SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

![[ANALYSIS] Upper-middle income Philippines by 2019: How true?](https://www.rappler.com/tachyon/r3-assets/0C8DB6A9BEEF4ACAA74E52A5B74A198A/img/FDB6E7E1C68846FAB6D7A6D0DB1E8FF9/Upper-middle-income-status-October-10-2018.jpg)

Various government officials have been trumpeting – with increasing frequency – that the Philippines is set to join the ranks of “upper-middle income” countries by 2019.

One might be forgiven for suspecting the timing of such a pronouncement. After all, the country is currently beset by a double whammy of economic problems, namely, rising inflation and slowing growth.

However, the World Bank recently made a similar claim: based on their own projections, we’re “very close” to attaining a new income status.

But what does this mean precisely?

In this piece, I argue that although the country is indeed tantalizingly close to upper-middle income status, for many Filipinos this will be but an arbitrary name change that means little to them (especially in the short run).

Grain of truth

First, how are countries classified according to their incomes?

A country’s total income is typically measured by GDP or gross domestic product. It’s the total value of all final goods and services produced in an economy in a given time. This includes the output of all people in the country, whether by citizens or foreigners.

An alternative measure of the country’s income is GNI or gross national income: it’s just GDP plus the output of all Filipinos abroad (OFWs included) minus the output of all foreigners. You could therefore call it a truer measure of Filipino output.

If we divvy up GNI across all 106 million or so Filipinos equally, we will get GNI per person. This can be read as the yearly income of the average Filipino.

Back in 2017, the World Bank recorded it to be $3,600 per Filipino.

GNI per person is important insofar as the World Bank classifies countries by this metric. According to Table 1, we are considered a “lower-middle income” country.

