SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

![[OPINION] A guide to money laundering](https://www.rappler.com/tachyon/2023/01/Money-Laundering.jpg)

Right off the bat, 2023 has immediately ushered in a new set of scandals. But lest we forget, 2022 remains an unmade bed.

Falsehood, fake news, public relations spin, historical revisionism, and laundering – money, hidden wealth or otherwise – are conceptual synonyms. The latter two, given recent statutory machinations catalyzed by transactional politics, are intimately related and share parental DNA in many ways.

Now that the proposed Maharlika Investment Fund (MWF) has become one of the most toxic of topics, and which for some is incurable despite herculean efforts to cleanse it of inherent flaws, this allows us to illustrate methods to launder illegally gotten wealth.

Financial fraud is after all a complex crime. It often includes complementary predicates.

Where even former Supreme Court justices have opined on inherent unconstitutionality, where funds might automatically be funneled from pensions from specific constituencies, as lettered economists, bankers, and the country’s most credible business groups and chambers of commerce unanimously express their deepest fears, one of the least discussed is the potential for money laundering. It is the bane of any investment for as long as certain characteristics are worked into it.

For those hell-bent on altering history, superimposing new narratives over established facts, any laundering, whether it involves plundered wealth, the cleansing of notorious ignominy, or even simply the misrepresentation of educational records, is an integral part of historical revisionism.

Historical revisionism that induces mass amnesia is especially disconcerting where undiscovered billions plundered generations ago remain hidden in some foreign land, especially in the face of our continuing poverty, underemployment, runaway inflation, and an imminent recession half a century hence.

It is a cause for concern when generic sovereign investment funds obfuscate sources and thus provide anonymity.

But apart from anonymity, there are other characteristics that raise red flags.

There is the application of generous doses of fragrance enhancers and odor-eaters in the form of charitable institutions, or philanthropic and developmental objectives claiming to alleviate the plight of the destitute and poor. Note how laundering using lotteries, sweepstakes draws, or foundations can be used to cleanse what would otherwise be dirty.

There is also money laundering through games of chance, where the prize money is large and where both benefactors and beneficiaries remain unidentified, their identities as well as sudden one-time surges in personal assets protected. Where bureaucracies have erected the highest walls around the statement of assets, liabilities, and net worth (SALN) requisites, the genus impuratus can confidently compliment by claiming charitable lottery or sweepstakes windfalls.

The inconsistencies and ambivalence in enforcing SALN disclosures likewise enable “rich uncle inheritances” as convenient laundering options.

A third method is the use of the state-run casino system to bury fruits of plunder among the daily anonymous wins and losses of gaming and gambling.

The ultimate objective is to quickly transform plundered proceeds, even unused campaign donations, into other forms of wealth, less obvious and less malodorous. The choices are legion, ranging from missing priceless paintings, even lost Picassos that end up in private collections, to real estate, rare metals, precious jewelry, and cryptocurrencies. Add to the list fabled pre-Spanish era gold and golden-domed New York buildings and apartments.

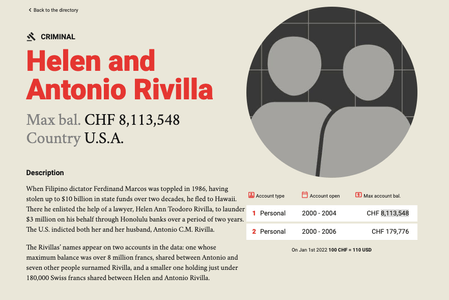

Another, albeit not a mutually exclusive, modus, is to use an alias for Swiss or offshore accounts, and a tax-haven address plus a cryptic post office drop-box. Anonymity is the critical default. The options may involve charitable foundations, estates, holding companies, dummies, and offshore deposits.

Remember the infamous example that relates both laundering and revisionism intimately?

Historical records show that in 1968, between March 20 and 21, spouses using names like “Saunders” and “Ryan“ opened four offshore bank accounts with instructions that all correspondence be directed through a third party via a Manila Post Office box. The deposit was well over 3,000% of the couple’s known 1968 income.

To sum up, employing the critical anonymity factor, it would not be difficult to launder long-plundered hidden wealth as fruits of offshore investments. – Rappler.com

Dean de la Paz is a former investment banker and managing director of a New Jersey-based power company operating in the Philippines. He is the chairman of the board of a renewable energy company and is a retired Business Policy, Finance, and Mathematics professor.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.