SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

WASHINGTON, USA – The International Monetary Fund on Tuesday, July 9, cut its global economic growth forecast, citing new downside risks in key emerging-market economies and a deeper recession in the eurozone.

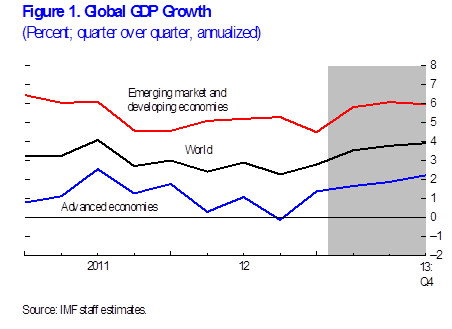

The IMF projected the world’s economy would grow 3.1% in 2013, down from its April estimate of 3.3%. China and other emerging economic powers now face new risks, it warned, “including the possibility of a longer growth slowdown.”

The global lender said that growth had been affected by increased financial market volatility and rising interest rates in advanced economies since its last World Economic Outlook report was published in April.

“Emerging-market economies have generally been hit hardest, as recent increases in advanced economy interest rates and asset price volatility, combined with weaker domestic activity have led to some capital outflows, equity price declines, rising local yields, and currency depreciation,” the Fund said in a WEO update.

The expected US Federal Reserve’s unwinding of its massive monetary policy stimulus could trigger sustained capital outflows from emerging-markets, the IMF warned.

“Monetary easing can be the first line of defense against downside risks” in emerging-market and developing economies, where inflation was generally expected to moderate, it said.

But fiscal policy options may be limited.

“Real policy rates are low already, and capital outflows and price effects from exchange rate depreciation may also constrain further easing,” the Fund said.

Emerging markets

Growth in the emerging-market and developing economies was expected to slow to 5% in 2013, instead of the 5.3% expansion seen a few months ago.

China, the world’s second-biggest economy and a main engine of global growth, would expand by 7.8%, three-tenths a point slower than thought.

Growth in the rest of the top emerging-market economies — Brazil, Russia, India and South Africa — was also cut. The forecast for Russia was slashed by 0.9 points to 2.5%, and South Africa was cut 0.8 point to 2%.

Lower commodity prices were curbing growth in commodity exporters. Crude oil prices were expected to fall 4.7%, while non-oil commodity prices were projected to decline 1.8%.

Some of Sub-Saharan Africa’s largest economies, such as Nigeria and South Africa, face weaker growth in part due to weaker external demand, while in the Middle East and North Africa, growth remains weak “because of difficult political and economic transitions,” the IMF said.

Meanwhile, combined growth in the advanced economies was estimated at 1.2%, down a tenth point from the prior estimate.

Europe, US, Japan

The recession in the eurozone was deeper than expected, the IMF said, citing a toxic combination of low demand, depressed confidence, weak balance sheets and the impact of tight fiscal and financial conditions.

The IMF predicted a 0.6% contraction in the 17-nation eurozone, down two-tenths a point from the April estimate.

US growth was weakening under pressure from government spending cuts that offset improving demand in the private sector, notably from a recovery in the housing market. Growth in the world’s largest economy was trimmed by two-tenths of a point to 1.7%.

Japan’s growth outlook was upgraded by a half-point to 2%, with the IMF citing the impact of the Bank of Japan’s huge stimulus efforts.

Gloomy future

But overall, the IMF was somewhat gloomy, saying threats to growth continue to cloud the future.

It called on advanced economies to take additional measures to bolster their defenses, citing the need for the United States to not let politics interfere with a timely, necessary increase in its official borrowing ceiling to avoid a spending crunch.

It also said euro area governments need to “do what it takes” to bring back growth and reverse “financial fragmentation.”

Generally, all major economies need to undergo structural reforms to spur growth and support global rebalancing, the Fund said.

“This implies measures to sustainably raise consumption (China) and investment (Germany) in surplus economies as well as measures that improve competitiveness in deficit economies,” it said. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.