SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

![[OPINION] Taxes and the coronavirus pandemic: An open letter to lawmakers](https://www.rappler.com/tachyon/r3-assets/3ADEFBD793B34E23893186F6C6FFA482/img/B90A4DB9D9BD4F68A85F4F487EEDBD28/20200502-virus-taxes.jpg)

To our honorable senators and representatives,

Amid the COVID-19 pandemic, countries around the world are implementing emergency tax relief to support companies, especially small businesses and their employees.

As the economic and social impact of this health crisis increases, government and business leaders have a crucial role to play in developing both short-term and long-term solutions to mitigate the risks and continue to create values without compromising people’s health and the economy at large.

Now more than ever, world leaders and citizens must cooperate and adopt best practices to manage the impact of the coronavirus. Immediate action is critical, but governments must consider this as an opportunity to fix distorted tax policies and help companies and their employees prepare for the new normal in the coming months through a strategic economic recovery plan.

Here are some of the economic tax relief plans consolidated by the Tax Foundation, which the Philippine government can consider in preparing its economic recovery plan:

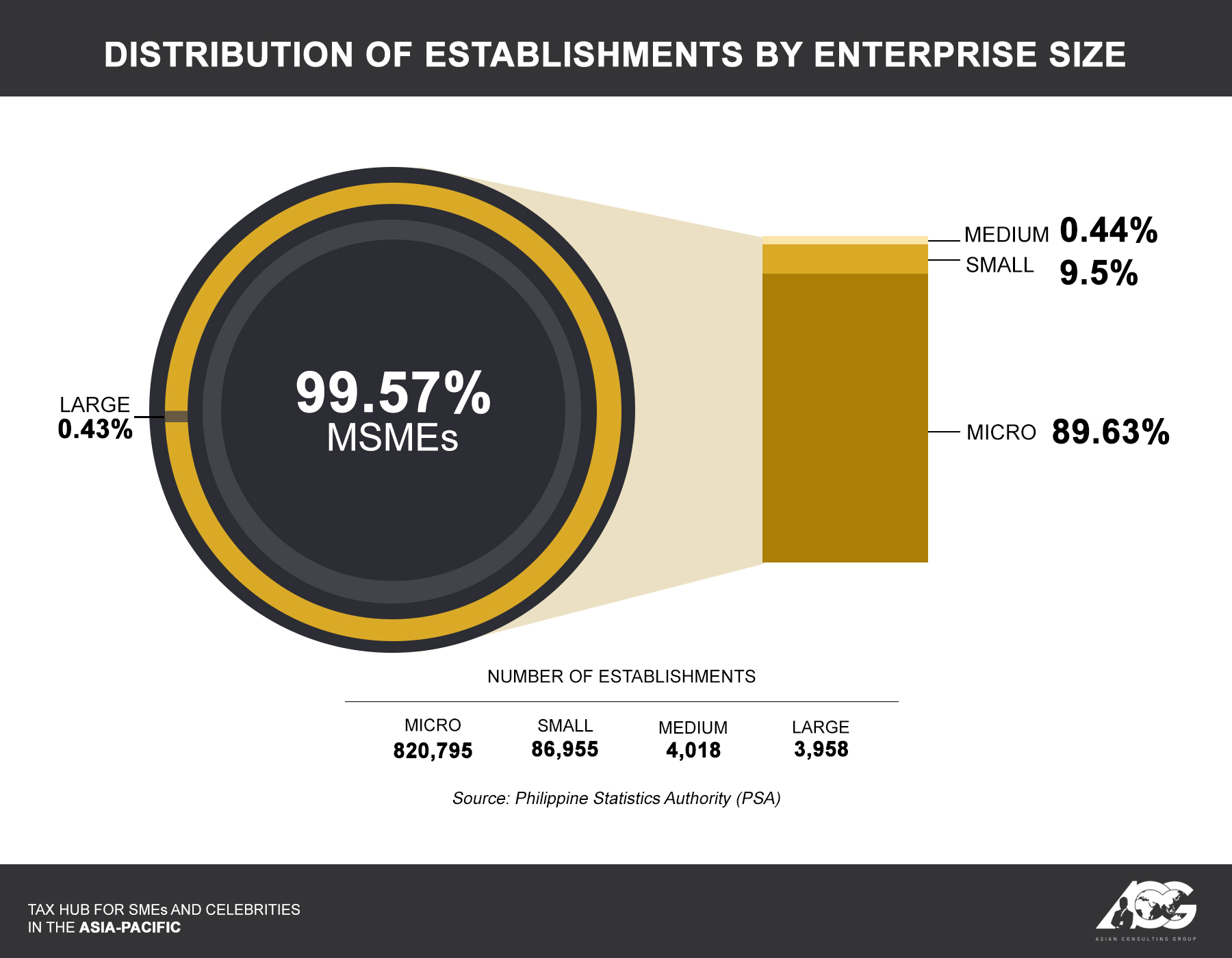

According to the 2018 List of Establishments from the Philippine Statistics Authority, there are 1.003 million business enterprises operating in the country and almost all of them (99.52%) are micro, small, and medium enterprises (MSMEs). The government should thus prioritize MSMEs when it comes to social protection or assistance, considering that they employ 63.19% of the country’s total workforce.

During this enhanced community quarantine (ECQ), small businesses have zero or no income, but they still have to pay for salaries, rent, phone bills, internet, and other fixed costs. With the grace period granted by the Bayanihan to Heal as One Act, payments have been deferred, but where will they get cash to pay their accumulated bills after the lockdown? By now, small businesses have incurred debts and losses.

Finance Secretary Carlos Dominguez III presented to Congress the P1.49-trillion 4-pillar socioeconomic strategy against COVID-19. However, the integrated task force is still designing a bounce-back plan for a post-ECQ scenario. The total lockdown will definitely kill micro and small businesses if the government will not prepare immediate and long-term economic tax relief plans.

