SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

![[ANALYSIS] Dismal growth: Why is the PH economy losing its momentum?](https://www.rappler.com/tachyon/r3-assets/612F469A6EA84F6BAE882D2B94A4B421/img/1EE9622AE44A4F25AD5E92467C4E83EE/dismal-growth-ph-economy-losing-momentum-august-15-2019.jpg)

I did a double take when I first saw the dismal numbers.

Before this year’s State of the Nation Address, the economic managers proudly announced that economic growth during President Rodrigo Duterte’s term is “impressive,” “robust,” and “continues to gain momentum.”

Specifically, Finance Secretary Carlos Dominguez III trumpeted the fact that our economy grew, on average, by 6.5% in the first 11 quarters of the administration.

But the government’s most recent official GDP (gross domestic product) report for the second quarter of 2019 plainly shows that the economy is losing, rather than gaining, momentum.

Recall that GDP measures the value of all goods and services produced in an economy in a given period. Notwithstanding its imperfections, GDP can tell us a lot about what’s going on in our economy.

In this article let’s parse the data to spot the red flags throughout our economy.

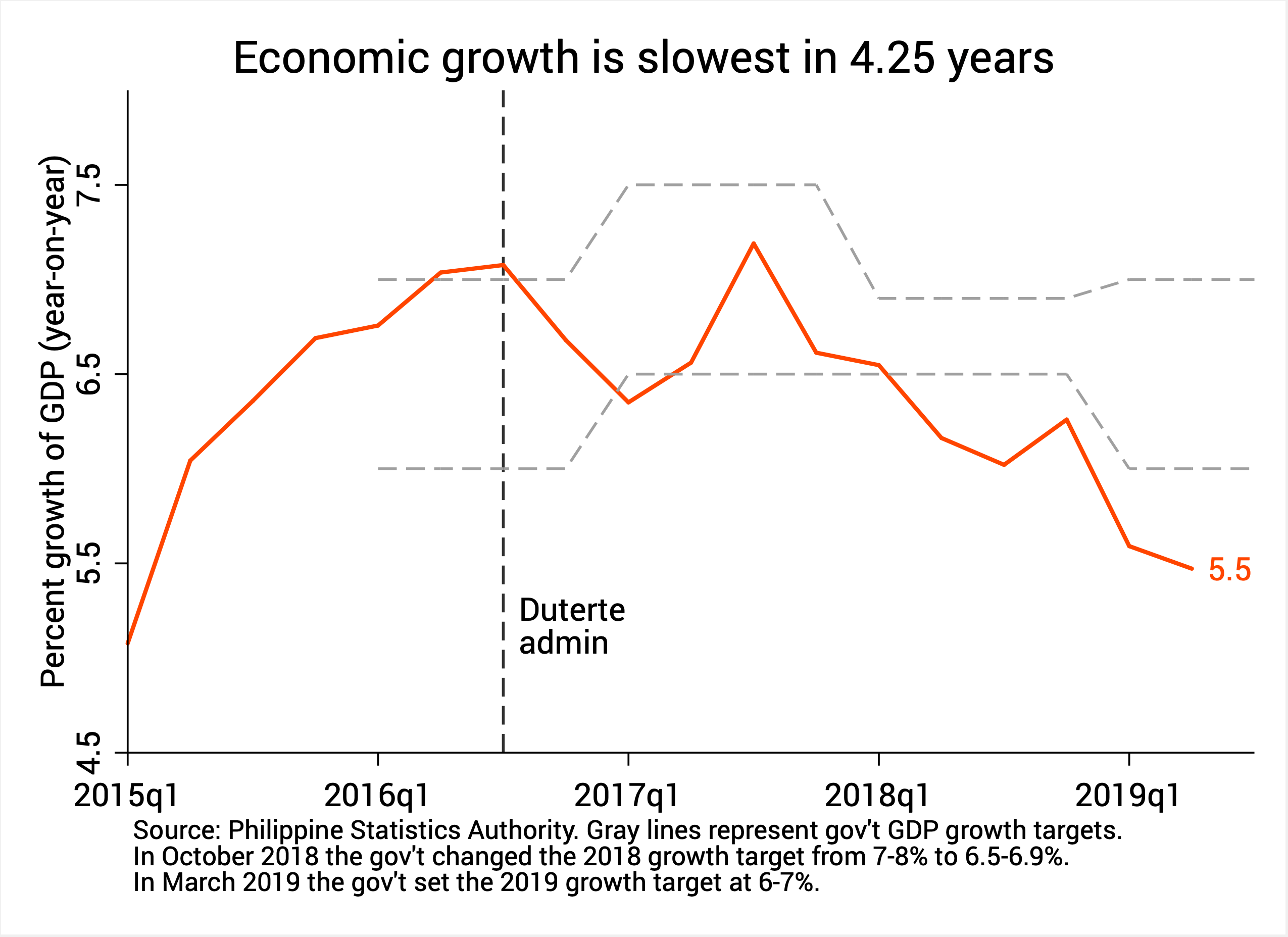

1) The economy is decelerating.

First and foremost, the Philippine economy is slowing down alarmingly. In the second quarter of 2019, GDP grew by just 5.5% (Figure 1).

Figure 1.

Figure 1.

This is appallingly low for many reasons.

First, it’s the lowest in 4.25 years. I wonder how the economic managers can look at the steadily declining graph and still proclaim that growth “continues to gain momentum.”

Second, 5.5% is lower than the economic managers’ target range of 6% to 7% this year. In fact, the economic managers keep missing their own growth targets.

Third, 5.5% is also lower than analysts’ forecasts. In a recent BusinessWorld survey, the median forecast was 5.9% and nobody predicted below 5.7%.

Fourth, the country’s growth continues to dip in spite of the May polls, which should have boosted growth. Imagine how much lower growth would have been sans the elections.

Fifth, the Philippines could, in fact, be growing much faster. In the wake of the global financial crisis, potential GDP growth was estimated to range from 6% to 7.4%, according to a recent study.

Sure, our economy is still growing. Yet a further deceleration could mean lower incomes for Filipinos, fewer job opportunities, or both.

But why is our economy slowing down?

