SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

![[ANALYSIS] Will Duterte’s new tax measure kill foreign investments?](https://www.rappler.com/tachyon/r3-assets/612F469A6EA84F6BAE882D2B94A4B421/img/2CF68EBEE36D488B85E9FDEB8300BEF7/thought-leaders-foreign-investment.jpg)

The sequel to the controversial TRAIN law, called Citira, pits two key economic agencies against each other.

Citira, which stands for Corporate Income Tax and Incentive Rationalization Act, is previously known as the Trabaho bill, which the House already passed on third and final reading in the previous Congress but ran out of time in the Senate.

On September 9, the House of Representatives passed Citira on second reading.

The Department of Finance (DOF) claims Citira will do the country good. Yet the Philippine Economic Zone Authority (PEZA) claims this tax reform measure will drive away investors and hurt the economy at large.

What does Citira aim to do? Will it really hurt foreign investments and kill the goose that lays the golden egg for our economy?

Declining foreign investments

First, note that foreign investments are falling fast.

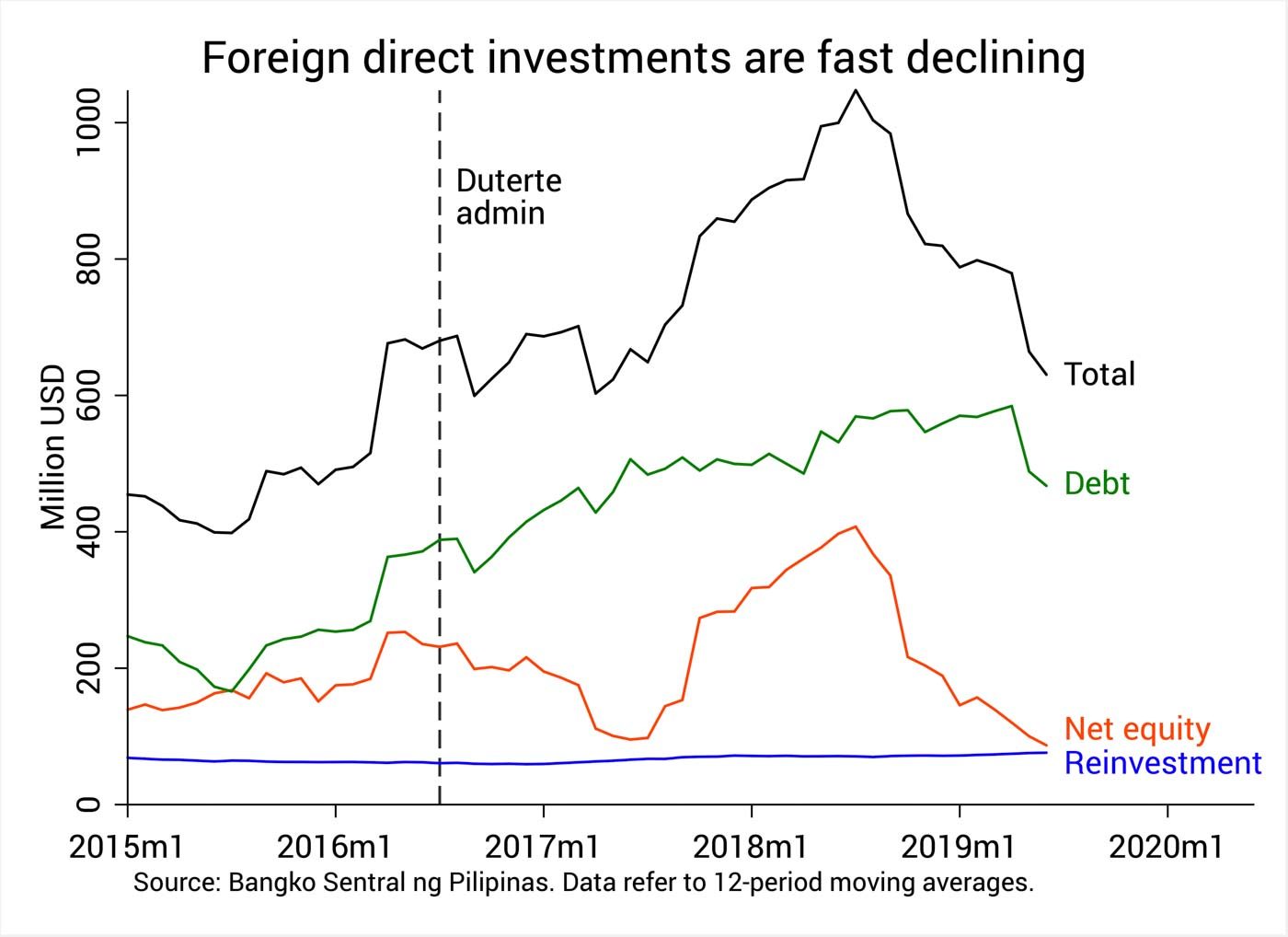

Figure 1 shows that after a steady climb over the years, foreign direct investments (FDIs) have started to plummet since the middle of last year.

