SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

![[ANALYSIS] Viral misconceptions about inflation, how to debunk them](https://www.rappler.com/tachyon/r3-assets/03AD21FB36684959A31F285ECFDA6C52/img/2830B0073888499EBD19B70087E34504/Viral-misconceptions-about-inflation-and-how-to-debunk-them-Sept-13-2018.jpg)

The past week saw an alarming explosion of myths and misconceptions about inflation (how fast prices are rising).

This came in the heels of the shocking announcement of the Philippine Statistics Authority (PSA) that inflation in August clocked in at a whopping 6.4%.

Not only is this the highest in 9.4 years, it’s also higher than the government’s upper forecast of 6.2%, higher than the government’s upper target of 4%, and highest in ASEAN. (READ: Why is Philippine inflation now the highest in ASEAN?)

But no sooner than the inflation figures were announced than several people – online and offline, in and out of government – proffered faulty and misleading analyses to dismiss its seriousness. Some of these analyses have even gone viral.

In this piece I would like to debunk these pernicious myths and misconceptions which I grouped into 3 main categories.

Misconception 1: Higher inflation is an indicator of a healthy, growing economy

One viral post online – which earned more than 11,000 shares on Facebook so far – argued that inflation is a “good indicator that the economy is working and heading upwards,” as well as a sign of “higher economic activity and brighter economic prospects.”

A similar message was trumpeted by Duterte’s economic managers. Socioeconomic Planning Secretary Ernesto Pernia said it’s “not alarming” and “quite normal in a fast growing economy resulting in strong demand and rising expectations of people.”

For his part, Budget Secretary Ben Diokno said 6.4% inflation is “manageable” and that he has “seen worse inflations.”

It’s true that – in the span of many decades or centuries – a nation’s cost of living rises in tandem with its income. Rich countries like the US and Japan, for example, have much higher costs of living than poor countries.

Yet in the short run, we don’t need high inflation in order to grow fast.

