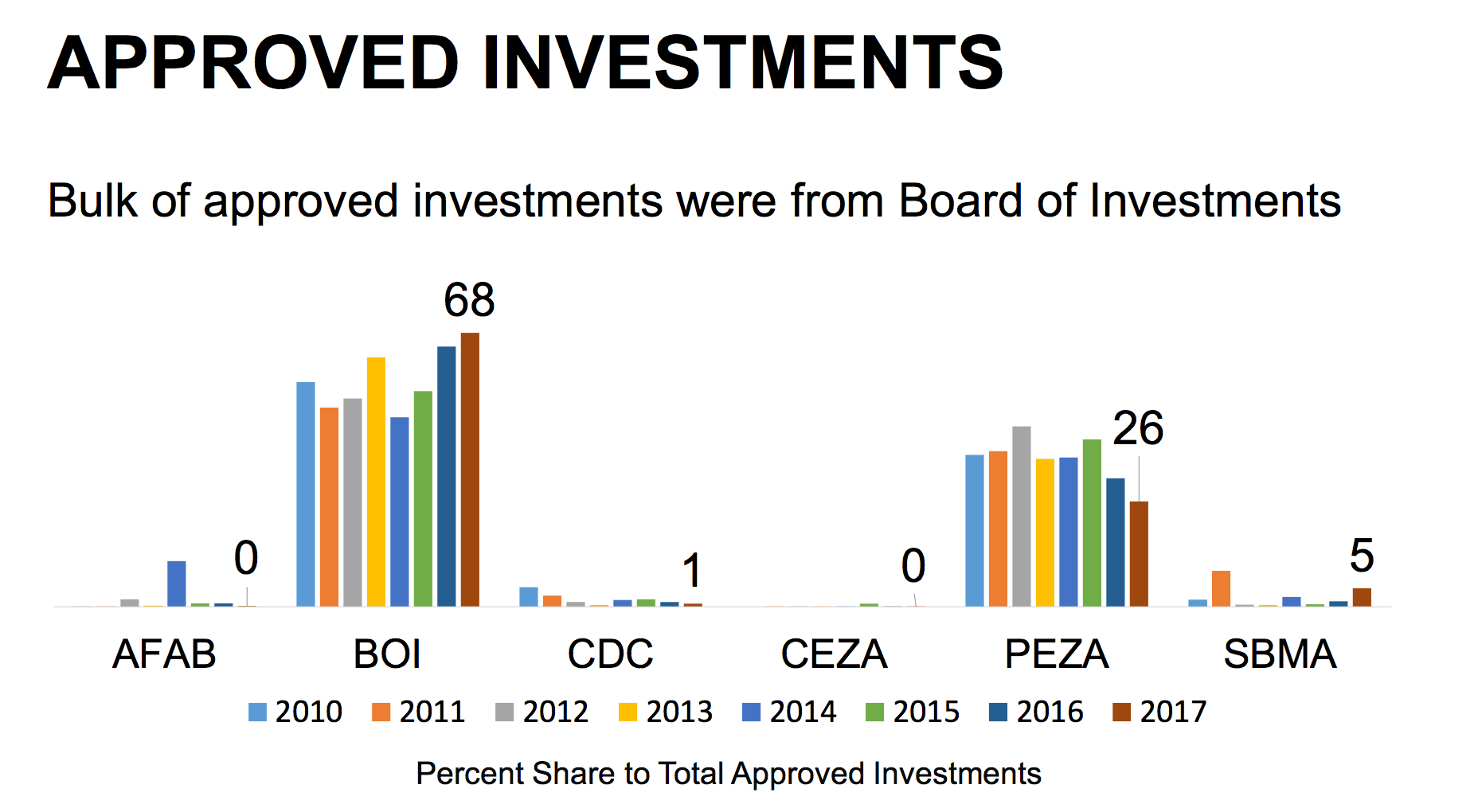

The biggest among them are the Board of Investments (BOI) and the Philippine Economic Zone Authority (PEZA).

The 12 others are the Cagayan Economic Zone Authority (CEZA), Freeport Area of Bataan (FAB), Phividec Industrial Authority (PIA), Clark Freeport and Special Economic Zone (CFEZ), John Hay Management Corporation (JHMC), Aurora Pacific Economic Zone and Freeport Authority (APECO), Bases Conversion and Development Authority (BCDA), Poro Point Management Corporation (PPMC), Subic Bay Metropolitan Authority (SBMA), Zamboanga Freeport Authority (ZFA), Bataan Technological Park Incorporated (BTPI), and Philippine Retirement Authority (PRA).

On top of these, the Philippines also has 123 investment laws and 192 non-investment laws that provide tax incentives. Communication and postal services seem to enjoy the most perks, with 43 related investment laws. Energy and oil, economic zones, and agri-related industries have 14, 11, and 8 investment laws, respectively.

