SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

![[ANALYSIS] Mere hiccups? Let’s be more honest about the economy](https://www.rappler.com/tachyon/r3-assets/A73D8A5961BE4B7691E44FF487BEC025/img/12F9B40997F64C28845657F27D72C580/Lets-be-more-honest-about-the-economy-Aug-31-2018.jpg)

It’s quite unfortunate that President Duterte’s economic managers are being less than forthright about the current state of the Philippine economy.

In a recent interview, Budget Secretary Ben Diokno downplayed concerns about runaway inflation. He said, “We’re not concerned with inflation as long as growth is happening because we want to sustain our growth. These to me are hiccups.”

Back in May, Diokno already earned the people’s ire by saying, “kung masipag ka lang, hindi ka magugutom sa Pilipinas.” (If you’re hardworking, you won’t go hungry in the Philippines.)

How can the economic managers be stubbornly oblivious to the worsening economic plight of our people? Can’t they even feign a bit of concern?

More disquietingly, it’s clear as day they’re being disingenuous about our current economic situation.

The truth is, economic growth is faltering even as prices are running away. The economic managers also missed the most important targets they set for themselves.

Missed targets

The economic managers, in coordination with heads of other government agencies, regularly adjust targets for important economic indicators like output growth (as measured by GDP or gross domestic product) and inflation (how fast prices are changing).

For 2018, their GDP growth target is 7% to 8%. For inflation, it’s 2% to 4%.

Sadly, it seems we’re going to miss both targets this year.

Figure 1 shows the rapid acceleration of prices in recent months. Back in July inflation clocked in at 5.7%. Not only is this the highest in over 9 years, it’s also way above the government’s upper target of 4%.

Figure 1.

A number of people have argued that some amount of inflation is normal – in fact welcome – especially in a fast-growing country like ours. It typically indicates brisk economic activity and growing demand for millions of goods and services throughout the economy.

Yet while prices have surged, economic growth has stumbled.