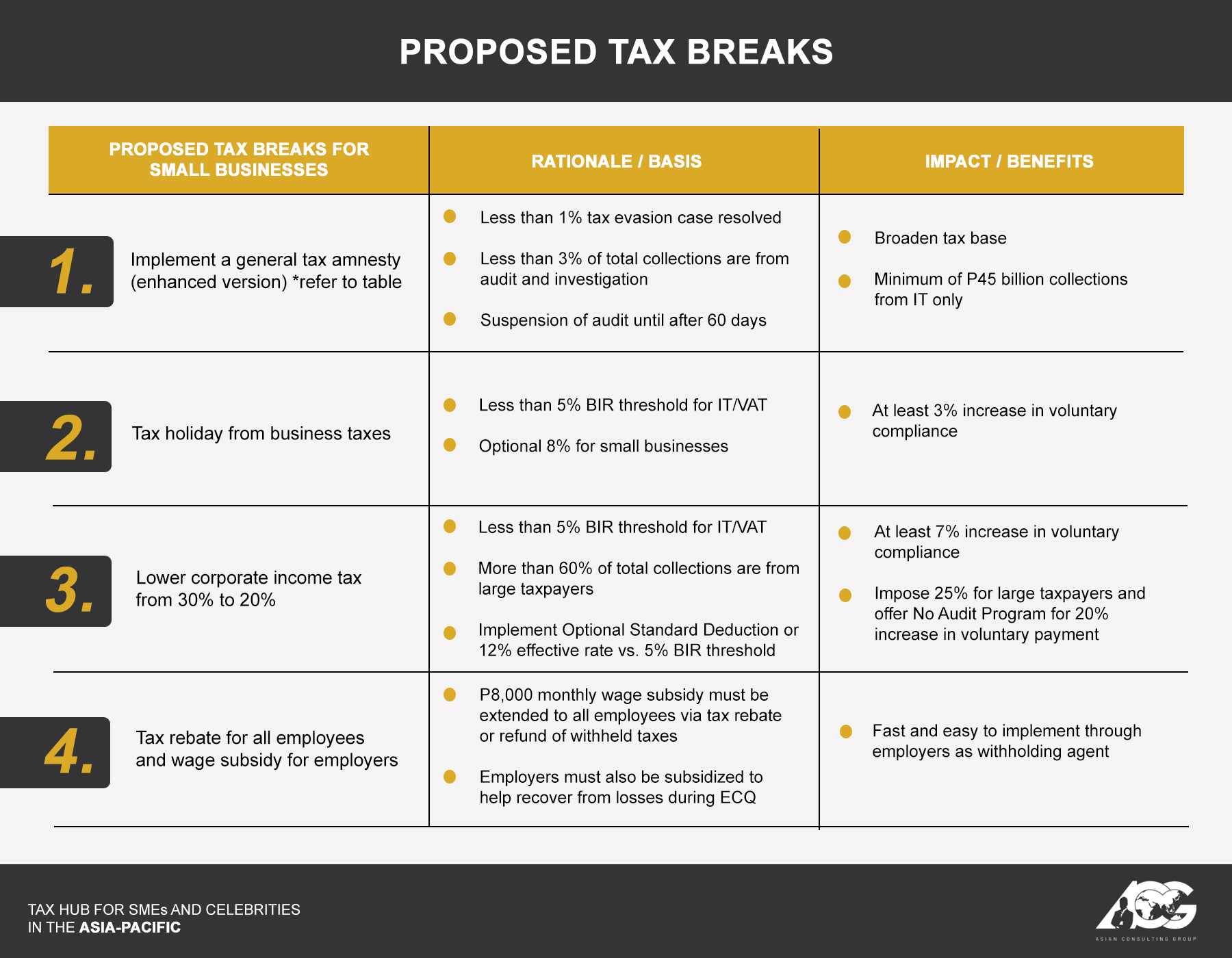

While we laud the government’s efforts to help MSMEs, here’s a bucket list of tax relief measures that can really address the cash flow or liquidity issues of a lot of small businesses while helping the government collect taxes from large taxpayers and those who can afford:

