SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

![[OPINION] How Duterte endangers your retirement](https://www.rappler.com/tachyon/r3-assets/DD1F4602E05443A5BE93E2B448318F2B/img/4D4B02F4B3EA43E1807242A5F891CC03/TL-How-Duterte-endangers-your-retirement-May-24-2018.jpg)

With each passing day, President Duterte’s incapacity to make sound economic policies becomes more and more apparent.

Back in January 2017, at Duterte’s behest and in partial fulfillment of his promise on the campaign trail, the Social Security System (SSS) hiked its pension benefits by P1,000 per month per beneficiary.

Last week, SSS President Emmanuel Dooc warned that their funds will be in a “precarious” state if they raise pensions in 2019 by another P1,000 without an accompanying raise of members’ contributions.

Pushing through with this plan is just bad economics. Not only does it endanger the future retirement of SSS members, it also adds to the economic hardship and uncertainty that they feel today.

Moreover, as a solution to the larger problems of the country’s social pension system, Duterte’s pension hike is simplistic, superficial, and short-sighted.

Shorter fund life

Maintaining the SSS fund is a lot like keeping water in a bathtub. Allowing a pension hike without a commensurate increase of members’ contributions is like opening the drain and closing the faucet: sooner or later, the bathtub will run out of water.

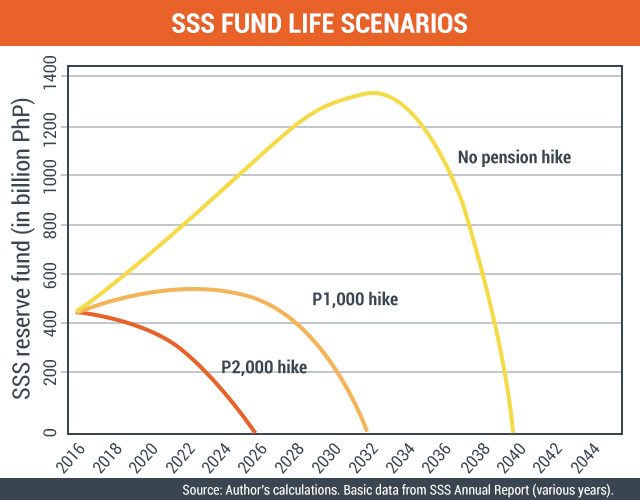

In a previous piece, I already discussed how Duterte’s pension hike significantly shortens the SSS fund life or lifespan (see Figure 1).

The first tranche in January 2017 had the immediate effect of reducing the profits of the SSS by 37% in 2017 and shortening its fund life by 10 years, from 2042 to 2032.

But the second tranche, set in 2019, not only requires an additional P33 billion in payouts, but also further shrinks the SSS fund life to 2026 – a mere 7 years hence.

Needless to say, this is an alarming prospect. For Duterte’s pension hike to make economic sense, it must be accompanied by a contribution hike of, say, 1.5% to 3%. Otherwise, there will be nothing left for future retirees.

Figure 1.

Sadly, what makes for good economics often makes for bad politics. Recall that President Benigno Aquino III vetoed a similar proposal by Congress to hike pensions – only to be vilified, castigated, and called “heartless”.

In contrast, the current crop of economic managers also sounded the alarms, but Duterte flatly ignored their advice. Now, the SSS fund is in the danger zone. In this case, who did the better economic policy?

If you think of it, the tradeoff involved in the SSS pension hike is a lot like the tradeoff in TRAIN, or the tax reform law Duterte signed in December.

The reduction in personal income taxes in TRAIN also served as a significant drain on government coffers, and just had to be accompanied by new taxes to supplant lost revenues.

The problem with TRAIN, of course, is that its new excise taxes – especially on petroleum products – could not have come at a more inopportune time. With world oil prices at a 4-year high and the peso at an 11-year low, TRAIN has stoked inflation beyond the 4% target of the Bangko Sentral for 2018.

Moreover, the inflationary impact of TRAIN tends to offset the impact of Duterte’s initial pension hike. While pensioners’ incomes increased by P1,000 per month, that amount’s purchasing power is counteracted by the recent acceleration of prices, leaving pensioners not much better than before.

Larger problems

Aside from its patently bad economics, Duterte’s pension hike also ignores the larger problems in the country’s pension system, as summarized in a 2017 study.

First, over 70% of working Filipinos do not contribute to any pension scheme, and only around 25% contribute to SSS. One reason is that most workers are in the informal sector or are non-regular. Hence, they are not automatically enrolled in the SSS or GSIS.

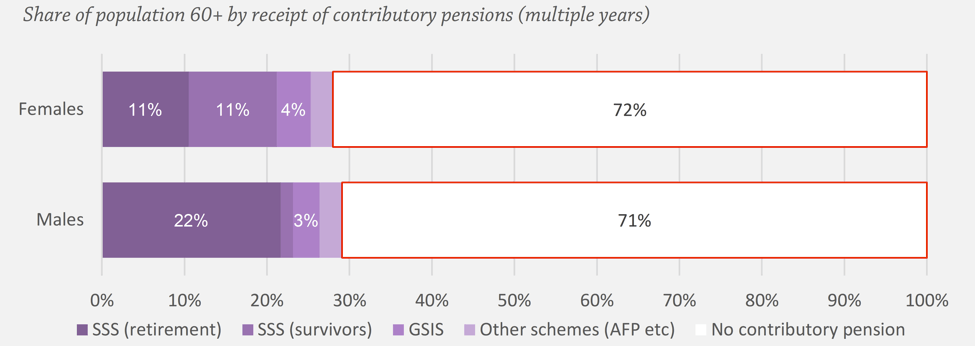

Second, as a result of inadequate contributions, less than a third of senior citizens actually receive some form of pension (Figure 2).

