SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

![[OPINION] To beat inflation, we can’t just fudge the numbers](https://www.rappler.com/tachyon/r3-assets/612F469A6EA84F6BAE882D2B94A4B421/img/EA20693B830245479842704006C97451/cheating-inflation-copy.jpg)

Amid record-high inflation, proposals to change the way we compute inflation have disturbingly sprung up.

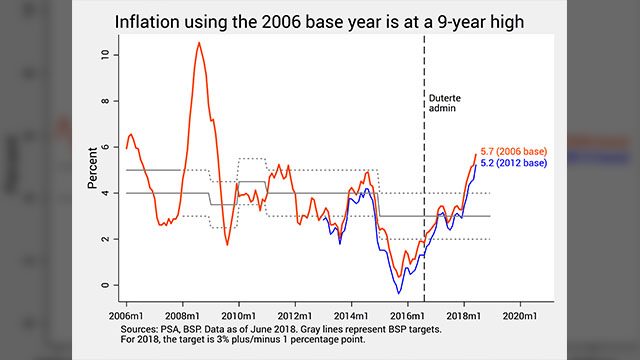

To recap, inflation – which measures how fast prices are rising – reached a 5-year high in June at 5.2%. Using the old base year (or reference year), this is actually the highest in 9 years.

Since this new data came out, some government officials have suggested removing certain products – namely tobacco and food – from the official computation of inflation. These products either have very high inflation themselves or contribute a lot to overall inflation.

But to redefine inflation, especially these days, is an act of cheating. Fudging the numbers (or even suggesting to do so) also gives the impression that government is unwilling or unable to address the root causes of accelerating prices.

Basket of goods

What goes into inflation in the first place?

Calculated monthly by the Philippine Statistics Authority (PSA), inflation is nothing more than the year-to-year changes of the so-called consumer price index (CPI).

The CPI pools together the prices of goods and services commonly bought by consumers. This is otherwise known as a “basket of goods”.

As of 2006, “food and alcoholic beverages” comprised 39% of this basket, followed by “housing, water, electricity, gas and other fuels” (23%), restaurant and miscellaneous goods and services (12%), etc.” (See full list here.)

But as consumers’ preferences change over time, so do these shares. To address this, the PSA began using a new base year in March, from 2006 to 2012.

Some goods and services, for example, might be more or less necessary or fashionable in 2012 than in 2006. Failing to account for these changes could paint an inaccurate picture of future price movements.

This so-called “index rebasing” had the immediate effect of lowering historical inflation data (see the blue versus orange trends in Figure 1), and many people interpreted this as cheating.

Figure 1.

But it so happens that this is standard procedure every 6 years, in line with international guidelines.

Regardless of which base year we use, however, it’s obvious we’ve already breached the government’s 4% upper inflation target.

It is in this context that proposals to revise the inflation computations have surfaced.

Removing tobacco

For one, Finance Secretary Sonny Dominguez said they will “consider a proposal to remove tobacco from the basket of goods.”

One of the proponents is Undersecretary Gil Beltran who said that “tobacco is not a consumer good – it is a vice. It is bad for the health and the pocket.”

Socioeconomic Secretary Ernesto Pernia didn’t object to this proposal, saying, “I think that might be okay. I don’t see anything objectionable to the proposal. It’s not really a big (portion) – its weight is 0.9 percent.”

Perhaps what triggered this proposal is the whopping 20.8% inflation rate of “alcoholic beverages and tobacco” in June.

But removing tobacco from inflation is not advisable based on international practice.

If you read the CPI handbook of the International Monetary Fund (IMF), for example, it says there that:

“The deliberate exclusion of certain types of goods and services by political decision on the grounds that the households towards whom the index is targeted ought not to be purchasing such goods…cannot be recommended because it exposes the index to political manipulation.” (emphasis mine)

The IMF even noted that the political targeting of vices in inflation is nothing new:

“For example, suppose it is decided that certain products such as tobacco or alcoholic drink should be excluded from a CPI. There is then a possibility that when taxes on products have to be increased, these products may be deliberately selected in the knowledge that the resulting price increases do not increase the CPI. Such practices are not unknown.”

Even if we remove tobacco, it’s unlikely to budge overall inflation anyway given its small share in the basket of goods.

Thankfully, there’s some pushback from the other economic managers. NEDA Undersecretary Rose Edillon, for example, said we must retain tobacco to have a more accurate feel for inflation “just so we know what is happening out there.”

