SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – The year 2012 was full of surprises, good news, tension, frustrations and more.

Below is a list of 12 of the biggest business, industry and economics stories Rappler’s business team covered in 2012. It reflects the new policies, partnerships and factors beyond Filipinos’ control that shaped 2012 and will be felt after the year is over.

It shows how the movers and shakers of the economy took advantage of opportunities and navigated the risks, how political leaders showed grim determination in decisions that affect lives and plans, and how intertwined players in both business and politics are.

1. Philippine economy takes off

The Philippine economy has been on a meteoric rise this year, posting a surprising 7.1% growth between July and September. The growth rate was the highest in Southeast Asia, helping the country finally shed its former label as the “sick man of Asia.”

The phenomenal growth — 6.5% average growth in the first 9 months of 2012 — has been bolstered by positive results in several surveys. In 5 out of 8 global surveys, the Philippines’ rank improved.

However, the phenomenal rise has some wondering if the growth story is too good to be true. The country still has a low share of foreign direct investments, the smallest of its ASEAN neighbors as of midyear, while red tape in doing business has yet to show improvements. The joblessness rate has stayed persistently high, rising to 6.8% in October from 6.4% a year earlier.

Government is optimistic growth will beat its previous forecast and even hit 6% to 7% in 2013 thanks to election related spending. If the 2012 Wealth Report’s forecast comes true, the Philippines will be the 6th fastest for growth worldwide between 2010-2050.

2. Sin tax reforms, credit rating upgrade

After over 15 years, Filipino lawmakers finally passed a law increasing taxes on the so-called sin products: tobacco and alcohol. The newly minted law, signed by President Benigno Aquino III in December, has prompted international agencies to upgrade the country’s credit rating to one notch below investment grade, a feat amid a slowing global economy.

The was largely attributed to President Aquino’s and his allies’ flexing their political muscle to push the reform bill through the legislative mill, essentially making good on the administration’s 2010 campaign promise of no-new-taxes.

The rougly P34 billion new taxes it will raise in 2013 will fund universal health care and a tobacco farmers’ livelihood program. The new law is considered a major victory against the strong industry lobby which had kept local cigarette prices among the cheapest in the world.

3. Philippine stock market, peso hit historic highs

The Philippine Stock Exchange (PSE) ended 2012 with a bang with the benchmark index shooting up 33% to 5,832.30 in the last trading day of 2012. The leap was impressive since it placed the market as one of the best performers in the region and the world.

The market broke record highs 38 times throughout the year. And as of October, Reuters said the PSE was the best performing stock market in Asia. Bullish analysts expect the market to hit the 6,500 in 2013 or even 10,000 as early as 2016.

With this rosy performance, the exchange pursued governance and capital reforms. The year ended with 10 listed firms that included units of the country’s biggest business groups failing to comply with the minimum 10% public ownership rule, and a complaint filed against 13 individuals over allegations of manipulating the price of listed agri firm Calata.

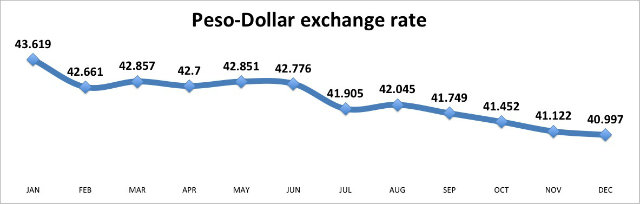

Meantime, at the foreign exchange market, the peso — the best-performing Southeast Asian currency in 2012 — strengthened against the dollar, reaching historic highs.

It settled at P41.05 on the last trading day of 2012, making the currency 6.53% stronger year-on-year, and bringing the average exchange rate to around P42.228 for the entire year.

The strong peso caused uproar among dollar-earners, including exporters, Business Process Outsourcing (BPO) firms and overseas Filipino workers. It has caused job losses as the products of local firms became less competitive abroad.

4. The China factor

The ongoing geo-political dispute over the South China Sea (also called West Philippine Sea) became an obvious display of how a diplomatic row can hurt the economy and business in 2012.

First: The gas exploration by the Pangilinan-led group in Reed Bank (also called Recto Bank) near the Philippines’ Palawan island province was put on hold after ships from China, which claims the entire sea, disrupted operations. This added risks to the capital intensive project, which could potentially produce the country’s largest indigenous energy source.