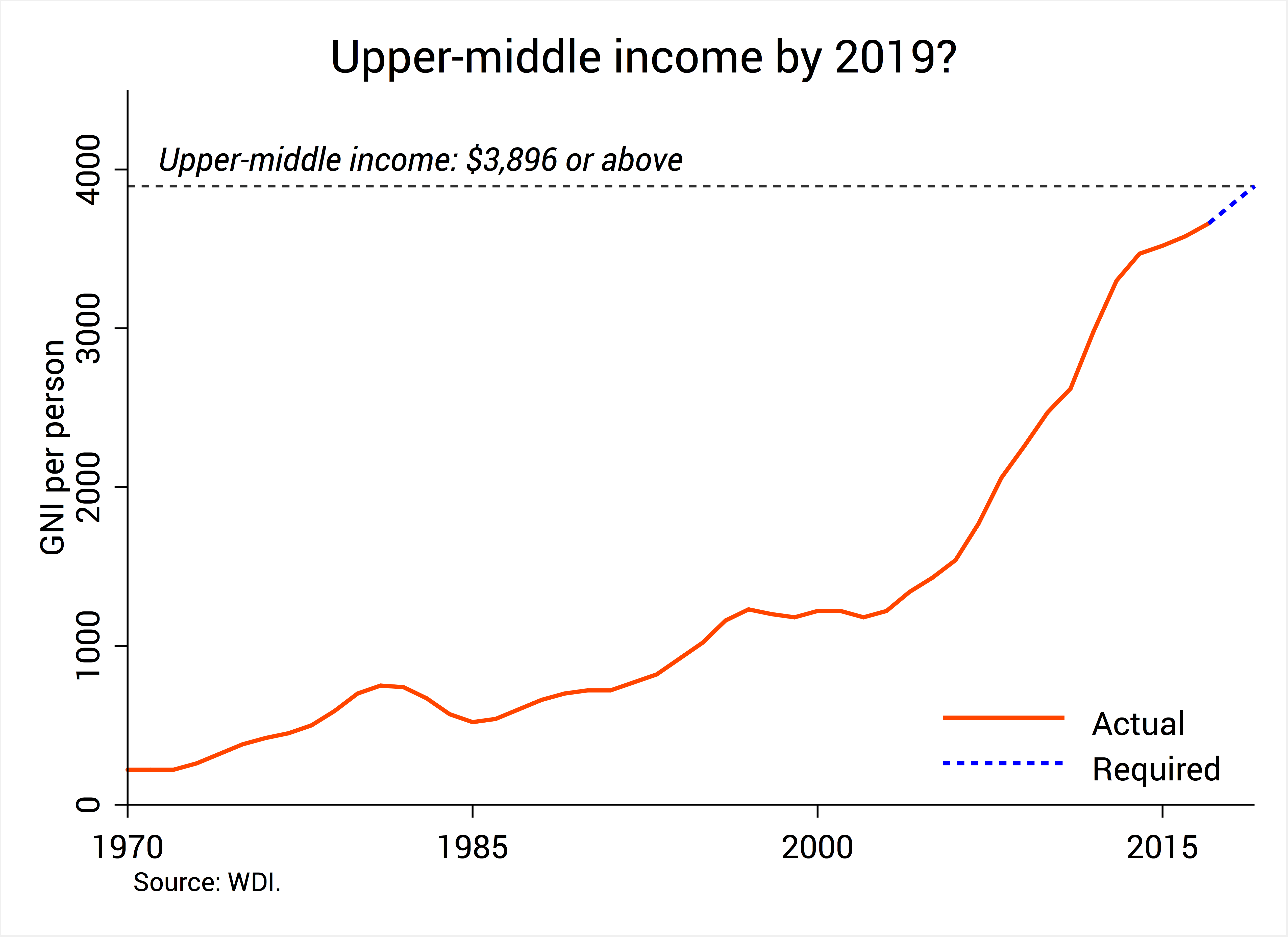

But Figure 1 shows just how close we are to $3,896, or the minimum GNI per person required for upper-middle income countries. To reach this by 2019, we just need an extra $236 on top of our 2017 income.

Indeed, at the rate the economy is growing, upper-middle income status is not just a pipe dream. It can actually happen, and there’s a grain of truth to the pronouncements of government officials.

Figure 1.

Caveats

Yet there are reasons to believe that such a new income category is overhyped.

