SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

In his latest effort to fulfill his campaign promises, President Rody Duterte recently ordered a crackdown on people involved in so-called “5-6” moneylending.

5-6 involves lenders – many of them Indian nationals – issuing small loans at a 20% interest rate or so. Payments are typically collected on a daily or weekly basis.

In last Monday’s (January 9) Cabinet meeting, Duterte ordered the arrest and deportation of such 5-6 lenders. Although their high interest rates are not illegal per se, they were deemed by the President “usurious” and “burdensome” to the people.

This directive has resulted in a flurry of government actions. For instance, Justice Secretary Vitaliano Aguirre claimed that such arrests could, in fact, be executed without warrants. Meanwhile, Foreign Affairs Secretary Perfecto Yasay Jr has already discussed the matter with the top Indian diplomat.

In this article we put the 5-6 lending scheme in context by situating it in the country’s broader financial system. We show that its enduring popularity stems from its ability to address certain limitations of our formal credit markets. In other words, 5-6 is but a symptom of a larger problem at play.

Overview of lending in the PH

First, let’s review some facts about Filipinos’ ability to access credit. Data from the Bangko Sentral show that as of 2015 around 47% (or nearly half) of all Filipino adults had an outstanding loan.

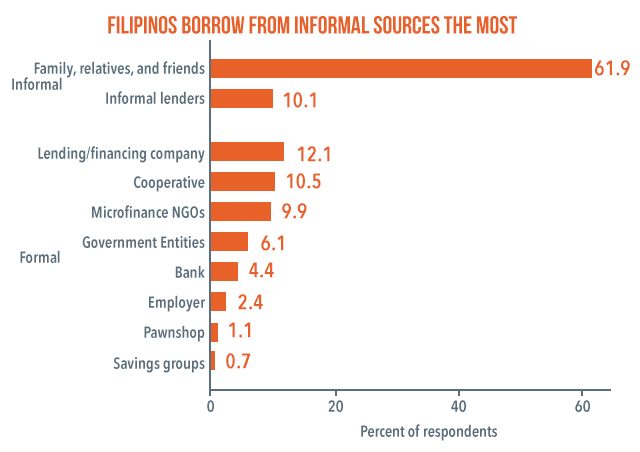

But a vast majority of them did not borrow from formal sources like banks or cooperatives (see Figure 1). Instead, they borrowed more from informal sources: 62% borrowed from family members, relatives, and friends, while 10% borrowed from informal lenders like loan sharks and 5-6 lenders.

Why is informal borrowing so popular? Although 84% of adults acknowledged the importance of loans in their daily lives, only 56% said they wanted to borrow from formal lenders.

One key reason for this is that borrowing from formal lenders remains to be costly and inconvenient. Among those who said they had difficulties obtaining credit from formal lenders, 28% cited high collateral requirements as their main problem, while 20% cited the numerous documentary requirements.

Credit market failures

Filipino entrepreneurs have an especially difficult time obtaining loans from formal lenders to start or expand their businesses.

Today around 99.6% or nearly all business establishments in the Philippines are classified as “micro/small/medium enterprises” (MSMEs). These are firms with less than 200 employees or assets less than P100 million. Of these, 90.3% are “micro enterprises”, or those with less than 10 employees or assets less than P3 million.

The small scale of these businesses hinders entrepreneurs from easily accessing credit from formal lenders. One study found that, indeed, high collateral requirements have become a “major impediment” for the development of MSMEs. Many MSMEs are also unable to satisfy other requirements, such as business plans and proofs of financial recordkeeping capabilities.

For their part, lenders are also reluctant to issue loans due to inadequate information about borrowers’ credit history and creditworthiness. As long as lenders and borrowers cannot be brought to the same page (and trust between them is hard to establish), then lending will become near-impossible and formal credit markets may fail altogether.

Enter informal lending

These difficulties give rise to informal lending mechanisms, which have their own pros and cons.

One advantage is that informal lenders accept non-traditional forms of collateral (such as retail goods or labor services) or even no collateral at all (as in the case of 5-6).