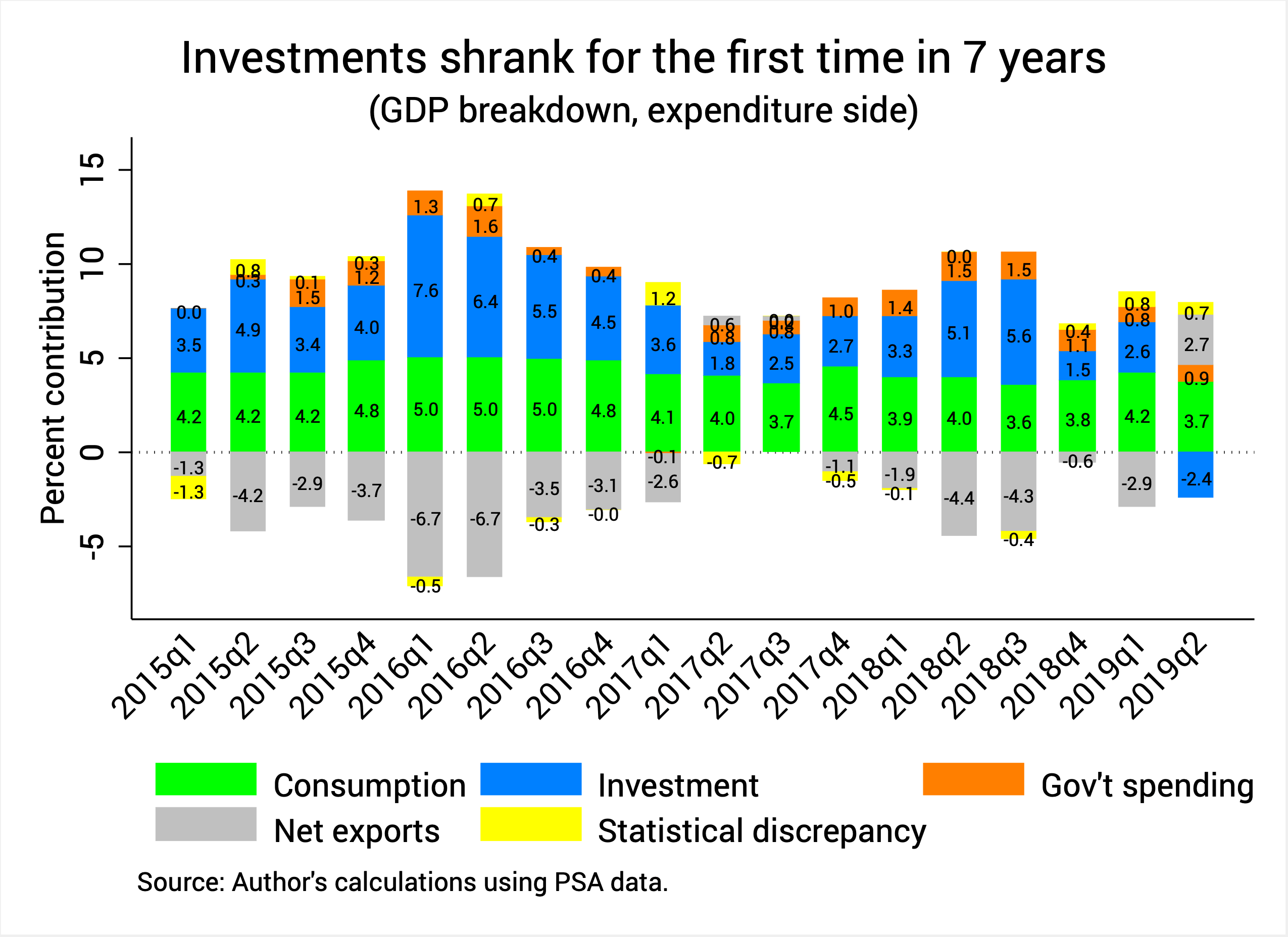

2) Private investments have shrunk for the first time in 7 years.

Figure 2 shows that private investments (blue bars) pulled down overall growth last quarter for the first time since 2012, or 7 years ago.

This is primarily on account of a steep decline in the production of durable equipment and inventories.

Figure 2.

Durable equipment comprise goods used “repeatedly or continuously in production processes for more than a year.” These might include road vehicles, telecommunications equipment, mining and construction machinery, and office machinery.

In other words, durable equipment fuel future industrial growth and development. A decline in their production does not bode well for future growth.

3) Exports and imports are grinding to a halt.

Figure 2 also shows that net exports (simply exports minus imports) contributed positively and significantly to overall growth.

This seldom happens. Usually, net exports drag down (rather than prop up) overall growth because imports often exceeded exports in recent years.