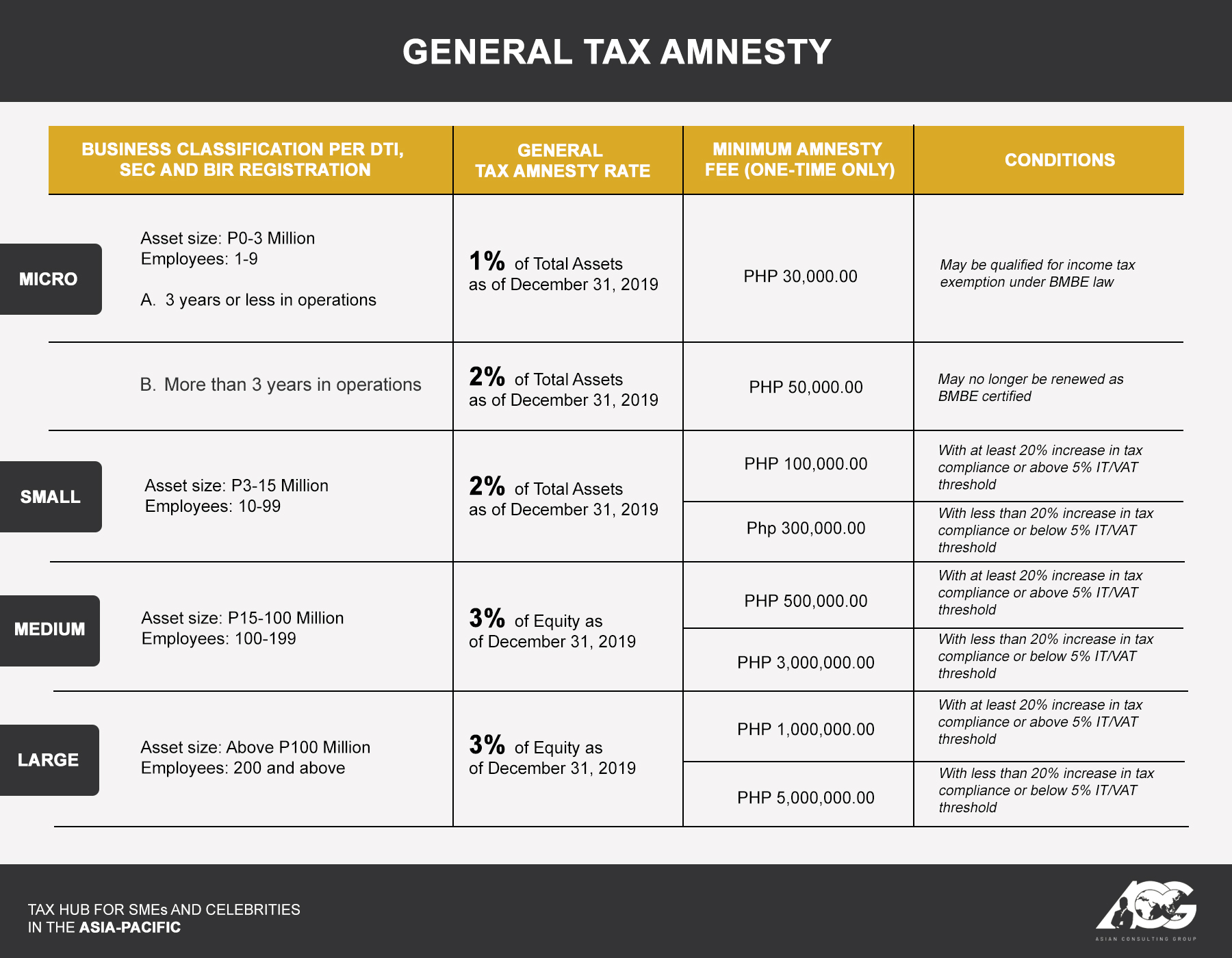

General tax amnesty

Of the more than 1,000 tax evasion cases filed by the Bureau of Internal Revenue (BIR), more than 90% remain pending at the Department of Justice.

In fact, less than 3% of the total tax collections are from audit and investigation, including delinquent accounts. Even the delinquency tax amnesty is barely making any impact as most taxpayers are protesting the assessment of BIR examiners.

Considering what’s happening on the ground, the low tax collections from audit, and the new normal after the ECQ, it’s the best time to implement a general tax amnesty.