Of all the components of FDI, the steepest decline can be been seen in “net equity capital,” which just equals incoming net of outgoing investments. Simply put, investments are pulling away at a faster rate than they are coming into the country.

In particular, FDIs in manufacturing and those from the European Union and ASEAN have fallen the most.

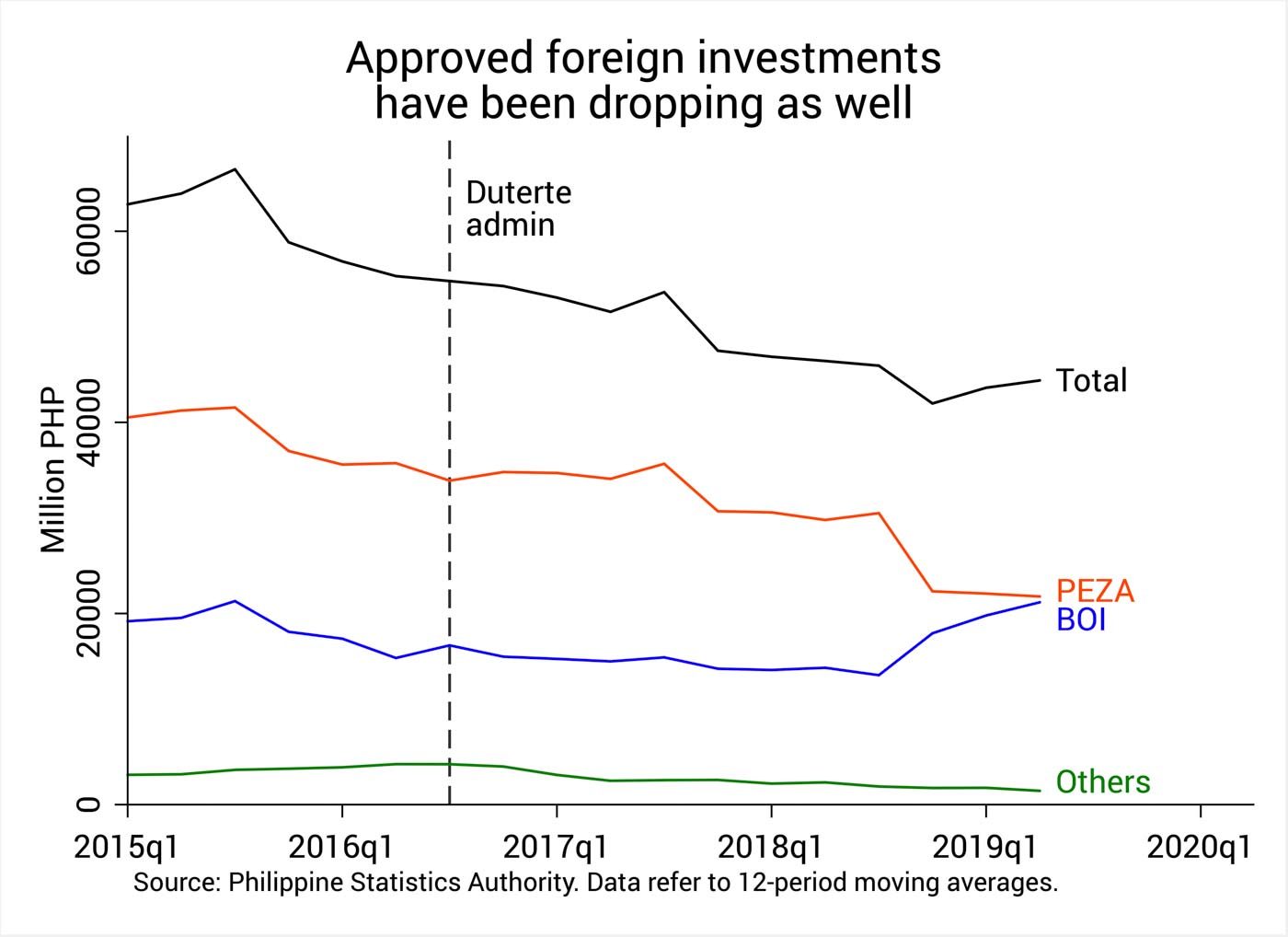

Figure 2 below shows there’s also a steady decline in the number of approved foreign investments.

Investments approved by PEZA have seen the largest drop, partially counteracted by investments approved by the Board of Investments (BOI).