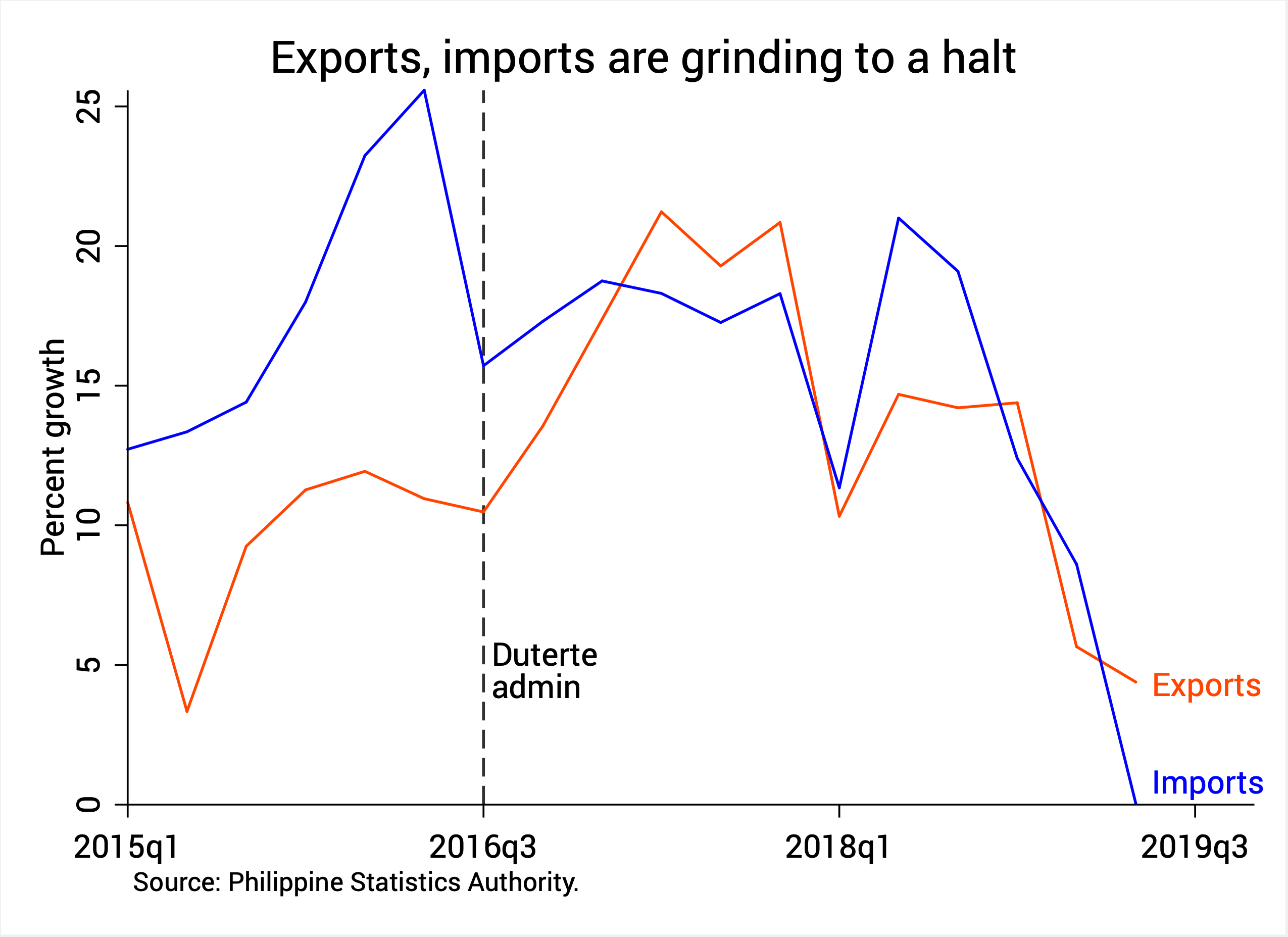

But the unusual growth of net exports hides the fact that both exports and imports – basically our trade with the rest of the world – are grinding to a halt (Figure 3).

Figure 3.

Exports will likely fall further if uncertainties surrounding the Trabaho bill and endo bill are not soon dispelled.

Meanwhile, the near-zero growth of imports is as curious as it is concerning. The economic managers defended aggressive imports before by saying it’s a sign that raw materials and equipment were coming in for various projects under Build, Build, Build.

Following their logic, does the recent faltering of imports imply Build, Build, Build is stalling? (READ: The pipe dream that is Build, Build, Build)

The economic managers also blame weak trade data on the escalating US-China trade war, which is expected to shave a few points off global economic growth.