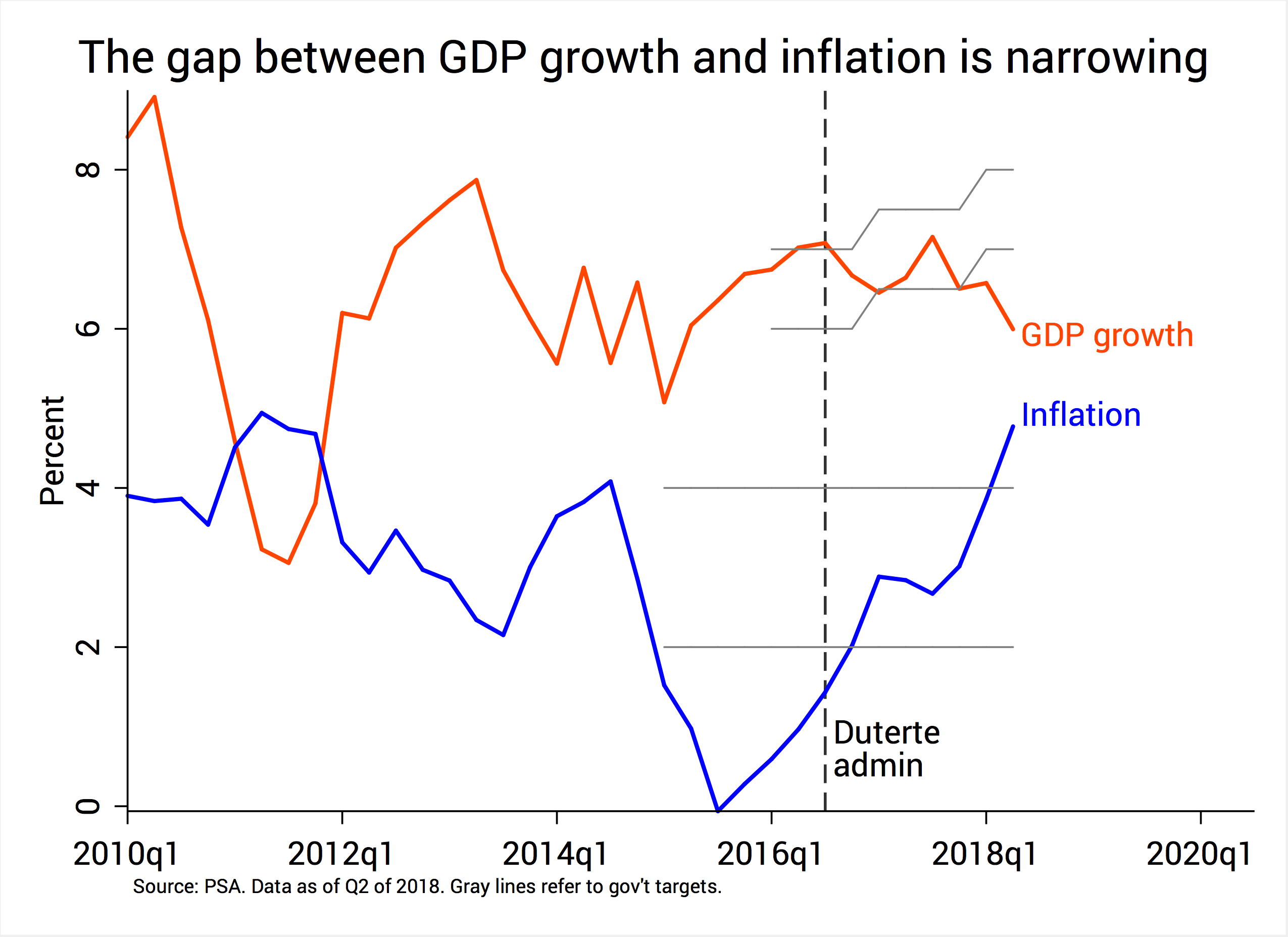

Figure 1 shows that right before the Duterte administration, we were, in fact, enjoying a period of low inflation and fast growth. Today, however, growth seems to be faltering even as inflation is skyrocketing.

In August, the inflation rate (6.4%) even exceeded the latest economic growth figure (6%). What gives?

Figure 1.