‘Unli’ perks

It is against this bleak foreign investment backdrop that the Duterte government is pushing for the Citira bill.

Citira has two main objectives which, on close inspection, actually make a lot of economic sense.

First, Citira aims to reduce the tax rate paid by corporations on their incomes.

Today the Philippines has the highest corporate income tax (CIT) rate in ASEAN at 30%. Lowering this to 20% over the next decade will go a long way in making our tax system more competitive in ASEAN and helping attract more investors.

At the same time, though, Citira aims to make it harder for some investors to enjoy the “unli” perks they have been enjoying – nay, abusing – for the longest time.

In 2017 our government spent P441 billion worth of investment incentives on just 3,150 firms. That’s 2.8% of our nation’s income funneled to just 0.3% of registered firms, solely to entice them to continue doing business in the country.

About a fifth of all firms in economic zones have also been enjoying investment incentives for more than a decade already. In contrast, other ASEAN countries’ investment perks are highly targeted, conditioned on performance, and expire after some date.

In sum, the DOF sees Citira as an opportunity to curtail some of these extravagant yet needless investment perks.

Killing the goose that lays golden eggs?

Naturally, PEZA has a completely different take on Citira. To them, such law will kill the fabled goose that lays the golden egg.

Right now PEZA operates nearly 400 ecozones nationwide, hosting around 3,558 firms (“locator enterprises”) in various sectors like manufacturing, agro-industry, and IT.

PEZA contends that the incentives received by its firms pale in comparison to the value they generate for our economy.

From 2015 to 2017, PEZA claims its firms got a total of P879.1 billion in investment incentives but generated over P7 trillion in export receipts, on top of other spending items.

By PEZA’s reckoning, every peso spent on incentives yields P11.4 in economic benefits.

This figure, although seemingly impressive, may be bloated because it includes not just the value of final goods (as is commonly the case) but also the value of workers’ salaries and corporate taxes.

Unsurprisingly, this number is also far from the DOF’s own estimate of incentive benefits, which range from just 60 centavos to P1.23 per peso of incentives.

PEZA Director-General Charito B. Plaza’s opposition to Citira has been loud and clear.

In one of PEZA’s presentations before Congress, one slide showed in all caps, “PEZA IS NOT BROKEN. PLEASE DON’T FIX IT.” At the very least, Plaza hopes that PEZA will be spared from Citira once passed.

Because of this adamant stance against Citira, some surmise Plaza is the female economic manager that President Duterte wants out due to alleged underperformance.

Caught in the crossfire

Amid continuing debates and quarrels on Citira between the DOF and PEZA, one thing is certain: investors are caught in the crossfire.

Some analysts even blame the recent decline of foreign investments on the cloud of uncertainty spawned by Citira.

Recently the DOF trumpeted a 112% increase in approved foreign investments during the first half of 2019. For them, this belies the claim of “noisy naysayers” that investors are getting spooked by Citira.

Although the figure is correct, it hides the overall downtrends in foreign investments seen in Figures 1 and 2.

Right now prospective investors are reportedly holding off their expansion in the Philippines or else eyeing to invest in other ASEAN countries like Vietnam. This is completely understandable: investors will not invest until they know exactly the taxes and perks they will end up paying and receiving.

Tax competition in ASEAN is indeed getting stiffer, and Vietnam is now proving to be the region’s fastest-growing investment hub.

For instance, most of Samsung’s smartphones are now made in Vietnam, and Samsung plans to further expand there alongside other tech giants such as Intel and Microsoft.

Many Chinese firms hit by the ongoing US-China trade war are also seeking refuge in Vietnam. Hence, Vietnam is widely expected to turn escalating trade tensions to its advantage.

A recent study by the Asian Development Bank also found that the Philippines, too, could stand to gain from the US-China trade war – but only if we can attract enough investors our way.

Until Citira is settled soon, though, we can’t expect foreign investors to flock in droves to our country just yet.

Worse problems

For all we know, investors may be bluffing.

Even if Citira does pass, many investors will likely choose to enter and stay because of our economy’s other redeeming factors, such as our young, educated workforce and our investment grade ratings.

Yet our government must also ensure that the country’s investment climate remains alluring enough even without a surfeit of fiscal incentives.

Disquietingly, red flags are beginning to crop up throughout our economy. In the last quarter GDP growth continued to plummet below target, private investments shrank, agriculture remained anemic, and construction of infrastructure projects faltered.

In other words, many other things could make or break our country’s attractiveness to investors. Citira’s stricter investment incentives may be the least of our worries. – Rappler.com

The author is a PhD candidate at the UP School of Economics. His views are independent of the views of his affiliations. Thanks to Jerome Abesamis for valuable insights and comments. Follow JC on Twitter (@jcpunongbayan) and Usapang Econ (usapangecon.com).

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.