SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

![[OPINION] Without enough transfers, tax reform law will hurt the poor](https://www.rappler.com/tachyon/r3-assets/612F469A6EA84F6BAE882D2B94A4B421/img/FF5C9FDC58274CC3842A246900F84CF8/collage-thought-leaders-train.jpg)

There’s a great deal of confusion and fear now surrounding the new tax reform law or TRAIN, so much so that even high-ranking government officials are spreading wrong advice on how to deal with it.

But many are genuinely interested to know: when all is said and done, is TRAIN good or bad? How will it impact ordinary Filipinos?

In a sense, this is futile to ask. Tax reform is, by nature, a series of pluses and minuses. So it’s really hard to say whether TRAIN is categorically “good” or “bad”.

But let’s try to answer it anyway. I argue that, while TRAIN is good for Filipinos in general (especially in the long run), it will hurt the incomes of the poor (especially in the short run).

Without enough offsetting transfers delivered by the DSWD, the poor will lie dangerously close to TRAIN’s tracks.

A watered-down law

It may be hard to believe, but a lot of good economics actually went into the very first draft of TRAIN. After more than a year of debates and concessions, however, a lot of these good ideas ended up being watered down.

First, TRAIN cuts personal income taxes and hikes taxes on certain products like sugar-sweetened beverages and petroleum. In doing so, TRAIN adheres to the basic idea that people should be taxed for what they take out of the economy, not for what they put into it.

But: The new income taxes will matter little to the poor (since many of them are minimum wage earners and tax-exempt to begin with) and those in the informal sector (like taho vendors, jeepney drivers, sari-sari store owners).

Second, TRAIN aligns with the usual prescription of economists to “widen the tax base”: that is, to tax more goods rather than less, because this gives us more room to lower the tax rate on any one good.

But: While TRAIN removed many tax exemptions, it also introduced new, almost arbitrary ones, like electric vehicles and pickups.

Third, TRAIN imposed taxes on goods that produce socially undesirable effects, such as petroleum products (for the pollution they create), automobiles (for the congestion they cause), and cigarettes and sugar-sweetened beverages (for the health problems they pose).

But: These tax hikes ended up lower than expected because of intense lobbying from the affected industries. Lawmakers even managed to pass tax cuts for luxury cars.

Fourth, TRAIN included provisions to simplify our overly complex tax system, like limiting income tax returns to 4 pages and requiring quarterly rather than monthly filing for certain forms.

But: This doesn’t solve other key administrative issues, such as chronic corruption in the Bureau of Customs.

All in all, the first package of TRAIN was an opportunity to correct many problems that have long ailed our tax system. While a step in the right direction, many of TRAIN’s well-meaning provisions got watered down by politicians.

Remember that we’re just on the first package of TRAIN. Any imperfection can still be fine-tuned and remedied in the future packages. (READ: Duterte wants 2nd tax reform package to fund teachers’ salary hike)

How TRAIN hurts the poor

The biggest problem with TRAIN is that it’s not very progressive. Sure, its taxes reduce the incomes of the richest individuals, like CEOs and other top taxpayers. But it will also hurt the incomes of the poor.

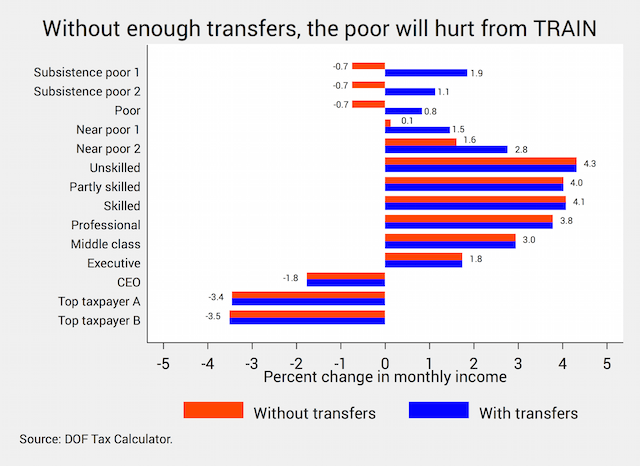

Figure 1 summarizes the net impact of TRAIN on the take-home pay of people with different incomes, using the DOF’s official Tax Calculator. Throughout, I computed the effect of TRAIN on single persons in the private sector with 4 dependents each.