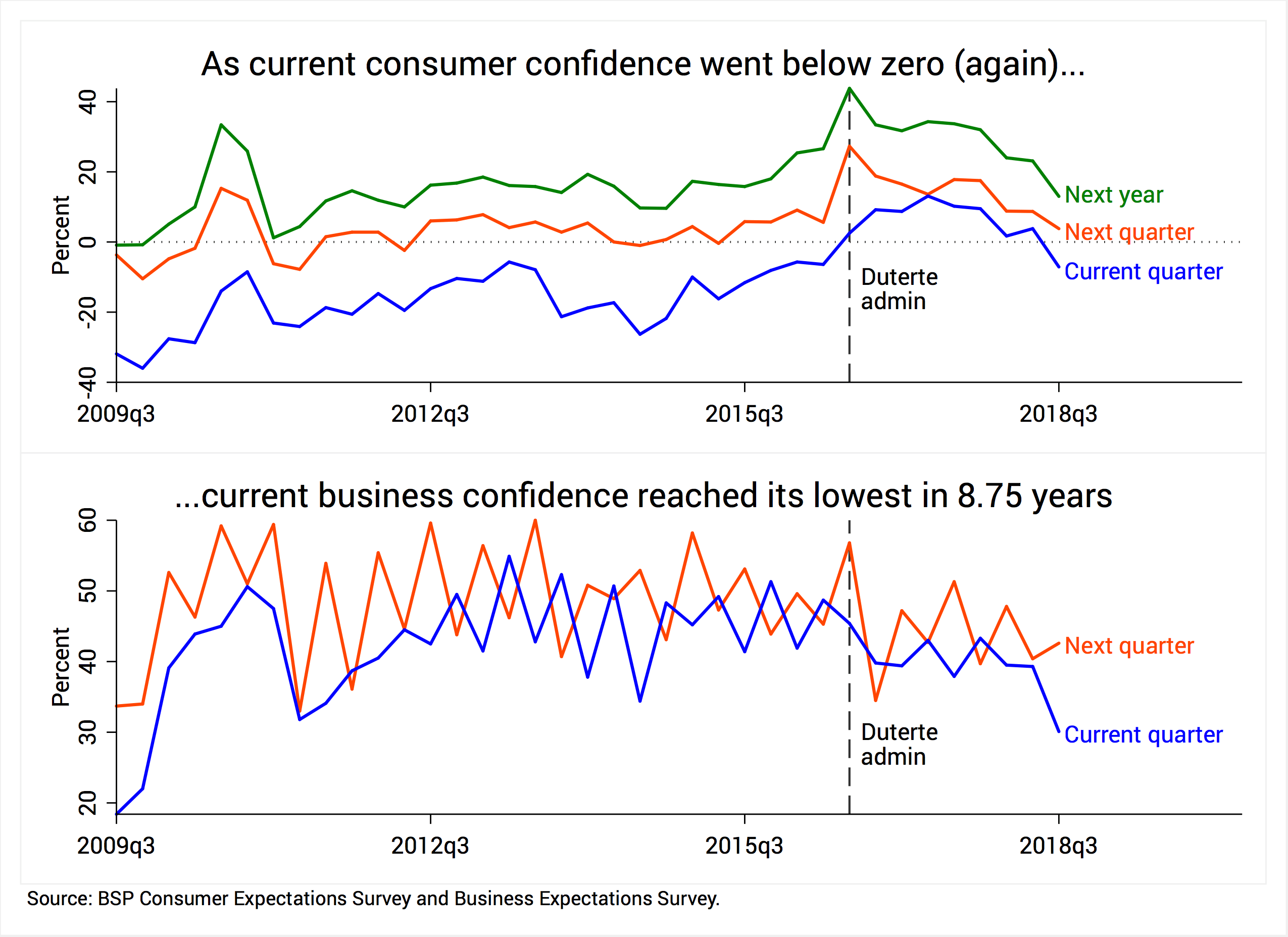

Data also belie the claim that inflation is a sign of “brighter economic prospects.”

Figure 2 below shows that, in July, consumers’ confidence in the current state of the economy dived into the negative region this quarter – the first time since Duterte came into office. Meanwhile, businesses’ confidence in the same period reached its lowest in almost 9 years.

If inflation is a sign of better things to come, why are these measures of economic confidence plummeting?

Figure 2.

Misconception 2: Inflation today is not so high compared to historical levels

Some have also belittled recent inflation by saying it’s not that high historically.

To bolster that claim, some assembled data – going as far back as 1960 – to show we’re far from the highest inflation rates in history.

Others still, including one “data scientist,” argued that 6.4% inflation is on par with the average inflation rate of the past 5 administrations combined.

Unfortunately, arguments like these are not only misleading, they also provide ammunition to government propagandists. PCOO Secretary Martin Andanar, for example, made very similar claims on state-run radio recently.

Data confirm that inflation used to be much higher. Back in 1984 – right in the middle of the economic crisis brought about by President Marcos – inflation even reached a mind-boggling 50.3%.

