SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

This week President Duterte announced in Beijing that he will be severing military and economic ties with the US, and that he will be more “dependent” on China for investments, trade, and aid.

If indeed pursued, this “pivot” or realignment to China can be considered as one of the most dramatic foreign and economic policy turnarounds in recent history, and is sure to send shockwaves worldwide and spell confusion among Filipinos.

As we enter this new era of Philippine-Sino relations, perhaps it would be helpful to step back and look at the current state of the Chinese economy which, it seems, we will be increasingly exposed to.

In particular, we wish to highlight one major red flag about the Chinese economy that President Duterte is hopefully aware about, namely China’s spiraling debt and its impending banking and financial crisis.

China’s slowdown

China is fast becoming the world’s economic superpower, leading some to say that the 21st century is really the “Chinese century”.

Back in 2011, China overtook Japan as the world’s second-largest economy. Various forecasts also suggest that, at the rate it’s growing, China could overtake the US as the world’s largest economy between 2020 and 2030, or in less than 14 years.

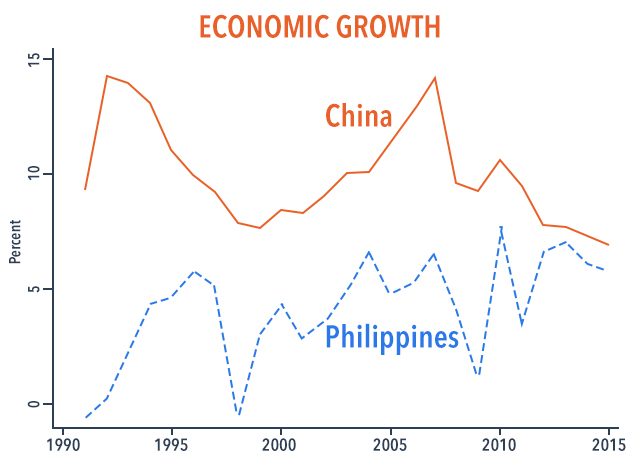

But recently, Chinese economic growth has gone down considerably. Figure 1 shows that from stellar double-digit GDP growth rates a decade ago, economic growth has slowed down to 6%-7%, or what President Xi Jinping called the “new normal”. Last year’s growth was also the slowest in more than 25 years.

To be sure, a 6%-7% annual growth rate is still pretty impressive – it implies that the Chinese economy will double in the next 10-12 years.

China’s debt-driven growth

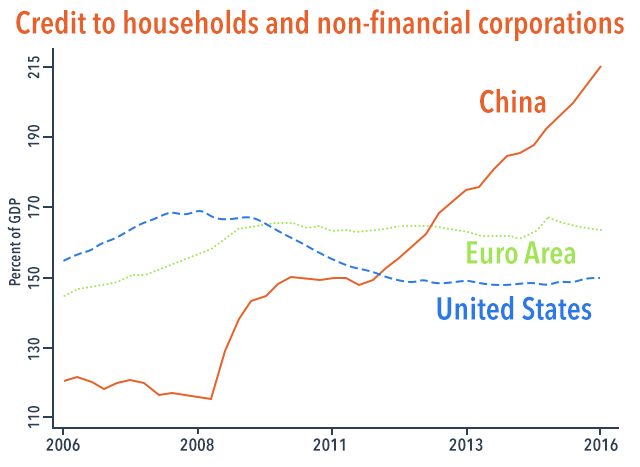

What’s more troubling, however, is that much of Chinese growth has been driven primarily by excessive domestic lending, especially among the private sector. As of June 2016 this has led to a total domestic debt of $25 trillion-$26 trillion, or a whopping 250% of its GDP.

While China’s debt ratio is not the largest in the world, it is certainly the largest among emerging economies and one of the fastest-growing.

Figure 2 shows that this was due mainly to a massive growth of credit to the private sector over the past decade. As of the first quarter of 2016 credit to households and non-financial corporations amounted to 210% of GDP.

Note that Chinese credit has accelerated as economic growth has decelerated. These trends are not coincidental – China has, in fact, deliberately relied on credit as a way to prop up its weakened economy, especially in the aftermath of the global financial crisis.