But the Asian Development Bank said such trade war could prove to be a boon for ASEAN countries like the Philippines, if only we attracted enough foreign investors seeking refuge from the trade war. Somehow, we’re missing out on this opportunity.

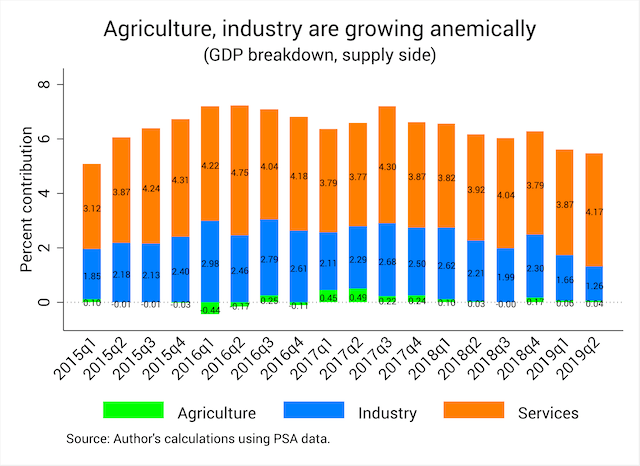

4) Agriculture and industry are faltering.

If we look at growth from the perspective of the different sectors, the picture is no less grim. Figure 4 shows that agriculture and industry, in particular, are growing anemically.

Agriculture’s poor performance is hardly a shocker at this point. But last quarter’s 1.27% contraction was due largely to a sizable 5.7% drop in crop production.

One possible reason behind this is the unusually long spell of El Niño. Yet another is the Rice Tarrification Act which disincentivizes local production because farmers must now compete and contend with torrents of imported rice.

Figure 4.