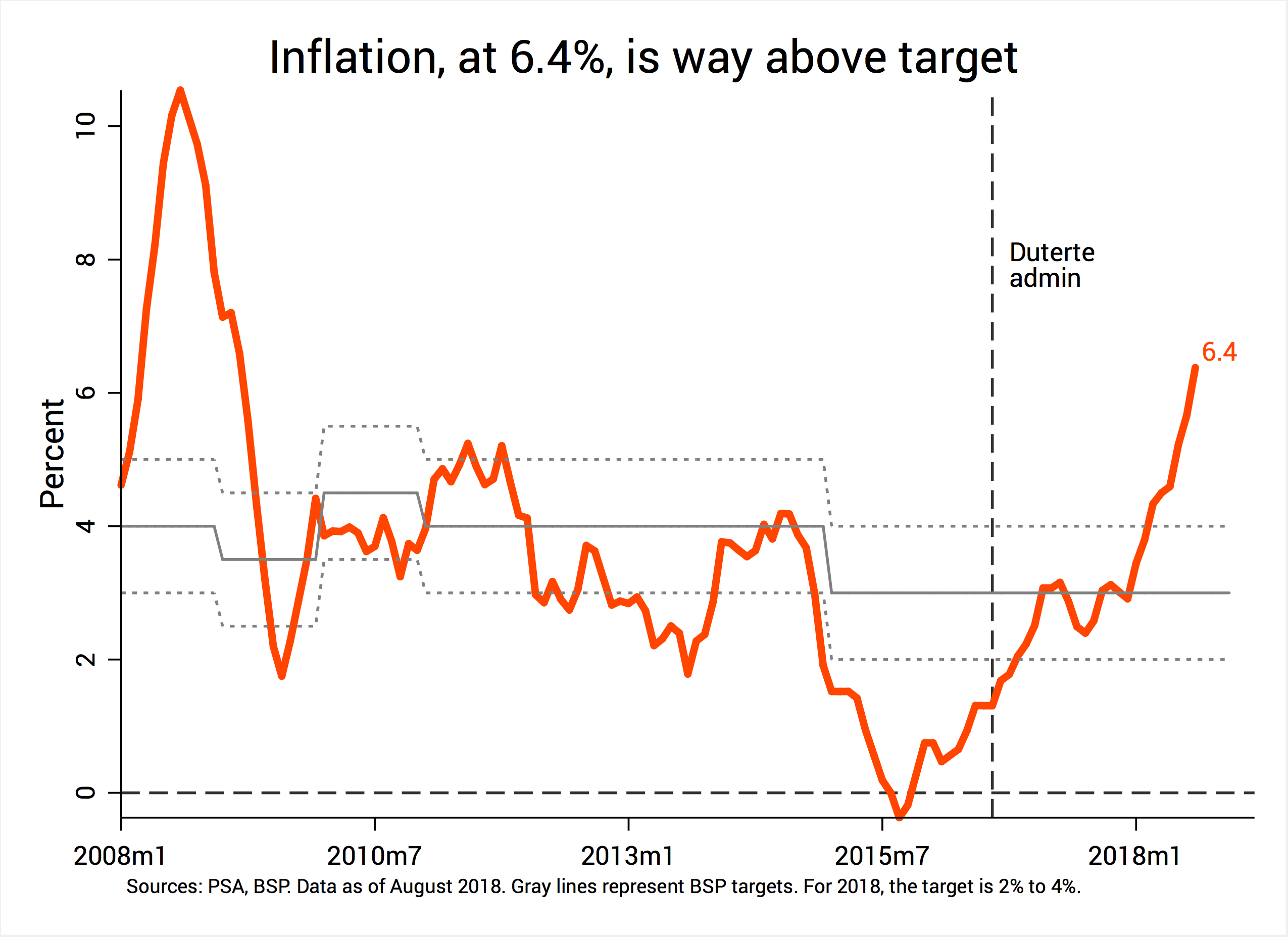

But inflation is better judged in relation to the government’s avowed target. For 2018, that target is 2% to 4%. Figure 3 shows that inflation last month was already 60% higher than the government’s upper target.

Figure 3.

Also, to say that 6.4% is not too bad – because it used to be in excess of 50% – is like saying the number of extrajudicial killings in the time of Marcos is no reason for alarm because Duterte’s current record is much higher.

Just as the relatively smaller Martial Law death toll is utterly deplorable, the relatively lower inflation rate of 6.4% today is nothing to celebrate about.

Notice, too, the patent contradiction between this argument (high inflation is bad) and the previous one (high inflation is good). Which is it, really?

Misconception 3: Inflation is largely because of international factors (world oil prices, Trump’s policies) and therefore beyond our control

Finally, many have pointed to international factors as the main culprits for our inflation woes.

