SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

Editor’s Note: This calculator is being revised to consider amendments to relevant laws.

MANILA, Philippines – The Tax Reform for Acceleration and Inclusion’s (Train) first package promised citizens higher take-home pay through the reduction of personal income tax.

A key component of the bill, the Department of Finance (DOF) said on its website, is that with the tax reform in place, “effective tax rates will be lowered for 99% of tax payers.” (READ: EXPLAINER: How the tax reform law affects Filipino consumers)

How much additional take home pay can one expect from Train?

For starters, minimum wage earners will continue to be tax exempt. (READ: [OPINION] Without enough transfers, tax reform will hurt the poor)

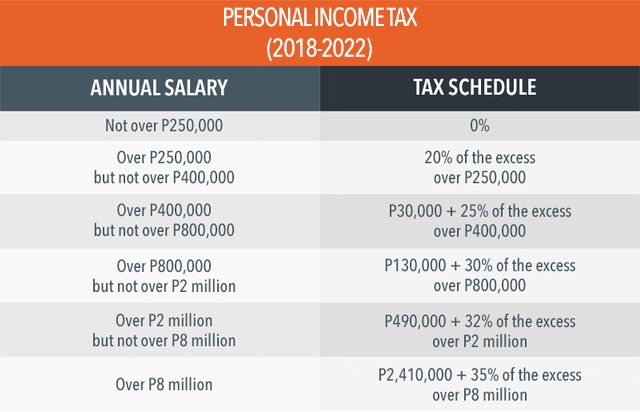

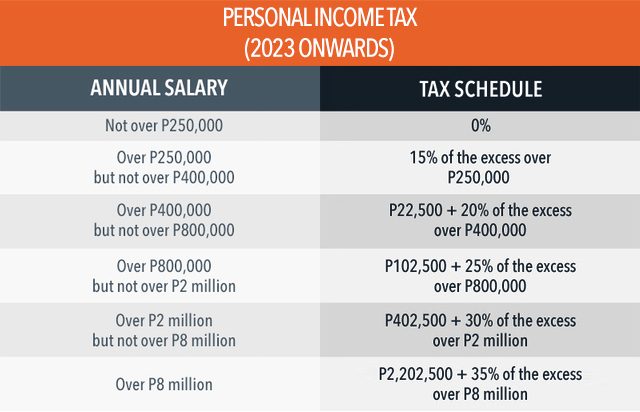

New income tax rates also see those earning an annual salary of P250,000 – or about P22,000 monthly and below – exempt from paying income tax. Previously, those earning an annual salary of P10,000 and below were taxed 5% on their earnings.

Meanwhile, Train will further reduce personal income tax rates in 2023.

Taxpayers can also expect the first P90,000 of the 13th month pay and other bonuses exempted from income tax.

Compute your income tax in the calculator below.

How to compute

Here’s how to compute for your new income tax:

1. Take your montly salary and deduct contributions for SSS, PhilHealth, and Pag-Ibig Fund.

For example, Employee 1 who earns P25,000 a month would be deducted a total of P1,025.05, broken down to P581.30 for SSS, P343.75 for PhilHealth, and P100 for Pag-ibig.

P25,000.00 – 1,025.05 = P23,974.95

Meanwhile, Employee 2 who earns P100,000 a month would be deducted P1,231.30, or P581.30 for SSS, P550 for PhilHealth, and P100 for Pag-ibig.

P100,000.00 – 1,231.30 = P98,768.70

2. If your salary exceeds P90,000 a month, get the taxable amount of your 13th month pay by subtracting P90,000 from your salary and dividing the result by 12. Then, add the amount to the result from step 1 to get your taxable income per month.

Employee 1 would not go through this step, because his monthly salary did not go over P90,000. His monthly taxable income is still P23,974.95.

But Employee 2 would. He would be adding P833.33, because P100,000 – P90,000 = P10,000, which would then be divided by 12. His monthly taxable income is:

P98,768.70 + 833.33 = P99,602.03

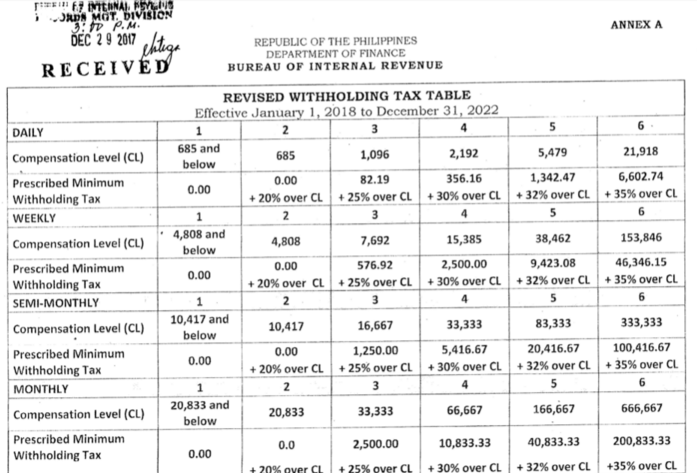

3. Refer to BIR’s withholding tax table to know which bracket your result from Step 2 will fall. Then compute for your tax due.

For Employee 1, P23,974.95 falls under bracket 2 (compensation exceeds P20,833.33). This means we subtract P20,833.33 and multiply the difference by 20%.

( P23,974.95 – 20,833.33 ) x 0.20 = P628.32

For Employee 2, P99,602.03 falls under bracket 4 (compensation exceeds P66,666.67). This means we subtract P66,666.67, multiply the difference by 30%, and add P10,833.33.

[ ( P99,602.03 – 66,666.67 ) x 0.30 ] + 10,833.33 = P20,713.94

– Rappler.com

Notes on the tax calculator: The 13th month pay is included in the calculation of the income tax, assuming that the taxable amount, if any (if 13th month pay exceeds P90,000), is “annualized” or distributed equally to the 12 months of the year. Meanwhile, the computation under the old tax system uses the old maximum amount for bonuses exempt from tax (P82,000) and the old contribution table for PhilHealth. PhilHealth implemented its new contribution table in 2018, separate from the implementation of the Train Law.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.