The income tax holiday (ITH) is the centerpiece among all the incentives, followed by the 5% gross income earned (GIE) tax and customs duty exemption. The GIE is given indefinitely and is in lieu of income, value-added tax (VAT), and local taxes.

Other incentives enjoyed by select industries include tax investment allowances; higher deductions for research and development, training, and labor; net operating loss carryover; customs duty exemptions; and export subsidies.

Businesses and legislators are worried that cutting and rationalizing these perks would scare away investors. But the DOF said its analysis shows investors are not taking the bait to begin with.

Reforms needed

According to the DOF, there is huge inequity under the current incentive system. Firms with no incentives pay the regular rate of 30% of the net taxable income, while firms with incentives pay only 6% to 13%.

Out of the 915,000 registered firms in 2015, 2,844 firms were granted incentives. The government estimated P301 billion in foregone revenues due to the tax exemptions.

The government admitted that incentives are needed to attract investments that support the country’s industries. These investments must create better jobs, promote research and development, encourage innovation, stimulate local industries, and diversify product space.

But economic managers insist that incentives must be performance-based, targeted, time-bound, and transparent.

The DOF said the government has been supporting over 600 firms unnecessarily for at least 15 years, and it’s time for these firms to help the government.

Economic managers also pointed out that these perks have not really boosted the Philippines’ foreign direct investments (FDI). The country’s FDI has been growing, but not as much as those of its regional peers.

Since 2000, the Philippines has been overtaken by Indonesia, Malaysia, Vietnam and Thailand in terms of FDI inflows.

Total foreign investment pledges during the 1st quarter of 2018 fell sharply by 37.9% compared to the same period last year, according to the latest data of the Philippine Statistics Authority (PSA).

The total foreign investment pledges approved by the 7 biggest investment promotion agencies stood at P14.2 billion. Only CEZA posted year-on-year growth.

Foreign investment commitments plummeted by 51.8% to P105.6 billion in 2017 from P219 billion in 2016.