Some officials of the Department of Finance, for example, have emphasized the role of higher world oil prices.

Assistant Secretary Tony Lambino – who by the way previously said year-on-year inflation is an “abstract” concept and “not how people experience prices” – also recently claimed that record-high oil prices are to blame, not TRAIN. “Without TRAIN, inflation would still be high,” he said.

Meanwhile, Duterte himself blamed Donald Trump and his trade war against China. In Jordan he told Filipinos there that, “Inflation is – dahil ‘yan kay Trump. When Trump raised ‘yung tariff and banned other items.”

One viral post – 13,000 shares so far – echoed Duterte by devoting several paragraphs to the so-called “Chimerica trade war” and spinning wild conspiracy theories about the US.

Although inflation is borne by both international and domestic factors, the latter demonstrably dominate the former.

For example, even if world oil prices are indeed at a 3-year high now, TRAIN’s excise taxes – which are completely within government’s control – add directly to the rising costs of petroleum products like gasoline, diesel, and kerosene.

On January 1, 2019, these excise taxes will increase even more because of TRAIN. Halting these automatic tax hikes – as has been proposed by some lawmakers – only seems prudent to pursue.

Meanwhile, Trump – even if he’s as economically illiterate as Duterte, if not more so – cannot be blamed for our runaway inflation.

First, unless we impose higher tariffs on imports from the US or China – and join the trade war ourselves – I see no immediate reason how the trade war could impact domestic inflation.

Second, some analysts have posited that the Philippines actually stands to benefit (rather than suffer) from the burgeoning US-China trade war, in the form of Chinese investors relocating to ASEAN countries like ours.

Third, perhaps more worrisome is a general slowdown of growth in the US or China that could arise from their trade war. But so far, indicators paint pictures of robust growth in both countries.

In sum, we don’t have to look too far to identify the causes of recent inflation. The problems, by and large, lie within our own backyard.

Putting the blame on international factors not only distracts us from the real issues at hand – including the rice crisis, TRAIN, and unmoored inflation expectations. More importantly, it could lull our policymakers into inaction and complacency.

Let’s not downplay inflation

You don’t really need to crunch the numbers to know there’s a problem with inflation. Just go to the nearest palengke or talipapa or grocery to see that prices have skyrocketed to alarming levels.

Sadly, there’s now a concerted effort to downplay the magnitude and impact of inflation, whether by misreading the data or blaming foreign affairs.

Worse, a number of people have speculated that government has already started fudging the numbers.

One report, for example, indicates that the original inflation estimate for August was actually 6.6%, not 6.4%.

But Secretary Pernia, upon seeing the initial report of the PSA, called for a last-minute correction (in his word, a “corrigendum”).

This downward revision of the August figure – which led to an unusual one-hour delay of the inflation announcement last week – raises several questions.

For example, how come the PSA failed to mention this “corrigendum” in their press release as the reason for their delayed announcement? Instead, they blamed congestion and technical glitches on their website. (READ: PSA contradicts Pernia, blames technical glitch for late inflation data)

Regardless of the exact reason, this last-minute “corrigendum” gives the unwelcome impression that government is now in the business of massaging the numbers to hide ugly truths about the economy.

Rather than rebuild the people’s trust in government, such actions only serve to erode them further. – Rappler.com

The author is a PhD candidate at the UP School of Economics. His views are independent of the views of his affiliations. Follow JC on Twitter: @jcpunongbayan.

Add a comment

How does this make you feel?

![[ANALYSIS] A new advocacy in race to financial literacy](https://www.rappler.com/tachyon/2024/04/advocacy-race-financial-literacy-April-19-2024.jpg?resize=257%2C257&crop_strategy=attention)

![[In This Economy] Can the PH become an upper-middle income country within this lifetime?](https://www.rappler.com/tachyon/2024/04/tl-ph-upper-income-country-04052024.jpg?resize=257%2C257&crop=295px%2C0px%2C720px%2C720px)

There are no comments yet. Add your comment to start the conversation.