Indeed, excising tobacco is not unlike removing your bad math or science grade from your GPA: it only belies your bad performance.

Removing food

If we can remove tobacco, why stop there? As if on cue, Agriculture Secretary Manny Piñol already came up with an even wackier suggestion of removing food from inflation altogether.

Last week he reportedly said, “I don’t believe that food should be included in the list of items that contribute to inflation.”

Piñol even challenged the economic team by saying, “I would like to refute the reports of the economic cluster ranking price of food and price of rice as the cause of inflation.”

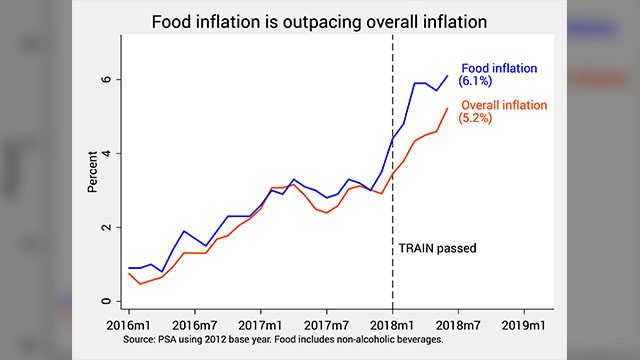

First, data confirm that food drives much of recent inflation. In fact, food inflation has already outpaced overall inflation, starting around the passage of TRAIN 1 along with its new excise taxes (see Figure 2). In June, “food and alcoholic beverages” also contributed to 44% of inflation, the largest share of any category.

Figure 2.

Without food, inflation will doubtless go down. Yet recall that inflation aims to encapsulate the price movements of goods and services commonly bought by consumers.

Removing food therefore defeats the very purpose of measuring inflation. If government succeeds in doing this, we might as well stop measuring inflation altogether.

Second, if food contributes a lot to overall inflation, then government must enact policies that could bring down food prices, rather than suggest ways to fiddle with the numbers.

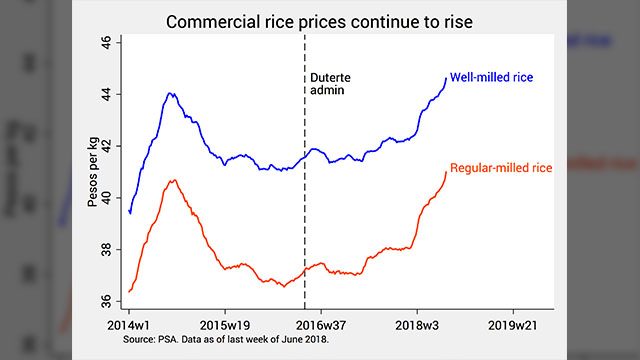

Rice, for example, plays a huge role in food inflation, and Figure 3 shows that rice prices are at a multi-year high, largely due to depleted NFA rice stocks and delayed rice imports.

Figure 3.

This surge of rice prices has impelled the economic managers to push for “rice tariffication” – the conversion of rice import quotas to their equivalent tariffs – which President Duterte is said to certify as urgent soon. Once passed, this law is expected to cut rice prices by P4 to P7 per kg and help abate inflation.

Aside from rice (which had an inflation of only 4.7%), other food categories with large price movements in June include corn (14.1%), fish (11.2%), and vegetables (8.6%).

The agriculture secretary will spend his time better tempering the prices of these agricultural commodities than tampering with the data.

We can’t cheat our way out of inflation

All in all, proposals to change the way we compute inflation are actually quite puzzling. All government forecasts point to lower inflation later this year, and government is not exactly bereft of policy options to work on.

Wanting to redefine inflation at this time only suggests that either government is not confident about its own inflation forecasts, or it is too lazy to explore serious policy options. Either way, government is sending all the wrong signals.

Thankfully, the Philippine Statistics Authority is very unlikely to succumb to political pressure just to cheat our way out of inflation. But we should nonetheless be disturbed that such proposals were made at all, no less by ranking Cabinet members.

In the end, we should protect the integrity of official statistics at all costs. In this tempestuous era of disinformation and uncertainty, they are our most steady anchors.

Losing our grip on the data will only send the country’s economic boat adrift. – Rappler.com

The author is a PhD candidate at the UP School of Economics. His views are independent of the views of his affiliations. Follow JC on Twitter: @jcpunongbayan.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.