Figure 1. These estimates are based on the 2018 projected monthly income of people across income groups (deciles).

Focus on the orange bars first, which show the raw impact of TRAIN’s new taxes.

The biggest winners from TRAIN are the unskilled workers (who will enjoy a 4.3% bump in their monthly incomes), followed by skilled workers (4.1%), partly skilled workers (4%), professionals (3.8%), and the middle class (3%).

Meanwhile, the biggest losers are CEOs and top taxpayers (whose incomes will fall by 1.8% to 3.5%). At the same time, the poor will also see income cuts, albeit not as much (less than 1% of their incomes).

TRAIN hurts the poor chiefly because of its higher excise taxes and the faster rise of prices (or higher inflation) it causes. Fewer VAT exemptions and higher excise taxes will push up the prices of food and transportation, and this will eat away at people’s take-home pay.

I wrote before that the richest households consume most of the petroleum products in the country, so that they (not the poor) will suffer the most from higher excise taxes on petroleum.

But higher petroleum taxes will spill over to the rest of the economy, from the costlier transport of vegetables from Baguio to the larger Meralco bills coming through our doorsteps.

The higher inflation that TRAIN will stoke will, unfortunately, hurt the poor the most. Data show that everyone will hurt from higher inflation, but the effect on the poorest will be more than twice the effect on the richest.

Will the transfers be sufficient?

TRAIN, therefore, will have the bitter side-effect of hurting the incomes of the poor. The government was aware of this from the very beginning.

To counteract this, part of TRAIN’s revenues will go back to the poorest households, as identified by the Department of Social Welfare and Development (DSWD). Preparations for these lump sum transfers reportedly started last year.

For 2018, the transfer is P200 per poor family per month, or P2,400 per poor family per year. This monthly lump sum will increase to P300 in 2019 and 2020.

The hope is that, when poor families receive such transfers, they will enjoy higher take-home pay in spite of TRAIN’s new taxes. This is represented by the blue bars in Figure 1.

But this is a big if. Many questions about this transfer scheme remain unanswered and unresolved (and receive surprisingly little attention in media).

For example: are these amounts enough to tide over each poor family? How ready is the DSWD to effectively distribute the money to 10 million poor households? How sure are we that politicians will not exploit such transfers to promote their campaigns for 2019?

Aside from the logistical nightmare of such a massive transfer, the poor are also vulnerable to the recent surge of profiteering induced by TRAIN. Many retail establishments are already using TRAIN as an excuse to post higher prices for their goods and services.

The poor, unaware of illegal profiteering, could easily be taken advantage of. Will P200 also protect them from such profiteering?

How to avoid a TRAINwreck

Tax reform is not just an opportunity to make the economy more efficient; it’s also a chance to make society a little bit fairer.

But it’s still the early days. We don’t yet know whether TRAIN will achieve the former, much less the latter.

It’s unfortunate that TRAIN’s new taxes will tend to reduce the take-home pay of the poor. Without sufficient offsetting transfers, the new taxes could end up harming the poor instead of improving their plight.

But now that TRAIN has left the station, so to speak, we can only hope that the offsetting transfers are sufficient and reach their intended beneficiaries in a timely manner, especially once the higher prices start to kick in.

Otherwise, the new law could prove to be the #TRAINwreck many people are already claiming it to be. – Rappler.com

The author is a PhD candidate and teaching fellow at the UP School of Economics. His views are independent of the views of his affiliations. Follow JC on Twitter: @jcpunongbayan.

Check out the DOF’s new Tax Calculator to see how TRAIN could impact your own income: http://taxcalculator.ph/.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.