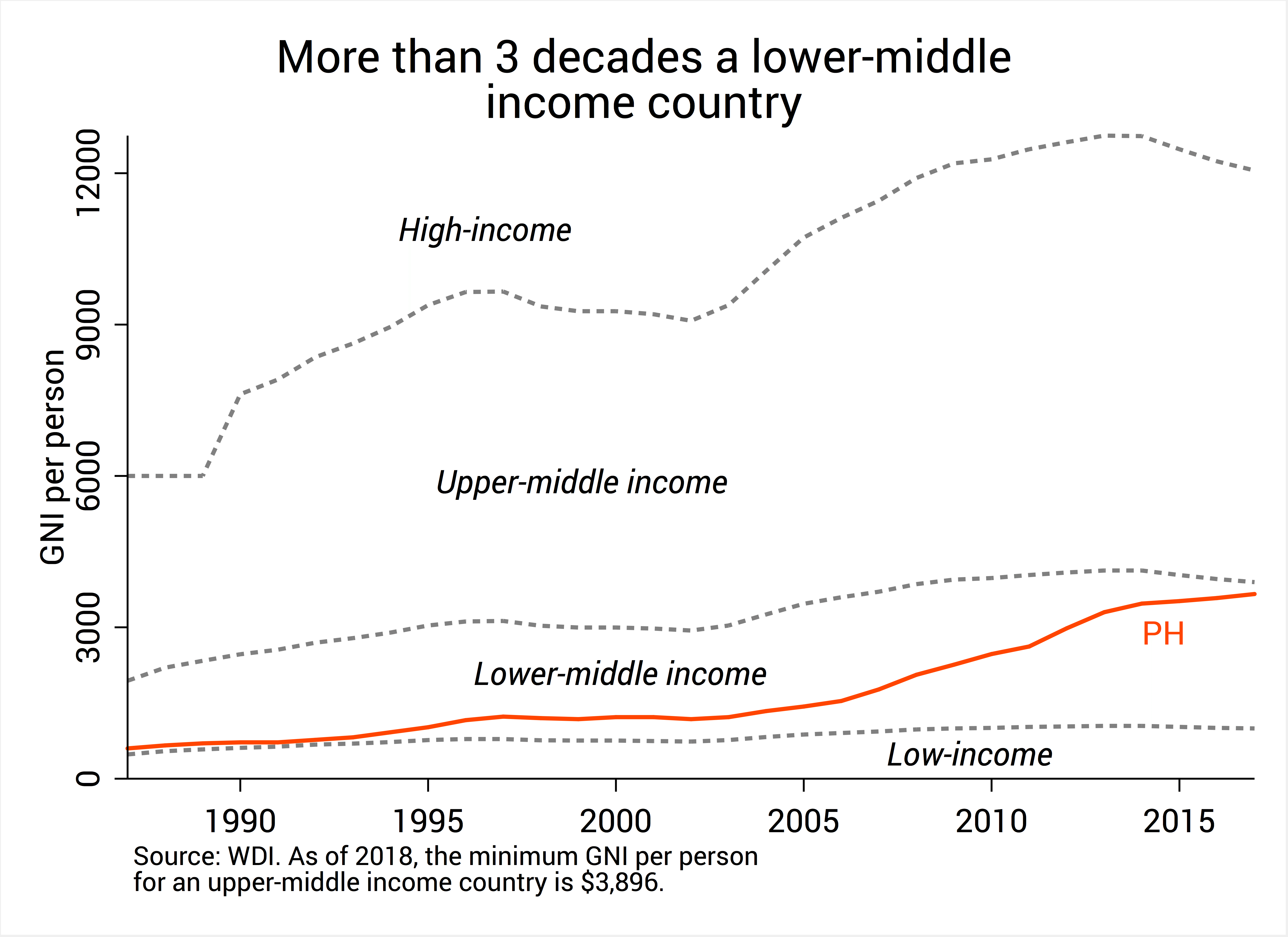

Figure 2 speaks volumes. First, notice that the World Bank’s income thresholds are not fixed. In recent years, the threshold for upper-middle income countries actually went down a bit.

Therefore, being upper-middle income is really nothing to brag about: it’s like passing an exam not because your score was high, but because the passing rate was set lower.

Figure 2.

Second, we’ve been a lower-middle income country since 1987, when the World Bank first used its income classification scheme.

This raises an all-important question: Why have we languished in this income category for more than 3 decades, and why did it take that long to graduate into upper-middle income status?

Third, Figure 2 shows that there’s a wide chasm between upper-middle income and high-income status. We’re obviously a far cry from high-income status. In 2018, to reach that level, we need an income more than thrice than what we currently have.

So don’t expect us to be anything like Singapore or South Korea any time soon.

Who benefits?

We also need to remember that the poor do not partake in growth in the same way as the rich. In all likelihood, the country’s newfound upper-middle income status, once we attain it, will make little difference to the poor.

This is attested by the fact that, as of 2015, and despite years of “robust” economic growth, nearly 4 million Filipino families were considered poor. These comprised families that live on less than P10,000 per month, or just above P300 per day.