As a result, Chinese credit has been increasing faster than its economy. Furthermore, a recent working paper by the IMF shows that, if China doesn’t slow down its credit growth (or “deleverage”), then each unit of credit will be able to generate less and less output in the near future.

China’s impending banking crisis

Runaway indebtedness in a global superpower is a red flag since, if you remember, it partially led to the world economy’s stumbling during the 2008-2009 global crisis. Our very own economic crisis in 1983 was borne by the Marcos regime’s rapid accumulation of debt.

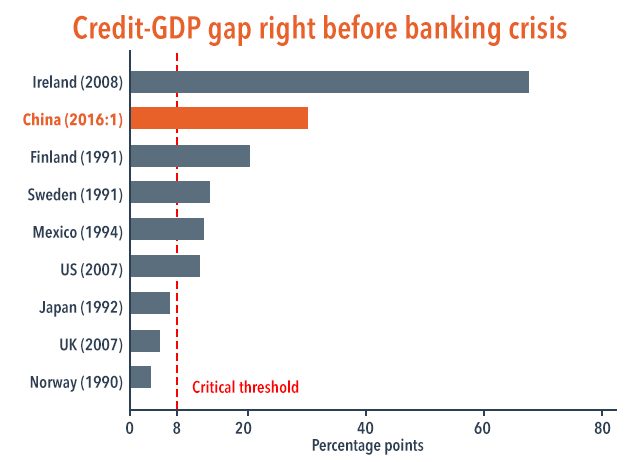

Some recent studies have shown that one very good predictor of a banking crisis is the so-called “credit gap”, or the gap of the credit-GDP ratio to its long-run trend.

Figure 3 below shows the credit gap for 8 different countries a quarter before they experienced a severe banking crisis, including the US financial crisis of 2008-2009.

Most of the time a credit gap in excess of 8 signals a high chance that a severe banking crisis will happen soon. China today is well within this danger zone: its credit gap as of March 2016 is already at 30.

While the credit gap is a good predictor of a banking crisis, it doesn’t predict when exactly it will happen. The credit gap can remain very high for long periods before a crisis occurs.

Nevertheless, many other indicators point to the Chinese financial sector’s poor health, including a recent increase in the share of bad or non-performing loans, which amounts to 6.5% of China’s GDP or thereabouts.

Many experts suggest that it’s not too late, and that the impacts of a debt crisis could be mitigated if the Chinese government steps in to temper rampant credit growth.

First, Chinese debt could be restructured in a number of ways, including debt-for-equity swaps (where a company’s debt is exchanged for shares of stock), infusing banks with new capital (for the bad loans they lost), or creating a market for bad loans.

Second, the Chinese government should quickly address the growth of its “shadow banking” sector, or financial firms subject to less regulatory oversight than banks. In recent times they have accounted for a growing portion of private lending, including the alarming surge of risky subprime housing loans.

Third, to discipline banks and borrowers, the Chinese government should also dispel the notion that it will always be there to bail them out. Already, 9 big banks in China foresee the need to be bailed out by 2018.

Conclusion: Beware the red flags in the Chinese economy

In sum, most indicators point to China’s impending banking and financial crisis, owing to its insatiable appetite for domestic credit and its mounting debt load. Most experts agree that it’s no longer a question of if, but when, it will happen.

What are the implications for the Philippines? In this age of globalization, when the world’s superpowers like the US or China cough, the whole world almost certainly gets a cold in varying degrees.

For smaller countries like the Philippines, the problem lies not so much on our new borrowings from China, which should be manageable as long as we have sufficient wherewithal to repay them. (READ: China commits $9B in ‘soft loans’ for PH drug rehab, dev’t projects)

Instead, the greatest exposure would be a slowdown or contraction of trade with China and the rest of the world, owing to the slowdown in global trade that would result once the Chinese debt crisis breaks out.

All in all, the gap between the Philippines and China is becoming narrower by the day. Hence, before we embark on ever deeper ties with China, it’s imperative that our leaders – starting with the President himself – have a good idea of who we’re dealing with and what exactly we’re signing up for. – Rappler.com

The author is a PhD student and teaching fellow at the UP School of Economics. His views are independent of the views of his affiliations. Thanks to Prof. Calla Wiemer (UP School of Economics), who specializes on the Chinese economy, and Kevin Mandrilla (UP Asian Center) for valuable comments and suggestions.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.