SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

![[OPINION] Economic hardship in the time of Duterte: Here’s the data](https://www.rappler.com/tachyon/r3-assets/612F469A6EA84F6BAE882D2B94A4B421/img/A8BF4240B302434E909DF9F3B1C22790/tl-dutertes-misery-index-dec-15-2017.jpg)

Fast economic growth to the tune of 6-7% is impressive and beneficial for the country. After all, it ultimately means higher incomes for many Filipinos.

But this doesn’t mean everyone’s benefitting from growth the same way. In fact, these growth figures are nearly meaningless for the poor – what matters more to them is that they have a job and that prices do not rise fast.

In this article we look at objective and subjective measures of Filipinos’ economic hardship in the time of Duterte. All in all, the numbers don’t look too good. By focusing too much on growth, we risk overlooking the plight of many Filipinos whose boats have not been lifted by the rising economic tide.

Misery index

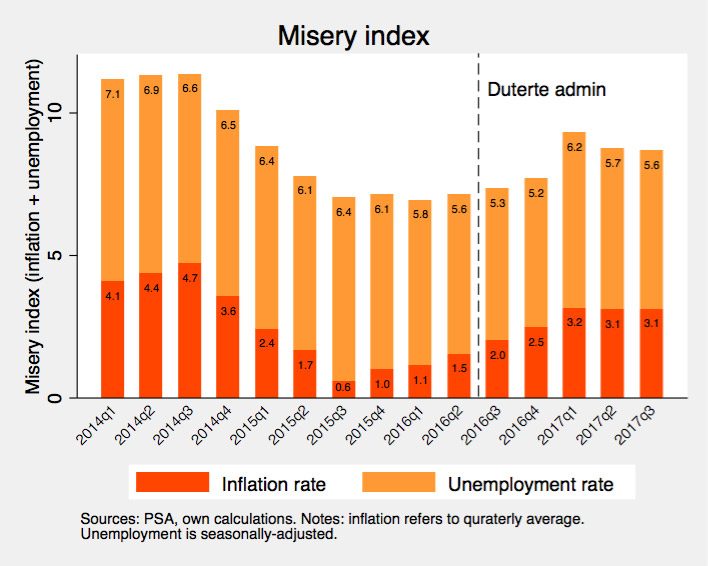

Few economic statistics impact people’s lives as directly as the inflation rate and the unemployment rate.

Inflation simply refers to how fast the prices of commonly-bought items are rising. Higher inflation (a faster rise of prices) eats away at the purchasing power of every peso we earn.

Meanwhile, unemployment measures how many people are without work, but available for work and seeking work. Unemployment brings not just lost incomes, but also much stress and uncertainty.

When both inflation and unemployment go up, people can feel more miserable in economic terms. This is why their sum is sometimes called the “misery index”, coined by American economist Arthur Okun in the 1970s.

How does the misery index look like for the Philippines? Figure 1 shows that the misery index has been going down since late 2014. But it has picked up recently: on a year-on-year basis, the misery index has been increasing in the 5 consecutive quarters since President Duterte came into office.

Figure 1.

This uptick is due more to higher inflation than unemployment. But the latest jobs data are no less troubling: in October 2017 (not included in the graph) there were 134,000 fewer employed Filipinos from last year, owing to the 1.43 million jobs lost in the agricultural sector. What happened to all of them?

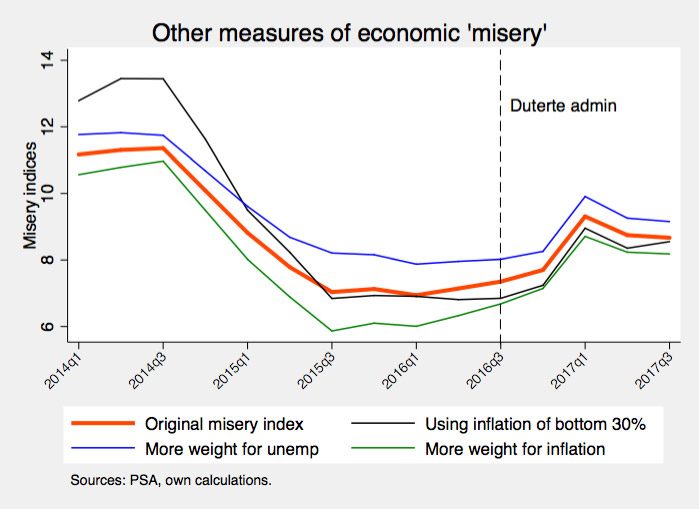

There are, of course, other ways to compute the misery index. One might want to give more weight to inflation than unemployment, or vice-versa. One might also want to focus on the inflation rate experience of the poorest 30% of households, who are more sensitive to food inflation than anyone else.

Figure 2 summarizes these alternative measures of the misery index. Regardless of their differences, all of them display the same recent uptick since the start of the Duterte administration. (Some argue that underemployment may be a better gauge of job misery. If we use this in the misery index instead, things won’t look as bad.)

Figure 2.

Regardless of the precise definition, there’s reason to believe the misery index will keep rising in the coming months due to higher expected inflation. Factors include: robust economic growth; the rollout of the government’s “Build, Build, Build” program; and the implementation of the tax reform law, which features (necessarily) higher taxes on petroleum, automobiles, and tobacco.

The think tank Nomura already expects inflation in 2018 to exceed the government’s target of 2-4%. The IMF also warned earlier that the economy risks “overheating” due to strong credit growth, and this could manifest in higher inflation.

There’s a silver lining, though. Basic macroeconomics tells us there’s a short-run tradeoff between inflation and unemployment: robust economic growth might increase inflation (due to higher demand for goods and services) but it may also reduce unemployment (because of the new opportunities it brings).