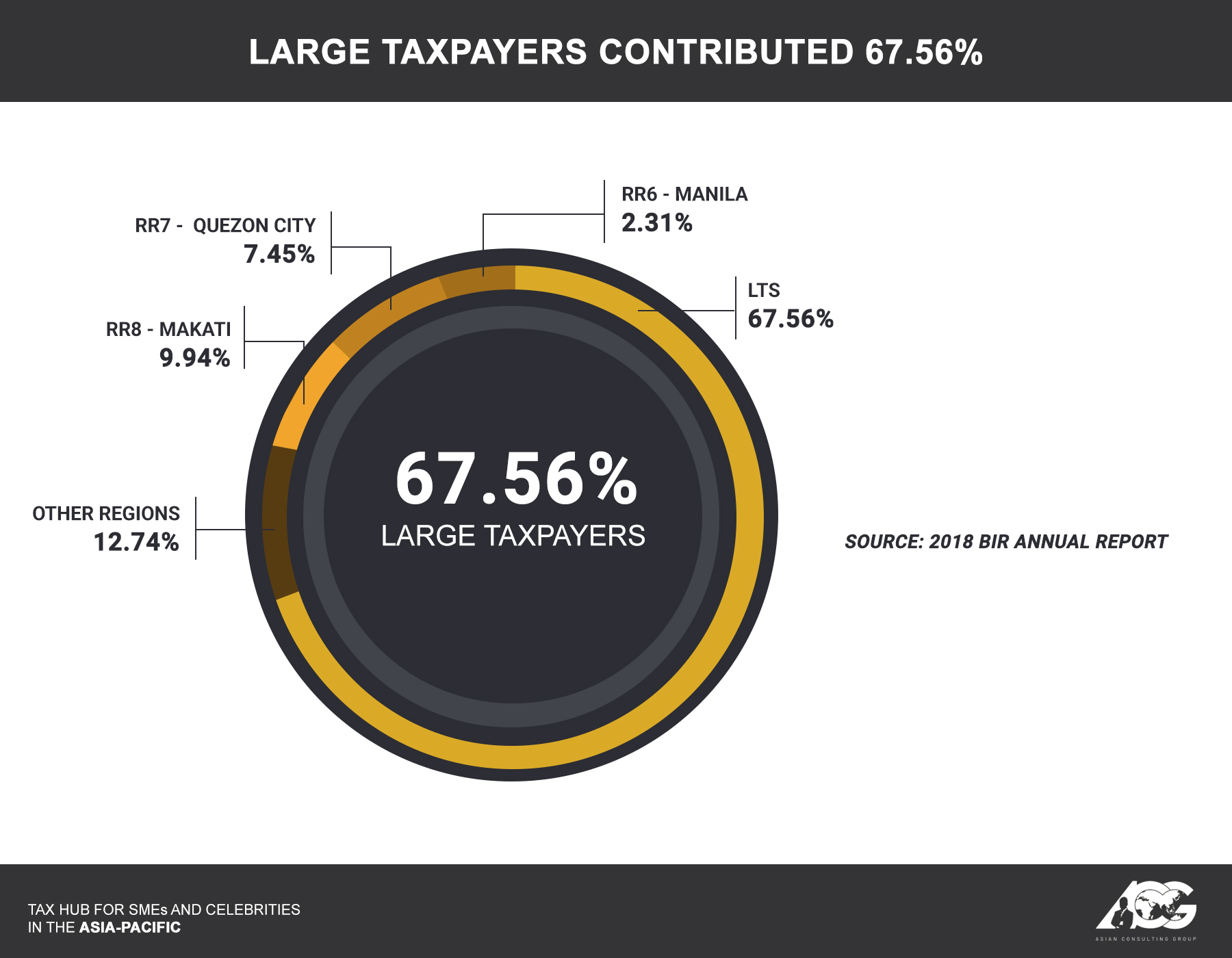

Lower corporate income tax

Instead of a 10-year period of lowering our corporate income tax from 30% to 20%, the government must consider immediate reduction to 25% for large taxpayers or top corporations and conglomerates using the itemized deductions, but no less than the 5% income tax and value-added tax (VAT) threshold.

For small businesses or those not classified as large taxpayers, a lower rate of 20% may apply, but mandate the use of optional standard deduction or an effective rate of 12%. Otherwise, they will have to use the 25% reduced rate.

Tax credit or rebate

Rather than simply prioritizing those who are BIR and Social Security System (SSS) compliant, this can serve as an opportunity to encourage those in the informal sector, unregistered and noncompliant, to register now and comply so they can avail themselves of the benefits from the government. Provide a one-time amnesty to waive all penalties for them to register or update their contributions by deducting it from their supposed wage subsidy.

The goal is to close the gap among the records of the government. The Department of Labor and Employment says there are more than 40 million employees, the SSS has almost 30 million registered employees, while only 17 million are registered with the BIR. This gap prevents employees from receiving benefits and now aid from the government as only 3.4 million are prioritized recipients under the Small Business Wage Subsidy program.