A second advantage is that trust is easier to establish between informal lenders and borrowers. For instance, in rural settings loans are often tied to existing economic relations, such as those between sari-sari owners and their suki (patrons), landlords and their tenants, and traders and farmers. When borrowers fail to repay their loans, they jeopardize their other important economic ties.

But to compensate for the larger risk they are taking, informal lenders usually impose higher interest rates and monitor payments more frequently. Most people are familiar with the 20% interest rate in 5-6 arrangements. But in Nueva Ecija, for instance, informal interest rates as high as 60% are not unheard of.

It is therefore no wonder that informal lending schemes are often accused of causing further financial distress to the poor who rely on them the most.

Microfinance revolution

In the presence of credit market failures, the government has taken several steps to help increase people’s reliance on formal credit.

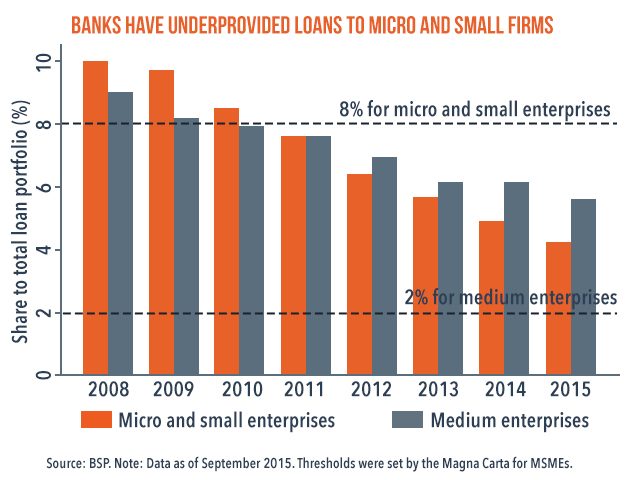

For example, in 2007, Congress passed the “Magna Carta for MSMEs” which required banks to allocate at least 8% of their loan portfolio to micro and small enterprises, and 2% to medium enterprises.

However, Figure 2 shows that compliance with this law has been mixed: banks have underprovided loans to micro and small enterprises, but at the same time have overprovided loans to medium enterprises. This attests to the continuing difficulties in bridging the information gaps between banks and small borrowers.

Another way to improve access to formal credit is by promoting the growth of community-based microfinance institutions (MFIs). By making use of existing community relations, MFIs can afford to lend with minimal requirements. This model, pioneered by the Nobel Prize-winning Grameen Bank, has been particularly successful in South Asia.

President Duterte’s support for this type of microfinance – through the DTI’s new program called P3 or “Pondo sa Pagbabago at Pag-asenso” – is a welcome development. However, such programs will work best when complemented with comprehensive financial literacy programs.

Finally, new technologies can improve the growth of microfinance. Latest innovations include “credit scoring” (which helps lenders distinguish between good and bad risks) and “digital microlending” (which makes use of SMS messaging and social networks to expand the reach of formal credit).

Conclusion: Let’s not mistake the symptom for the problem

5-6 lending is but a small part of the country’s informal credit system, which is essentially a reaction to the difficulty of accessing loans from banks and other formal credit institutions.

Worldwide, the role of informal credit generally diminishes as countries progress. With the continued growth of microfinance in the Philippines, our people will come to rely less and less on informal schemes like 5-6. In fact, the Philippines is already making impressive strides in the pursuit of greater financial inclusion.

But moving forward, the government ought not to mistake symptoms for our problems. In the same way that a cold won’t go away instantly just by sweating it out, we won’t achieve 100% financial inclusion just because we arrest and deport all 5-6 lenders.

As in many other aspects of development, shortcuts and magic formulas are often a poor substitute to careful thought and hard work. – Rappler.com

The author is a PhD student and teaching fellow at the UP School of Economics. His views do not necessarily reflect the views of his affiliations. Thanks to Kevin Mandrilla for helpful comments and suggestions.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.