If this tradeoff holds, then higher future inflation might be counteracted by lower future unemployment. But economists worldwide are finding weaker evidence of this short-run tradeoff. How the Philippine misery index will play out in the future is therefore hard to predict.

Self-rated poverty, hunger

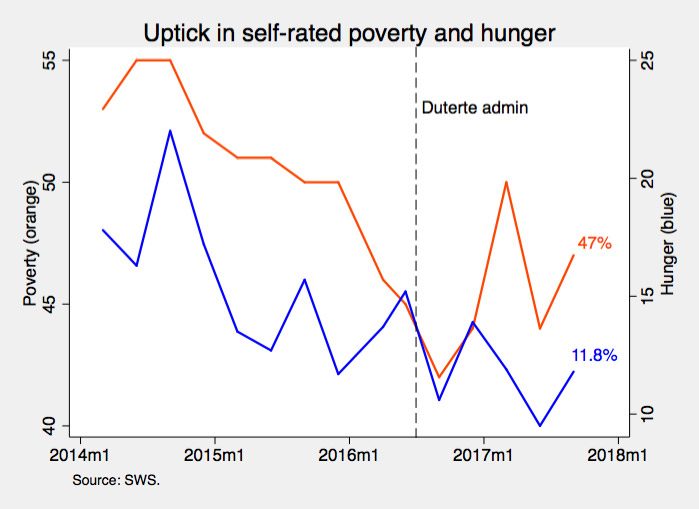

Yet another way of quantifying economic hardship is by looking at how people perceive their own poverty and hunger. Their limits notwithstanding, such subjective measures of welfare are an important social barometer that complement official poverty and hunger statistics (which are harder to come by).

Figure 3 shows the self-rated poverty and hunger statistics since 2014. Both have declining long-run trends, but in September 2017 there has been a recent uptick for both: 47% for poverty, 11.8% for hunger.

Figure 3.

These data immediately put the Palace on the defensive, and they blamed higher inflation and the peso’s depreciation. For once, this is not an unreasonable explanation coming from them: the peso’s depreciation increases the prices of imported goods (say, petroleum products), and this feeds directly into domestic inflation.

Unfazed, Palace spokesperson Harry Roque said, “It is for this reason that while the administration is building a strong and sustainable domestic economy, growth must be inclusive and must be translated to a more comfortable life for all.”

But a more comforting message would’ve been to say what exactly the government plans to do to mitigate the impact of higher expected inflation.

Consumer confidence

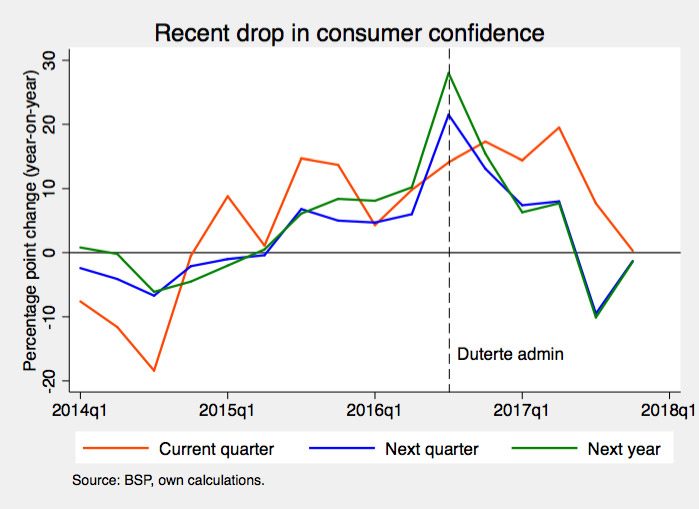

Finally, we look at consumer confidence statistics collected quarterly by the Bangko Sentral. Respondents are asked to rate their optimism and pessimism about the economy and their household finances at present, in the next quarter, and in the next year. Consumer confidence is, roughly put, the degree to which optimists outnumber pessimists.

Overall consumer confidence in October 2017 was registered at 9.5%, lower than last quarter’s 10.2%. Figure 4 below shows the changes in the overall trends. As one can see, there was a spike in consumer confidence around the time President Duterte came into office, but this has since dwindled.

Figure 4.

Respondents in the fourth quarter said they were less optimistic due to: “higher prices of goods and household expenditures” and “peace and order problems (particularly, extrajudicial killings, drug issues and crisis in Marawi).”

This is one manifestation of the economic spillovers of President Duterte’s prized policies on peace and order. In many instances we’ve seen the police and military perpetrate violence and lawlessness themselves, often to little or no consequence. Unless this culture of impunity changes, people’s anxieties about peace and order will only worsen and erode their remaining confidence in the economy.

Don’t overlook people’s hardships

All these numbers hardly paint the entire picture of economic hardship today.

We haven’t talked about the drug war’s catastrophic death toll and its impact on poor families left behind. We haven’t talked about the Marawi crisis and the unintended consequences of martial law in Mindanao. We haven’t talked about the scourge of road congestion throughout the nation, which costs us enormous stress and billions of pesos daily.

Economic woes, if unabated, could lead to social unrest. Recall that it was not so much Ninoy Aquino’s assassination in 1983 that led to EDSA 1, but the deep, painful recession in 1984 to 1985 that preceded it.

We’re far from an economic crisis of that scale. But the Duterte government will do well not to overlook signs of Filipinos’ economic hardships today. Government might just regret it. – Rappler.com

The author is a PhD candidate at the UP School of Economics. His views are independent of the views of his affiliations. Follow JC on Twitter: @jcpunongbayan.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.