Figure 2. Less than a third of Filipino seniors get pensions. Data as of 2015. Source: Sevilla et al. [2017].

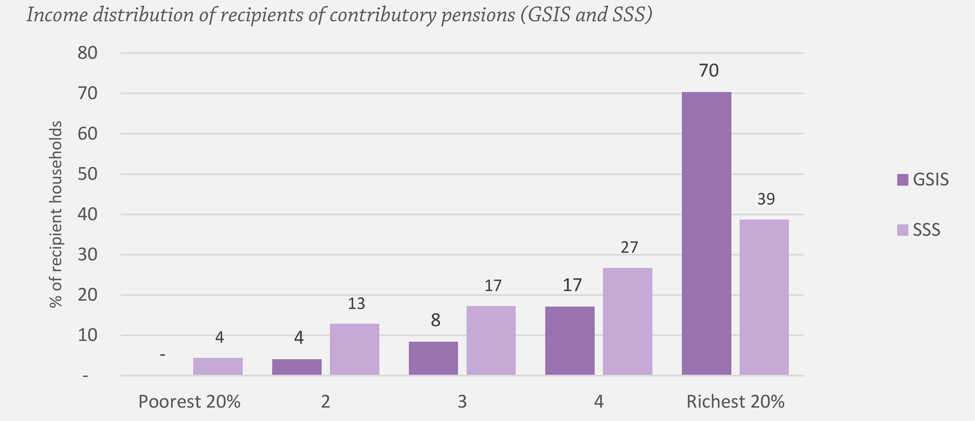

Third, those lucky enough to get pensions are not exactly poor: as of 2013, 39% of SSS beneficiaries belonged to the richest fifth of the population, while only 4% were found in the poorest fifth (Figure 3).

In addition, a large chunk of SSS pensioners – 29% of men and 44% of women – receive benefits less than P2,000 per month, which is hardly enough to ensure their income security.

Figure 3. Source: Sevilla et al. [2017].

These facts immediately reveal the drawbacks of Duterte’s pension hike. For instance, funding it from the SSS fund not only requires more contributions from the current pool of enrolled workers, it could also dissuade self-employed workers from joining the SSS.

Meanwhile, funding the pension hike from general taxes is tantamount to transferring money to the rich, since data show that most SSS and GSIS pensioners are in the population’s richest income group.

Universal social pension

Perennially inadequate contributions and limited coverage underscore the need for radical reforms in the country’s pension system.

One of the more prominent proposals now is a “universal social pension system,” which will automatically cover and guarantee a fixed income for every Filipino above a certain age, say 60.

This system – which is already in place in some of our neighbors – would greatly increase the scope of pension coverage especially among the poor and those in the informal sector. Moreover, it could improve healthcare access, lower depression, and abate poverty among the elderly.

But how much will universal social pension cost? Estimates in the Sevilla et al. study show that a monthly universal pension of P500 per month per beneficiary will cost around 0.3% of GDP, while P1,500 per month per beneficiary will cost around 1% of GDP.

Note that these estimates are entirely within the neighborhood of amounts spent by other developing countries like Brunei and Thailand.

Because of inflation, however, a fixed pension could actually have lower purchasing power over time. Hence, another proposal is to “index” or link pensions to inflation. This could raise the cost of universal social pension, but not so if economic growth remains robust in the coming decades.

Can the Duterte administration afford universal social pension at this point?

TRAIN is already expected to help fund a number of other big-ticket projects like “Build, Build, Build” and the free tuition law. Moreover, in the latest budget, government prioritized the pensions of government retirees in particular. Hence, there doesn’t seem to be much leg room for universal social pension now.

All in all, the yawning gaps of the country’s social pension system require bold, comprehensive, and forward-thinking solutions like universal social pension – not simplistic, superficial, and short-sighted ones like Duterte’s pension hike.

When helping hurts

Although Duterte and his friends in Congress originally wanted to improve the plight of old and poor retirees, their chosen method – simply increasing pension benefits – could very well endanger the future retirement of millions of workers in the private sector.

The road to retirement hell is paved with Duterte’s good intentions.

At this point, perhaps the best way to help workers is to hold back and stop the implementation of the second tranche of the SSS pension hike.

But what could change Duterte’s mind? If he won’t listen to his economic managers, he better listen to the millions of Filipinos whose retirements he put at risk because of his stubbornness and lack of economic sense.

Right now we’re already reeling from the effects of Duterte’s other economic policies, such as TRAIN’s ill-timed excise taxes, the Boracay shutdown, and the mismanagement of NFA.

Yet another reckless and ill-thought economic policy by Duterte – one that stands to endanger people’s retirement – is the last thing Filipinos need right now. – Rappler.com

The author is a PhD candidate and teaching fellow at the UP School of Economics. His views are independent of the views of his affiliations. Thanks to Aura Sevilla for useful insights about universal social pension and to Kevin Mandrilla for comments and suggestions. Follow JC on Twitter: @jcpunongbayan.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.