SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

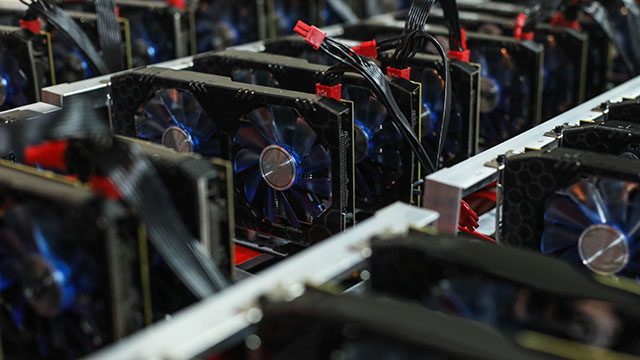

LONDON, UNITED KINGDOM – Surrounded by the cryptocurrency mining “rig” that is taking over his bedroom, “Ali” lays bare the risks of his trade, revealing his profits “are a tenth of what they were”.

Prices of cryptocurrencies have plunged since the heady heights of last year, slashing the profits of miners such as Ali.

“This is the worst possible time to invest,” the young Lyon native, who preferred to keep his name secret, told AFP.

Ali still ekes out a profit and has amassed enough reserves to absorb around six months of losses, but the days of generating 15,000 euros (£13,580; $17,450) profit per computer seem long gone.

He acquired his first rig, an assembly of six graphics cards, in January 2017, and was just about to buy his seventh.

This investment totalled around 13,000 euros, soon paid off with his initial gains.

But the cryptocurrency boom at the end of 2017, of which Bitcoin was the best-known example, has multiplied the number of miners.

Many virtual currencies require that machines are connected to the network and miners are rewarded with units of currency when they create a new block, achieved by solving complicated mathematical problems.

However, the more units are mined, the more the currency is devalued.

‘Not fair!’

“We were of course very uneasy about seeing our customers not getting what they expected,” recently admitted Genesis Mining, a company that rents computing power.

It blamed the “downward trend” of prices and the “heavily rising difficulty” of mining since April.

The collapse of Bitcoin, which has lost two-thirds of its value since December and dragged many more cryptocurrencies in its wake, has not discouraged miners.

On the contrary, the power dedicated to Bitcoin mining has more than tripled since its peak prices, and the trend shows no sign of abating, according to the bitinfocharts site.

A “farm” consisting of more than 3,000 mining units was inaugurated in Russia last week, cutting profitability even further.

In mid-December, the reference unit for computing power, the THash/second, permitted the equivalent of $3.84 to be mined in one day, compared to only 25 cents today.

As a result, Genesis Mining offered its customers newer equipment to rent at a reduced price, halving maintenance costs, but the proposal was not greeted warmly.

“This is not fair! Your early customers helped you get to where you are now. Give us a free upgrade, we deserve it and you know it,” tweeted one customer.

Electricity burden

Mining can also be expensive due to the huge amount of electricity required to earn units.

For example, the Antminer S9 – a mining device dedicated to Bitcoin – is worth more than 600 euros and consumes 1,600 euros of electricity per year.

Individuals, who generally focus on other virtual currencies that are easier to mine than Bitcoin, tend to rely on graphic cards to do the heavy lifting, which are less power hungry.

Those who get special rates on their electricity bills, such as Philippe Vanbaelinghem, an employee of UK energy company EDF, and a miner for almost a year, can therefore exploit their “huge advantage” for monetary gain.

His staff discount allows him to reduce his bill by 80 euros per month, helping him generate around 140 euros in monthly mining earnings.

“Not everyone is equal on this,” he admitted, pointing out that he could still have made a profit on standard tariffs when prices were high, but not now.

As a tenant, Ali’s electricity bill is fixed each month, and he has not received any complaints from his landlord.

Other costs include technical faults, maintenance and the hours required to learn how to optimize equipment, meaning miners have little room to cut costs, despite market prices.

“As strong believers in the industry and its potential, we are certain the market will soon recover,” said Genesis Mining.

Ali and Philippe are among the many miners who have incorporated speculation into their business model, hoarding some of their mined cryptocash.

Ali hopes to stop mining in four or five years.

With cryptos, “you have to expect everything,” said 25-year-old. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.