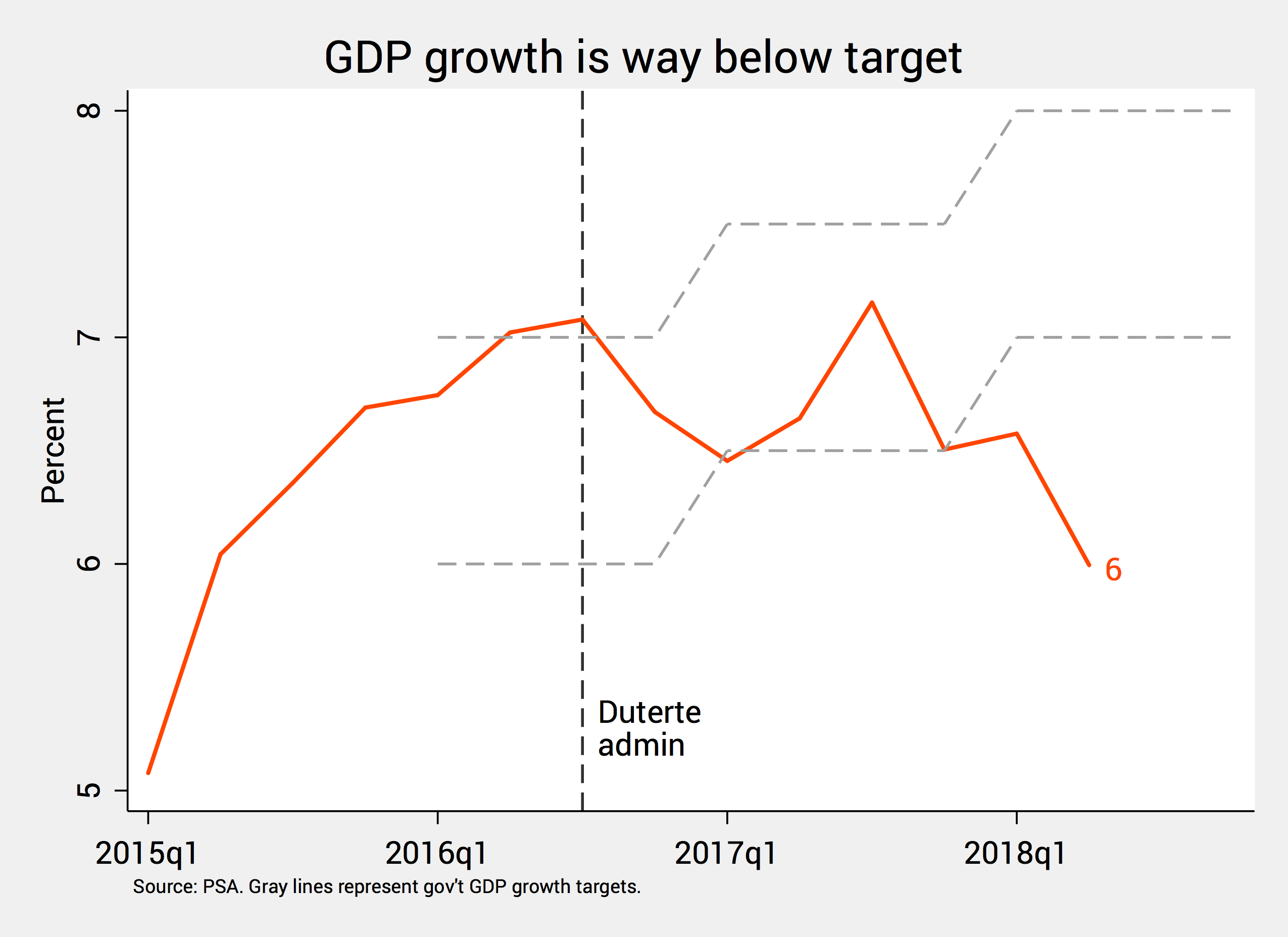

Figure 2 shows that economic growth fell to 6% in the second quarter of 2018. Aside from being the lowest since 2015, it also failed to hurdle the 7% lower target of Duterte’s economic managers.

Indeed, Figure 2 roughly looks like the trajectory of a ball you threw into the air: after peaking, it’s now coming back to the earth.

Figure 2.

In sum, the economic managers are missing both their growth and inflation targets. Growth is slowing down even as prices are speeding up.

What’s more, we don’t have to suffer this double whammy.

We saw in the Aquino administration, for example, that we can enjoy both high growth and low inflation at the same time. Figure 1 shows we even experienced a bit of “deflation” (lowering prices) in late 2015, while Figure 2 shows that growth was consistently inching upward – although at a diminishing pace – before Aquino left office.

How did the economic managers miss their targets recently? Were they entirely powerless to rein in these figures? Have they been overly optimistic about the economy’s prospects under Duterte’s watch?

Brace for worse

What’s more, there are reasons to believe this low-growth, high-inflation era is bound to stay for quite some time.

For starters, inflation is expected to continue rising till late 2018, although the Bangko Sentral expects it to peak in the third quarter.

To the extent that recent inflation was fueled largely by supply factors (higher world oil prices, weak peso, rice troubles) rather than demand factors, it’s uncertain how much the Bangko Sentral’s interest rate hikes will help temper inflation.

Unfortunately, global oil prices could soon skyrocket owing to fewer shipments from beleaguered key oil exporters like Venezuela and Iran. US oil inventories are also drying up.

The peso is also expected to weaken further (maybe reaching P54 to P55 per US dollar) on account of the US Federal Reserve’s upcoming interest rate hikes, as well as our growing trade gap (imports are flourishing while exports are shrinking).

Our burgeoning rice crisis is also expected to contribute to higher inflation in the coming months, especially hurting the poor. (READ: Filipinos don’t deserve fumigated nor weevil-infested rice)

Meanwhile, economic growth could still bounce back in the coming quarters. Yet we’re far from the 7% to 8% so boldly promised by the economic managers before.

To reach that, government must sweep away key constraints to growth.

This could include emergency support for the agriculture sector, which has ground to a halt and contributed nearly nothing to the 6% GDP growth last quarter.

Exports are also languishing despite the weakening peso. Government must lend stronger support to our exporters by, say, integrating them with higher global value chains and boosting their competitiveness in the region. (READ: Weaker peso boosts exports? Not necessarily)

Impediments to the infrastructure push called Build, Build, Build must also be removed, especially continuing underspending by pivotal government agencies like the Department of Public Works and Highways and the Department of Transportation.

The economic managers tried to solve lingering underspending by introducing “cash-based budgeting.”

However, aside from meeting intense resistance from lawmakers, the immense budget cuts it entails are also proving “contractionary”: instead of boosting overall spending by government, it could weaken it and further reduce economic growth.

Finally, government must reduce the overall sense of uncertainty hanging above all our heads, since it only adds to the cost of doing business in the country.

Worries about TRAIN 2 (otherwise known as the TRABAHO bill), federalism and charter change, and peace and order must be put to rest. Duterte’s weaponization of laws and regulations against antagonistic firms and disfavored sectors must also stop.

Try for some honesty, empathy

With inflation rising to a 9-year high and economic growth plunging to a 3-year low, I can’t see how these trends are mere “hiccups,” as Secretary Diokno describes them.

The truth is, we’re living in a sad combo of slowing growth and accelerating prices. Worse, indicators point to harder times ahead.

For all we know, the tide could still turn in the next year or so. Making economic predictions is notoriously difficult and frustrating, to the point of being futile.

But in the meantime, the least the economic managers can do is to be more honest about the state of the Philippine economy, and to try for some empathy.

Failing to do so not only alienates them further from the vast majority of Filipinos, who can now only see their callousness and hubris.

It also gives a bad rap to all the economists out there who – unlike so many in government right now – don’t let their cool heads prevail over their warm hearts. – Rappler.com

The author is a PhD candidate at the UP School of Economics. His views are independent of the views of his affiliations. Follow JC on Twitter: @jcpunongbayan.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.