SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

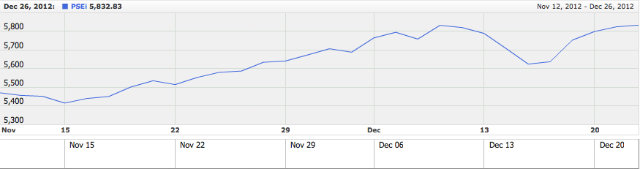

MANILA, Philippines – A day after Christmas, the main index of the Philippine Stock Exchange (PSE) surged to its 38th all-time high for 2012.

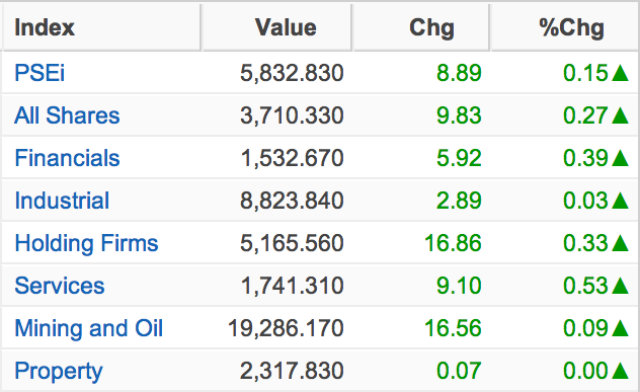

The PSE index (PSEi), a barometer of investor confidence, was up 0.15% or 8.89 points to 5,832.83 points on Wednesday, December 26.

The last time the index breached the 5,800 level was on December 21 with the PSEi closing at 5,823.94 points. President Benigno Aquino III has once said the index may hit 6,000 before yearend.

“The recent slew of good news triggered by the economy’s stellar performance and S&P’s recent credit outlook upgrade has resulted in a continued post-Christmas rally,” PSE President and Chief Executive Officer Hans B. Sicat said in a statement

The broad All Shares index was up 0.37% or by 9.83 points to 3,710.33 points.

Around 1.08 billion shares worth P3.5 billion traded hands on Wednesday.

There were 92 advancers and 60 decliners. Around 51 shares remain unchanged.

Metropolitan Bank and Trust rose 1.18% to P102.90 and SM Prime Holdings added 1.69% to P16.80.

The local bourse was closed in the past two days for the holidays. It will remain open until Friday, December 28, the last trading day of 2012.

Asian stocks

Asian stocks were higher in quiet post-Christmas trade Wednesday, with Tokyo shares lifted by a weaker yen which sank to a 20-month low against the greenback.

The Nikkei 225 index at the Tokyo Stock Exchange jumped 1.49 percent, or 150.24 points, to 10,230.36 as the Japanese currency dipped past 85.00 yen against the dollar for the first time since April 2011.

A strong yen is negative for Japanese markets as it erodes exporters’ revenue and makes their products less competitive overseas.

Seoul closed flat, adding 0.43 points to 1,982.25, while Shanghai gained 0.25 percent, or 5.52 points, to 2,219.13.12.

Markets in Hong Kong, Sydney and Wellington were closed for a public holiday.

Regional gains came despite a lack of fresh trading cues as US and European markets were shut for Christmas, with pessimism still lingering about prospects for a “fiscal cliff” deal by the end of the year.

US lawmakers are set to return to the negotiating table after Christmas holidays in a last-ditch effort to reach a deal to avert the so-called cliff, a series of steep tax hikes and spending cuts due to take effect in January.

Experts warn that going over the cliff could plunge the world’s biggest economy back into recession.

But despite those concerns, the dollar improved on Wednesday against the yen, hitting a 20-month high on expectations that the Bank of Japan would initiate more monetary easing steps.

The unit has been declining as the new Japanese premier Shinzo Abe, whose Liberal Democratic Party won a landslide election victory last week, steps up pressure on the central bank to take bold easing steps.

Abe was named prime minister on Wednesday, after he swept to power on a hawkish platform of getting tough on diplomacy while fixing the economy with active fiscal spending and monetary easing.

“The yen is firmly on a weakening path and there is no meaningful rebound in sight at the moment,” Daisuke Uno, strategist at Sumitomo Mitsui Banking, told Dow Jones Newswires.

However, the policy easing is “almost completely factored in now as the new government takes the reins. By (end-March 2013) the 86-87 mark is likely but the fall will be at a decelerated pace than what we’ve seen to this point”, he said.

In Asian trade the greenback was at 85.25 yen in the afternoon from 84.78 yen in Tokyo late Tuesday, while the euro bought 112.420 yen compared with 111.75 yen. – Rappler.com and Agence France-Presse

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.