These risks have prompted the Philippine government to halt the auction of energy blocks in the disputed sea, putting a pause on efforts to assert sovereign and economic rights.

Second: Philippine banana exports were impounded in Chinese ports following tensions over Scarborough Shoal. China, the second biggest export market of the Philippines for bananas, alleged the fresh fruits carried pests, shaving off millions of dollars from the Philippines’ export earnings, one of the major drivers of local economic growth.

Third: China’s travel advisory in May asking citizens to refrain from visiting the Philippines hit the local tourism industry. Hotels, resorts, and airlines felt the pinch when Chinese tourists cancelled their trips to tourist destinations. China is the Philippines’ 4th largest tourist market and the fastest growing one.

5. Casino ‘corruption’ makes global waves

The Philippines is poised to take its place on Asia’s gambling map with the launch of the 4 casino-entertainment operators at the upcoming Entertainment City, but some of the players were tagged with corruption charges in 2012, hitting headlines worldwide.

At the core of the controversy was Japanese gaming billionaire Kazuo Okada whose group dealt with past and present officials at the Philippine Amusement and Gaming Corporation (Pagcor), which is regulating Entertainment City. Okada’s US$2 billion project in Manila, and the money transfers and freebies given to Filipino regulators close to top politicians, became the center of Nevada-based regulators’ investigations on Okada group’s possible violations of US Foreign Corrupt Practices Act.

Okada, locked in a legal battle with bestfriend-turned-rival Steve Wynn and at a risk of losing his license in Manila and Las Vegas, has sued reporters and others for libel.

Still there are many votes of confidence in the industry, like the deal among the richest in the Philippines, Australia and Macau.

6. GMA-7 and TV5 fail to a seal deal

The most talked about deal of the year was the one that never happened — the acquisition of second largest media group GMA-7. It was the third time in 11 years that businessman Manuel V. Pangilinan group had tried and failed to acquire a controlling stake in the network.

Word of the deal sent shocks through the media and telecommunications’ worlds, as others scrambled to find partners. The second largest telco, Ayala-led Globe Telecom, struck a strategic alliance with the country’s leading media group, ABS-CBN Corp. Pangilinan’s business rival Ramon Ang began talks to acquire a personal stake in the partially state-owned media network RPN-9. Ang-led San Miguel Corp, the country’s largest conglomerate is already involved in communications through its stake in the operator of broadband provider Liberty Telecoms.

The acquisition of GMA-7 would have been a major game changer that moved Pangilinan-led Philippine Long Distance Telephone Co. (PLDT) one step further in its convergence strategy, which seeks to marry the vast network of a telecommunications firm with the rich content of a leading TV network. Pangilinan’s group will be pouring more funds into TV5, which is expectedly to finally stop losing money by 2014 and to hit 30% market share by 2015.

7. Uncertain future for mining

In July, the Aquino administration released Executive Order 79, a new policy on mining that was meant to provide guidelines for “responsible mining,” but industry players blasted government for changing the rules in the middle of the game.

The new policy imposed a no-new-mining-contract scheme until a new law is passed on who-gets-how-much of the mining revenues. It also did not address the conflicting national and local laws over the open pit mining method of Tampakan mine in Mindanao. This put the country’s potentially biggest foreign investment of US$5.9 billion on hold up to after the Aquino government steps down in 2016. These likely slashed mining revenues by 75%.

The uncertain future of the Philippine mining industry was made worse by the tailings pond leak at Padcal mine, the only operating mine of Philex Mining Corp, ironically the poster firm for responsible mining. Considered an indication that the Aquino government is not keen on this extractive industry, the Environment Department imposed a P1 billion fine against the country’s biggest gold and copper miner.

Visit #WhyMining page for different views on this controversial extractive industry.

8. The coco levy saga

Businessman Eduardo Danding Cojuangco Jr., a reported crony of the late dictator Ferdinand Marcos, and coconut farmers, who were forced to pay levy funds, have won some and lost some legal battles over the course of 26 years.

