SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

Combating social inequality is hard in itself. But the recent debacle over the proposed SSS (Social Security System) pension hike highlights the even tougher task of redressing inequality across generations: that is, balancing the welfare of current and future Filipinos.

This is already the second consecutive year that Congress has pushed for a P2,000 across-the-board pension hike. Proponents say that the hike will improve the living conditions of the 2 million or so current pensioners of the SSS.

But the Duterte Cabinet’s economic managers – Secretaries Ernie Pernia, Ben Diokno, and Sonny Dominguez – are persuading the President to reject the bill in its present form owing to the negative repercussions it will have on the financial sustainability of the SSS. In particular, the Cabinet members warned that the P2,000 hike will drastically reduce the lifespan of the reserve funds of SSS.

Naturally, such claim was questioned by some of the bill’s proponents, who recently dared the 3 secretaries to live on P40 per day to “feel” the plight of SSS pensioners. Some of them even called for the Cabinet members’ ouster at one point.

In this article we try to evaluate the competing claims by arriving at our own back-of-the-envelope estimates of the hike’s effect on the lifespan of SSS. We then use these figures to show the different scenarios that future beneficiaries face.

How to fill a leaky bucket

First, it may help to review the basics. The SSS is a social insurance system run by the government. It maintains a “reserve fund” from which it can provide financial assistance to its members in times of sickness, disability, maternity, old age, or death.

Maintaining a large-enough fund lies at the heart of the business model of SSS. The fund grows when contributions from its members grow, or when returns on the investments of SSS grow. Meanwhile, the fund contracts when benefit payments to members grow, or when operating expenses grow.

Think of the task of trying to hold as much water in a leaky bucket. As long as there’s more water pouring into the bucket than is escaping through the cracks, then water will be present inside at all times.

Analogously, if inflows of money always exceeded outflows, then the SSS reserve fund can theoretically provide benefits in perpetuity.

However, this typically isn’t the case: outflows have historically grown faster than inflows.

This shortfall is worsened by the fast growth of the elderly population (around 3 times the annual growth of the working population), which means that the SSS will have to make larger pension payments in the future.

As a result, there will come a time when more funds will leave the SSS reserve fund than will replenish it, thus depleting the fund eventually.

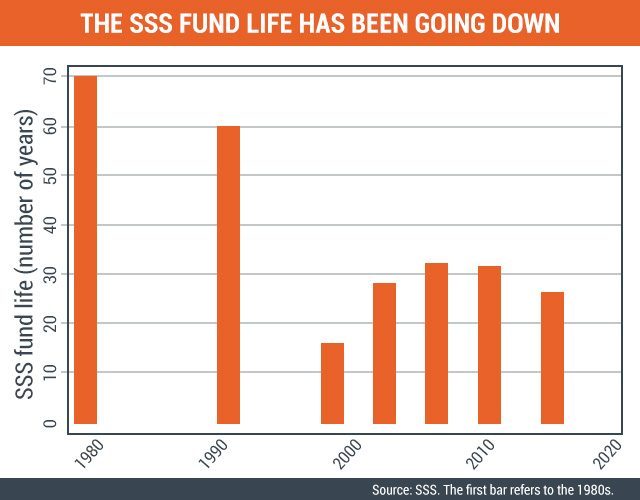

Back in the 1980s, this so-called “fund life” of the SSS reached 70 years (the international benchmark). But since then, such fund life has gone down significantly (see Figure 1). As of 2016 the reserve fund is projected to last for only 26 years (up to 2042 or thereabouts).

One key reason behind the diminished fund life is that pension hikes have happened much more frequently than contribution hikes. Data show that between 1980 and 2014 there have been 22 pension hikes versus only 3 contribution hikes.

Indeed, pension hikes not accompanied by contribution hikes only raise the chances that future SSS members will have nothing to enjoy once they get to retirement age.