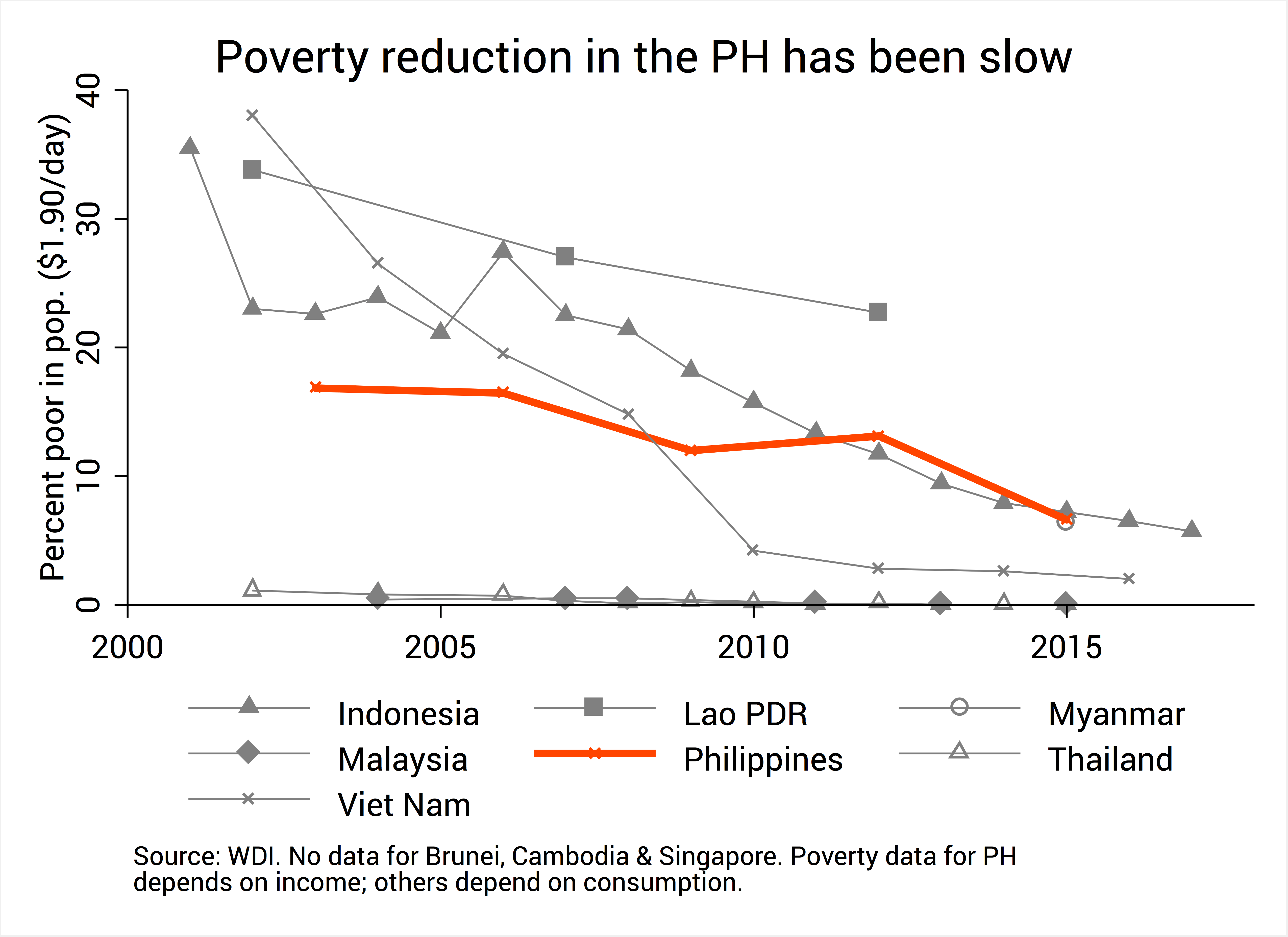

Poverty, to be sure, is falling in the Philippines – but not fast enough. Figure 3 shows that in Malaysia and Thailand, almost no one now lives on less than $1.90 a day. By contrast, poverty in the Philippines remains high, and has gone down unacceptably slowly.

Figure 3.

The acceleration of prices in recent months (reaching levels not seen in almost 10 years) is also likely to impoverish more Filipinos in the short run.

Inflation, indeed, can be seen as a tax on the poor, especially when borne largely by high food prices. According to Representative Joey Salceda, as many as 2.4 million Filipinos might have been driven into poverty by recent inflation.

Joining the upper-middle income club is also not such a proud feat, considering that the group currently includes such countries as Iran, Brazil, and Venezuela, all of which are in the throes of severe economic crises that have only exacerbated poverty.

In other words, upper-middle income status will not necessarily be a boon for the poor.

Growth threats

Finally, we need to maintain the economy’s growth if we are to maintain an upper-middle income status.

As the income threshold for upper-middle income countries changes (Figure 2), our actual incomes must catch up lest we revert to a lower-middle income country.

Disquietingly, our economic growth has faltered in recent times. From around 7% when President Duterte came into office, it’s now down to 6%. Why? (READ: Mere hiccups? Let’s be more honest about the economy)

One factor is that record-high inflation has dissuaded people from spending as much. Data show that the growth of private households’ spending has gone down while inflation has gone up.

Another reason is that some sectors of the economy have stagnated, notably agriculture. Last quarter, it contributed nearly nothing to overall economic growth.

Insofar as most of the poor work in agriculture, that sector’s decline serves as a real threat to the incomes of the poor, who are beset by rising inflation to begin with.

Hence, we need to worry not just about how the poor benefit from growth, but also from the threat of poorer growth itself.

Don’t obsess with labels

All in all, there’s a good chance that the Philippines will indeed enjoy a new income status in the next few years, maybe as early as 2019.

But we all need to temper our expectations. If becoming an upper-middle income country was hard enough – it took us more than 3 decades to do that – becoming a high-income country (like Singapore or South Korea today) will be harder still.

Rather than obsess with labels, our economic managers will do well to focus instead on policies that will pave the way for future growth. But can we be satisfied with their work so far?

We should also not think of this newfound income status as a direct consequence of President Duterte’s vision or policies, as his singular economic gift to the Filipino people. He just happens to be president during this historical (if arbitrary) transition. – Rappler.com

The author is a PhD candidate at the UP School of Economics. His views are independent of the views of his affiliations. Follow JC on Twitter (@jcpunongbayan) and Usapang Econ (usapangecon.com).

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.