The economic tax relief must cover all employees as tax credit or rebate if they have withholding tax, and also tax rebate for small business owners who released salaries during the ECQ period.

Tax holiday from business taxes

This tax holiday from business taxes due to both national and local governments should eventually transition into a flat tax for self-employed and professionals (SEPs). This will further encourage registration and compliance among the least compliant taxpayers in the country.

Allowing SEPs or individual taxpayers who are not employed or incorporated and not part of the large taxpayers to pay a flat 8% tax in lieu of all taxes will not only simplify taxation for small businesses but also increase voluntary compliance without any need for an audit or investigation.

Congress has a crucial role to play as failure to adequately tax the wealthy is an attack on the poor. Lawmakers must end injustice by legislating tax policy reforms to help all businesses adjust to the new normal – with a simple, fair, and efficient tax system. – Rappler.com

Mon Abrea is the co-chair of the Ease of Doing Business Task Force on Paying Taxes and the brainchild of the TaxWhizPH mobile app. He was recognized as one of the 2017 Outstanding Young Persons of the World, 2016 Digital Mover, one of the 2015 The Outstanding Young Men of the Philippines, and an Asia CEO Young Leader because of his tax advocacy and expertise. Currently, he is the chairman and senior tax advisor of the Asian Consulting Group and founding trustee of the Center for Strategic Reforms of the Philippines. Email him at mon@acg.ph.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.