In September of 2012, the Supreme Court ruled with finality that shares representing a 24% ownership stake in San Miguel Corp, the country’s biggest business group, are public funds. San Miguel paid the farmers P57.6 billion in October.

In December, the high court also favored coconut farmer groups in their ownership claim to shares in United Coconut Planters Bank (UCBP), representing a 10% stake.

The recent rulings represented a change of fortune for the coconut farmers since the 2011 court decisions had favored Cojuangco. His personal 20% stake in San Miguel was considered not purchased using coco levy funds.

9. New leadership at Philippine Airlines

In April, the country’s biggest business group, San Miguel Corp., acquired a 49% stake in Asia’s oldest commercial airline, Philippine Airlines (PAL), from the Lucio Tan Group and gained management control. This made airlines the newest addition to the diversifying portfolio of San Miguel, and the landmark move in the consolidation efforts of the Tan group.

The timing of the deal put San Miguel as PAL’s white knight amid the legacy carriers’ years of losses following soaring fuel prices, a battle with labor unions that dragged on, and intensifying competition with budget airlines. Under new management, PAL was steered back to profitability, and a deal with a Cayman-based airline was clinched as a workaround to regulatory limitations on mounting additional flights to lucrative US routes.

PAL’s refleeting program became world news when it announced the biggest aircraft deal in the country and for getting two of the world’s biggest aircraft manufacturers — Boeing and Airbus, and their country’s top officials — scrambling for a piece of the action. Locally, it made waves when aircraft purchases hiked trade imports in June to a 10-month high.

10. Real estate boom

The local real estate market boomed anew in 2012, raising concerns about similarities to pre-1997 real-estate-led financial crisis. Experts and economists allayed the fears of worried Filipinos and foreigners, stressing the boom has two fundamental legs to depend on.

One: the remittances sent by Filipinos abroad that stayed resilient despite slowing global economy. With most buying homes for their retirement needs, real estate consultant CBRE noted that overseas Filipinos’ home purchases increased 61% this 2012. The growth in sector is obvious in the and even international players like Paris Hilton, Donald Trump and high-fashion house Versace are getting in on the action.

Two: the continuing growth of Business Process Outsourcing (BPO) business, which requires vast office spaces. With a doubling of revenues to $25 billion by 2016, Philippine skylines are fast developing to meet demand.

Three: Record low interest rates helped make financing a home purchase and office lease more affordable.

11. Chief Justice’s dollars get him into trouble

President Aquino has been clear that he will go after corrupt officials and the former Chief Justice Renato Corona felt the force of that promise when he was removed from the highest post in the judiciary in May.

Local banks were dragged into the fray when they had to face a legal limbo: disclose Corona’s at least US$2.4 million dollar-denominated bank accounts or follow strict bank secrecy laws on foreign deposits. Weighing in on the historic impeachment trial in the Senate, former monetary officials noted that the disgraced former chief justice’s dollar trading in the 1960s was illegal.

The Aquino government has not stopped. Somehow following the strategy to jail Al Capone, Corona has been charged with tax evasion along with other former allies of the Arroyo government now being subjected to a name-and-shame campaign of the Bureau of Internal Revenue.

12. Unprecedented business unions

A few big conglomerates got into bed with each other in 2012, and the most aggressive of them all has been the Ayala group.

Taking strategic positions to clinch big-ticket and high-profile infrastructure projects under the government-led public-private partnership (PPP) scheme, the Ayala group sealed a deal with telco and water rivals Pangilinan group to pursue and develop light rail projects together. The partners are in the running for the P60 billion LRT-1 Cavite extension project, the government’s biggest infrastructure project.

Both are also partners with the Gaisano group in a low-profile project: the water supply venture in Cebu, one that was hailed by governance experts for a successful and scandal-free bidding of a local government project to private players.

They, however, will be rivals in the bid for the Mactan-Cebu International Airport project, which hosts the second busiest airport in the country. Ayala forged a strategic alliance with the Aboitiz group for the P20 billion airport terminal project, pitting them against another interested group, San Miguel Corp.

San Miguel, which has sealed a deal with Citra group, is technically a rival of the Pangilinan-led Metro Pacific group for the NLEx-SLEx link road project. Instead of choosing between the two, President Benigno Aquino III gave his nod to both of their separate connector road proposals. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.