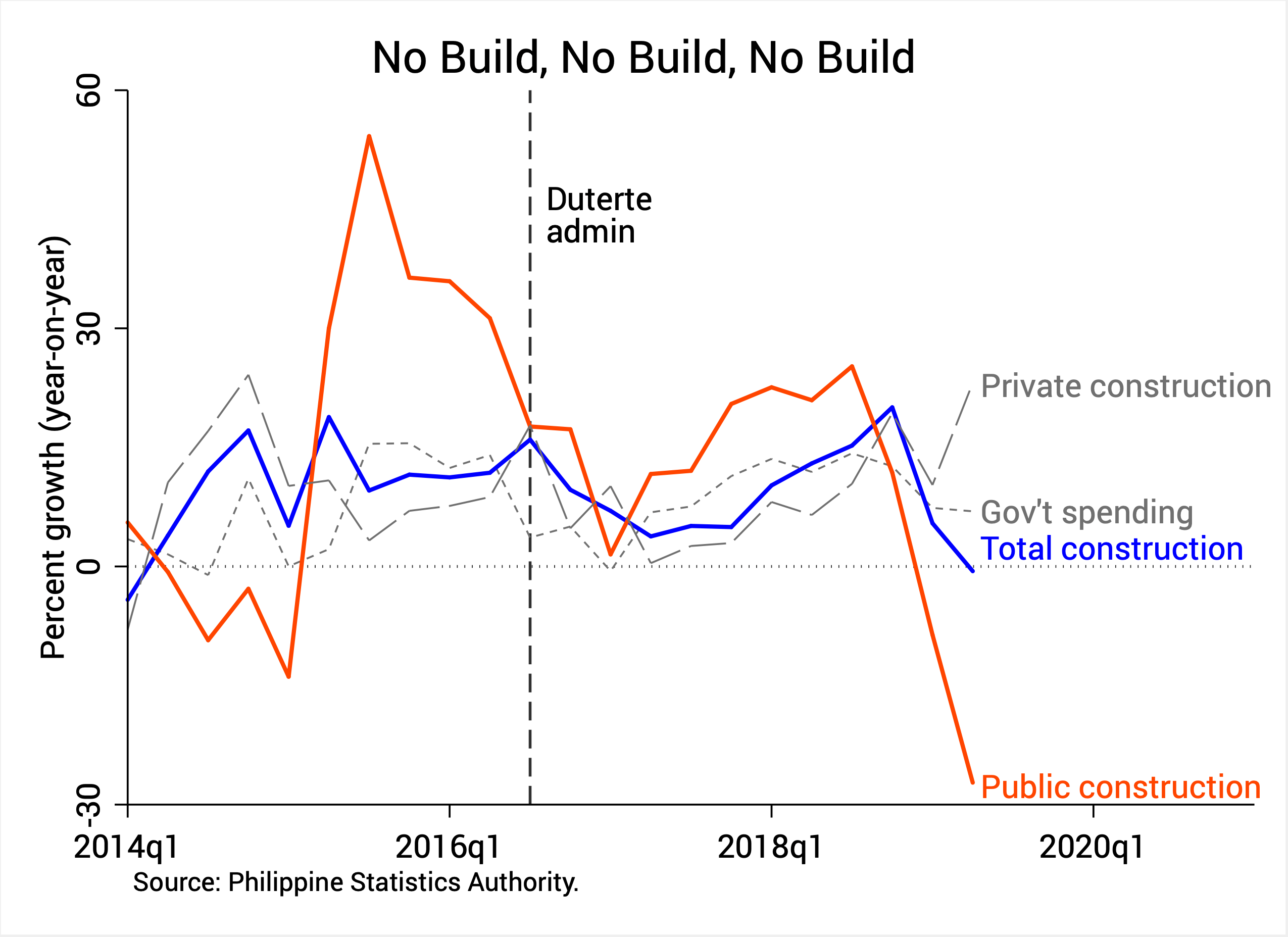

Industry is hurting, too. Construction seems to be the main culprit here, for it brought down overall industrial growth for the first time in more than 5 years (Figure 5).

If you dive deeper, it was public construction that took the hardest hit, what with a mind-blowing 27% decline. This was counteracted by construction in the private sector.

Figure 5.

It has become routine for the economic managers to lay the blame on the delayed 2019 budget, which admittedly stymied key infrastructure projects under Build, Build, Build.

Yet the delayed budget cannot entirely explain the movement at a snail’s pace of Build, Build, Build. Ushering in a “golden age of infrastructure” is not as easy as it looks.

Services, lastly, continue to grow robustly. But there’s no room for complacency here, either.

For instance, business process outsourcing (BPO), one of our top dollar earners, is now under threat on all fronts, including increasing competition, emerging artificial intelligence technologies, and US President Donald Trump’s disdain for American outsourcing.

What to do?

In sum, private investments are shrinking, trade is grinding to a halt, agriculture is growing anemically, and public construction is collapsing.

Cracks are beginning to emerge in the otherwise smooth and sturdy facade that is the Philippine economy. No wonder the Duterte government is embarking on “expansionary” policies to patch up growth in the short run.

The Bangko Sentral, for its part, further lowered its key interest rate last week to 4.25% in a bid to spur domestic spending.

Meanwhile, the economic managers announced in May a plan to fast-track infrastructure spending. Socioeconomic Planning Secretary Ernesto Pernia also recently implored Congress to pass the 2020 budget on time.

At any rate, the economic managers will need to be more forthright about the current state of the Philippine economy. They have been painting a picture of the economy that is much rosier than the data suggest.

Secretary Pernia still believes 6% growth is possible for the whole of 2019.

You may be forgiven for thinking this is a joke. To achieve that, we must grow by at least 6.45% in the next 2 quarters.

Seriously, though, how can we regain lost momentum and bring the economy up to speed? – Rappler.com

The author is a PhD candidate at the UP School of Economics. His views are independent of the views of his affiliations. Follow JC on Twitter (@jcpunongbayan) and Usapang Econ (usapangecon.com).

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.