SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

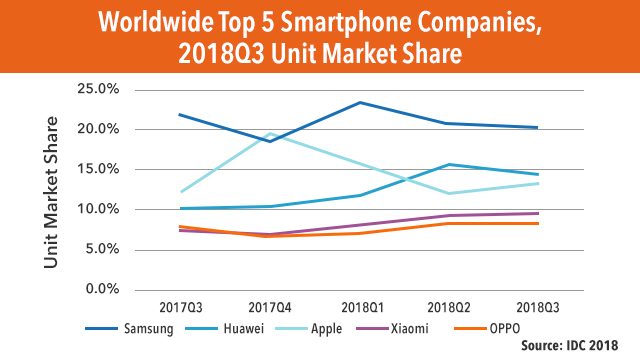

MANILA, Philippines – It’s been a good year for Huawei’s phone division in 2018, having maintained its No. 2 spot in the global smartphone market for two consecutive quarters, according to the International Data Corporation (IDC). It’s the longest that the company has been able to fend off long-time No. 2 Apple in IDC’s quarterly reports – although the margin remains slim, and the competition fierce.

Huawei first beat Apple in IDC’s rankings in Q2 2018, on the back of strong demand for its flagship P20 and P20 Pro phones and its lower-cost Honor phones, which are targeted at a younger audience. The run continued in Q3 2018, according to IDC’s latest reports, in which Huawei shipped 52 million units while Apple moved 46.9 million. Samsung remains the leader, shipping 72.2 million in the quarter.

While the battle for second is certainly something to keep a close eye on, what’s far more pressing for smartphone vendors is that the smartphone market has declined for 4 straight quarters since Q4 2017. Compared to the same period last year, shipments in 2018’s third quarter is 6% less, decreasing from 377.8 million to 355.2 million.

Among the top 5 vendors, Samsung saw the biggest decline, shipping 83.3 million in Q3 2017, down to 72.2 million in Q3 2018. In the same period, Huawei increased shipments from 39.1 million to 52 million; Apple from 46.7 million to 46.9 million; and No. 4 Xiaomi from 28.3 million to 34.3 million.

World No. 5 OPPO saw a slight decrease from 30.6 million to 29.9 million.

Down but not out

IDC points out several reasons for the continued decline. Consumer spending, especially in the world’s biggest market China, has been down, which can be traced to “high penetration levels” and “some challenging economic times,” says IDC’s mobile device tracking VP Ryan Reith. Yet, IDC remains optimistic for the 2019 market, expecting a “refresh cycle across all segments,” and later, 5G devices to reverse the trend. (Q&A: Xiaomi’s Southeast Asia director on how 5G will change phones)

As for the shorter term, specifically the last quarter of 2018? IDC research manager, Anthony Scarsella, puts his hopes on the army of flagships available now.

“No matter who leads in the overall market the holiday quarter should be an exciting one with a wide selection of new flagship devices available. With the new iPhones, Mate 20, Pixel 3, V40, Note 9, and OnePlus 6T, we can expect consumers will have a plethora of options when upgrade time approaches. The vast selection of high-priced handsets should move ASPs (average selling price) in a positive direction come next quarter,” Scarsella says.

In the Philippines, the most recent IDC figures have already shown a reversal, with the market in the first half of 2018 growing 5.6% larger than the first half of 2017. Filipinos are also buying more midrange phones, with the average price Filipinos paid for a phone increasing from $127 to $192. While ultra-budget phones still own the majority of the market, financing plans – such as Home Credit and Flexi Finance – and in-store retail credit have also allowed Filipinos to spring for the more expensive units. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.