SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

![[OPINION] Tax after death](https://www.rappler.com/tachyon/r3-assets/612F469A6EA84F6BAE882D2B94A4B421/img/CC35DB38E6F04870AE8D36C70DBEEEDB/thought-leaders-edward-gialogo.jpg)

Among the taxes in the Philippines, estate tax is probably the most ignored.

In legal parlance, the properties left by a dead person (otherwise known as “decedent”) are collectively called “estate,” hence the estate tax.

Usually, the heirs realize the need to pay the estate tax after years or even decades have passed from the decedent’s death.

For instance, a person with substantial properties died in 2007 and the estate tax (if paid on time) would have been P50,000. However, the heirs were not mindful of estate tax.

Today, 10 years later, a potential buyer of the property approaches the heirs. Since the estate tax will have to be settled first before the property can be sold, the heirs will now compute the tax. With the penalties, the P50,000 originally due will now inflate to around P170,000.

The buyer may be willing to advance the estate tax on the condition that it will be deducted from the selling price. However, the heirs will insist that the buyer must pay the estate tax on top of the selling price. Sometimes, this sole issue results in the collapse of the sale negotiation.

To avoid this unfortunate situation, it is advisable for the heirs to settle the estate tax within the deadline. If they do not have sufficient cash, they may request for an extension of time to pay or apply for installment payment.

Notice of death

The first obligation of the heirs under the Tax Code is to give a written Notice of Death to the Bureau of Internal Revenue (BIR) within two months after the death.

The Notice of Death shall be filed with the BIR’s local office (Revenue District Office or RDO) that has jurisdiction over the place of decedent’s residence at the time of death.

If the decedent is not a resident of the Philippines, the Notice of Death should be filed with the BIR office in South Quezon City (RDO Number 39).

Filing of return and payment of estate tax

Place of filing

Like the Notice of Death, the estate tax return shall be filed with the RDO (or other offices authorized by the BIR) in the city or municipality where the decedent was a resident at the time of death.

For a non-resident decedent (residing abroad at the time of death), the estate tax return is generally filed with RDO No. 39 in Quezon City.

Deadline of filing

The return should be filed within 6 months after the death. In meritorious cases, an extension of not more than 30 days may be granted by the BIR.

Deadline of payment

The estate tax shall also be paid at the same time the return is filed.

Payment by installment

The BIR may allow the payment by installment. However, the computation of estate tax shall always consider the entire estate and the corresponding penalty shall be imposed on any amount paid after the due date.

Extension of time to pay

The BIR may allow an extension of time to pay the estate tax.

The extension should not exceed 5 years in case the estate is settled through the court, or two years in case the estate is settled extrajudicially through the execution of an extrajudicial settlement.

Penalty

The late payment of estate tax will lead to the imposition of 25% to 50% surcharge, 20% interest per year, and a compromise penalty.

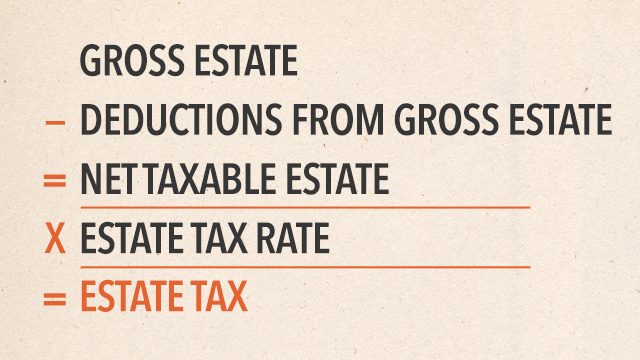

Computation of estate tax

Gross estate

It is the total value of all properties belonging to the decedent at the time of his or her death.

For citizens and resident foreigners, the gross estate consists of real and personal property regardless of location. Personal property includes tangible and intangible property like shares of stocks.

For non-resident foreigners, the gross estate comprises only of property located within the Philippines.

Deductions

The estate tax will not be based on the entire estate but on the net taxable estate. To arrive at net taxable estate, a number of deductions/expenses are allowed to be deducted from the gross estate.

The common deductions/expenses that may be availed of by the heirs are:

- Funeral expenses (maximum of P200,000)

- Fees of the accountant and/or lawyers who assisted the heirs

- Unpaid debts of the decedent

- Standard deduction of P1,000,000 (no substantiation required)

- Medical expenses within one year before death (maximum of P500,000)

- Family home (maximum of P1,000,000)

Net taxable estate

This is the remaining amount after deducting the applicable deductions/expenses from the gross estate.

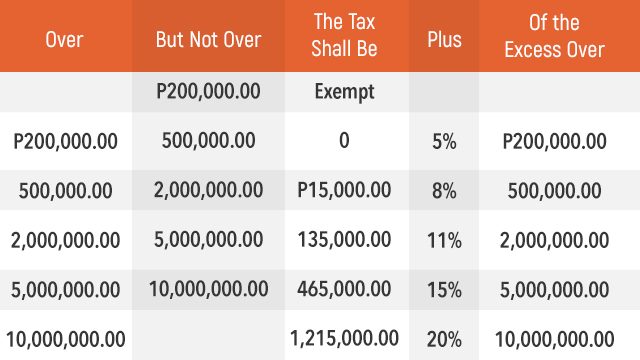

Estate tax rates

After computing the net taxable estate, the rates below are applied to arrive at estate tax due.

Based on the table, a net taxable estate not exceeding P200,000 is exempt from estate tax. Any amount in excess of P200,000 shall be subject to graduated estate tax rate of 5% to 20%. – Rappler.com

This article is for general information only. If you have any question or comment regarding this article, you may email the author at egialogo.gdlaw@gmail.com or call 09178718642.

Attorney Edward G. Gialogo is the managing partner of Gialogo Dela Fuente & Associates. He is also a tax speaker in Philippine Institute of Certified Public Accountants. He was an Associate Director in the Tax Services of SyCip Gorres Velayo & Company.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.