Effects of yet another pension hike

Today we’re faced with yet another request to hike SSS pensions – one so large that it threatens to drastically cut the fund life of SSS by 10 to 17 years.

I tried to look for the data behind these figures, to no avail. To get around this, I did my own back-of-the-envelope calculations using past data and some reasonable assumptions. (I myself am not an actuary, and formal studies to project the lifespan of SSS funds use much more complex models.)

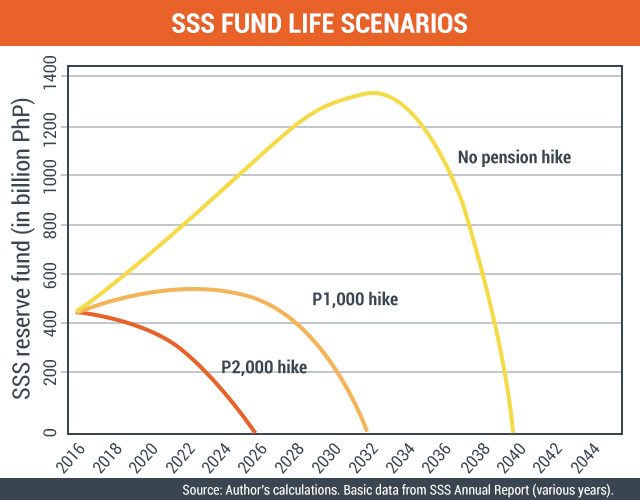

Figure 2 below shows 3 possible scenarios about the SSS fund life.

First, if no pension hike occurs, the reserve fund will still continue to grow until the mid-2030s, but will be depleted just before 2040. This is within the neighborhood of the government’s current projections.

Second, if a P2,000-pension hike occurs in 2017, the fund will shrink until it becomes depleted by 2025. This drastically cuts the SSS fund life, corroborating the statement of the Cabinet secretaries.

Third, an alternative P1,000-hike is not much better: the fund will be depleted by 2031, a postponement of just 6 years.

Options moving forward

Remember that the international benchmark for the fund life is 70 years. Hence, the proposed hike – holding other things constant – does nothing but imprudently shorten the fund’s lifespan away from this goal. It’s like deliberately shortening the life of someone who already has a few years to live.

To be sure, there are ways to extend the SSS fund life to accommodate any pension hike.

But as things stand, the SSS is supposedly working at an 88% collection rate. Hence, a contribution hike may be a more effective way to augment revenues. Indeed, the Cabinet members recommended a commensurate increase of SSS contribution rates from 11% to 17%. But lawmakers are likely to see this as a tough sell to the public.

Yet another possibility is to raise the retirement age from 60 to 70. By extending the working life of the elderly, this will increase social security contributions and cut benefits, thus extending the life of the SSS reserve fund. But this is a highly contentious issue requiring careful and extensive study.

Conclusion: We need forward-looking, sound economic policies

There’s no denying that today’s retirees enjoy pensions that are too small to cover their daily expenses, especially on food and medicine.

But the SSS fund life is too far away from the ideal lifespan of 70 years. Hence, the proposed P2,000-pension hike (without any accompanying increase in contributions) would only drain the SSS fund much faster and make it more difficult for society to provide for the future of Filipino pensioners.

The issue also showcases yet another important tradeoff between politics and economics. In this era of global populism never has it been more crucial to demand forward-looking and sound economic policies.

Arguably the best thing that came out of this pension debacle is President Duterte’s surprising willingness to listen to advice from his economic managers.

Moving forward, the President ought to maintain this openness to reason. After all, he is responsible for policies that will affect the well-being of not just the current – but also the future – generations of Filipinos. – Rappler.com

The author is a PhD student and teaching fellow at the UP School of Economics. His views do not necessarily reflect the views of his affiliations. Thanks to Chris Monterola (whose earlier analysis helped inspire this article) and Kevin Mandrilla (for very valuable comments and suggestions).

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.