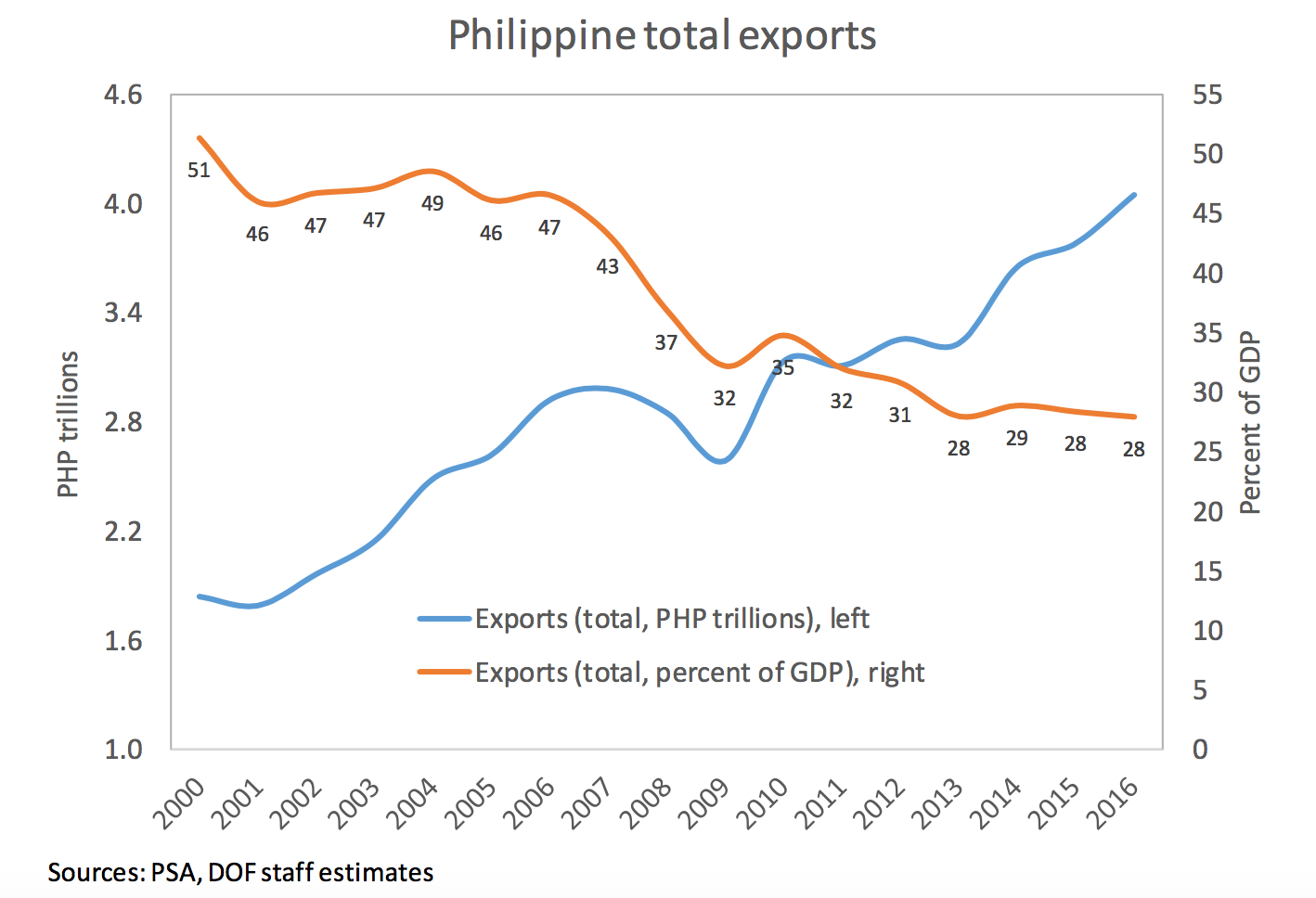

Export competitiveness has also declined and domestic industries have weak linkages to the export industry. The country has also relied too much on imported parts, which in turn resulted in weak domestic output. (READ: Philippines’ trade deficit widens by 47.6% in May 2018)

The agency conducted a cost-benefit analysis of the current tax incentive regime as well, and found that it costs taxpayers at least P257,281 just to create one job.

The DOF also found that registered firms and non-registered firms have the same employment relative to size, wages, level of exports relative to sales, and fixed assets. Both types of firms showed no difference in terms of productivity.

On average, the DOF found that for every peso granted as incentive, the government collected 32 centavos in taxes. But if taxes from unnecessary incentives are accounted for, the government would have been able to collect 86 centavos.

“For every peso spent on incentive, between P0.60 [and] P1.15 comes back in benefits, even after accounting for employment generated and spillovers, both direct and indirect,” the DOF said.

Investment agencies react

PEZA and the BOI, which both oppose the DOF’s proposal to trim fiscal incentives, presented their own analyses.

The BOI asserted that for every peso on tax expenditure, the government generates P2.02 additional tax revenue, P13 worth of domestic sales, and another P16.56 worth of export sales.

The agency added that the tax revenue from firms under the BOI was 31% higher than the remittances of 54 government owned and controlled corporations (GOCCs) and 92% higher than the net financing position of government financial institutions.

The BOI reported some P489.76 billion in CIT collections in 2015 alone.

Meanwhile, PEZA questioned the legality of the measure and cited Section 10 of Article III of the 1987 Constitution, which states that “no law impairing the obligation of contracts shall be passed.”

“This constitutional provision prohibits the enactment of any law that would impair the performance of contractual obligation,” PEZA said.

PEZA also reminded the DOF that the government invited both local and foreign investors to locate in economic zones with the promise that they would enjoy incentives provided by law.

“Since the incentives in the registration agreement are obligatory on the part of the government, it cannot be revoked by a subsequent law for it will result in the violation of the non-impairment clause which is guaranteed by the Constitution,” PEZA said, adding that its officials would be at risk of being sued.

In a nutshell, promotion investment agencies are wary that taking away fiscal perks would drive away both potential and current investors.

But economic managers said granting tax incentives is not the only way to directly help firms. The DOF said the government can use efficient and targeted subsidies as well as address infrastructure gaps and complex business regulations.

No steam

While economic managers can confidently defend the proposal through data and graphs, the political realm would be the true battleground for the 2nd package of the TRAIN law.

Senate President Sotto was previously quoted as saying that no senator wanted to sponsor the measure. He then said on Tuesday, July 31, that he was willing to sponsor it as long as the DOF can assure him it will not lead to new or higher taxes.

Senate ways and means committee chairman Sonny Angara, who supported the 1st TRAIN package, was coy on the matter.

“[As the 2019 elections near], you cannot have hearings, no one goes to Congress, we don’t have session,” Angara said in an ABS-CBN interview.

Taxes have always been a touchy matter for politicians, as it does not get them votes during the campaign period.

The 1st TRAIN package, which imposed higher taxes on sugary drinks and oil, was timed carefully by the government so as not to coincide with elections.

What would it cost the government if the 2nd TRAIN package failed to materialize?

Recall that the government initially aimed to generate around P1 trillion in the next 5 years for the government’s Build, Build, Build program through the TRAIN law. The infrastructure push is estimated to cost around P7 to P8 trillion and will be funded mostly by loans. (READ: Hits and misses of Duterte’s infrastructure push)

But since the 1st TRAIN package was watered down in its final form, the government had to manage expectations. It is now searching for other ways to raise funds.

Then again, the infrastructure push has not been as aggressive as expected. This sluggish pace could just buy the government more time to generate funds amid the upcoming political circus – election season. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.