SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – Private educational institutions have won a reprieve from the Bureau of Internal Revenue’s taxing powers.

A Makati Regional Trial Court issued a temporary restraining order on Friday, December 27, on a memo requiring schools to apply for tax exemption.

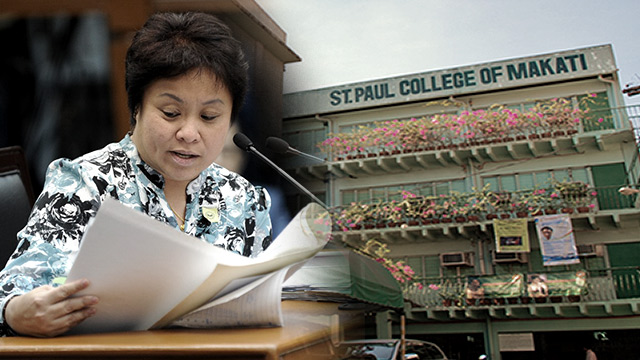

Revenue Memorandum Circular 20-2013, issued by BIR Commissioner Kim Henares, was challenged by St Paul College of Makati. The school argued that it is unconstitutional and an exercise of abusive powers of the BIR. It is a case that crosses religious lines – Catholic, Protestants, Iglesia ni Cristo, Muslims – and even the non-sectarian schools, as it could impact on their tax-exempt status.

Enhance monitoring

Issued on July 22, 2013, the BIR memo prescribes “policies and guidelines in the issuance of tax exemption rulings to qualified non-stock, non-profit corporations and associations.”

The move aims “to enhance monitoring” of corporations granted tax-exempt status to ensure that they comply with the conditions for the tax exemption, determine other taxable incomes not covered by the exemption, and plug tax leakages.

The memo states that corporations listed under Sec. 30 of the National Internal Revenue Code (NIRC) should file applications for tax exemption/revalidation from the Revenue District Office where they are registered.

Sec. 30 of the NIRC enumerates the tax-exempt corporations and associations, ranging from labor and agricultural associations to cemetery companies, non-stock and non-profit private and government education institutions and corporations or associations organized and operated exclusively for religious, charitable, scientific, athletic or cultural purposes.

However, Sec. 30 also says that any income from activities that are unrelated to their primary purpose is subject to tax.

The memo states that tax exemption certificates issued by the BIR before June 30, 2012 will expire on Dec 30, 2013. On the other hand, certificates issued after June 30, 2012 will be valid for 3 years.

It requires schools to make a reporting of their annual revenues and assets and how these were utilized. Expectedly, the memo did not sit well with private schools, which have been long spared from filing the tax exemption certificates.

Constitutional immunity

The case resurrects the issue of whether or not non-profit private educational institutions should be taxed, given the high tuition fees it collects from pupils and students.

Escalating costs of matriculation have become an annual woe for parents wanting to enroll their children in private schools. In this school year alone, higher educational institutions in Metro Manila upped their tuition fees by an average of P64 per unit. Primary schools on the other hand, were allowed to increase fees by 6% to 10%.

The Constitution, however, has cloaked schools – at least those registered as non-stock and non-profit – with tax immunity.

Article 14, Sec. 4(3) says, “all revenues, assets on non-stock, non-profit educational institutions used actually, directly and exclusively for educational purposes shall be exempt from taxes and duties.” The exemption is in recognition of the “complementary roles of public and private institutions in the educational system.”

But the Henares memo threatens to lift this constitutional tax immunity, St Paul College counsel Sabino Padilla IV explained.

Padilla also explained the memo runs counter to two previous Supreme Court jurisprudence recognizing the continuing tax immunity of non-profit or non-stock schools.

Letter to Henares

Following the issuance of the memo, a source familiar with the case said some members of the 1,219- strong Catholic Educational Association of the Philippines, wrote to Henares, asking her to reconsider her order. “They wanted her to study more the move, at the very least,” the source said.

But Henares held her ground.

Some schools, fearing reprisal, have actually filed applications for tax exemption with the BIR’s legal division. So far, around 50 schools have been issued tax exemption certificates, the source said.

What does this mean?

Without a tax exemption certificate, thousands of private schools are automatically no longer tax-exempt by Jan 1, 2014. Apart from national taxes, they will also be covered by local taxes like real-estate tax.

When it became clear that Henares was not going to reconsider, the CEAP-member schools that wrote Henares withdrew their letter but refrained from bringing her to court.

It was only St Paul College-Makati that took the challenge, in behalf of other schools.

Motion for reconsideration

The Makati RTC initially junked a motion to set aside the contested memo but reversed its earlier ruling upon a motion for reconsideration filed by St Paul College.

In its motion, the school argued that Henares, “had adjudicated for herself, and has delegated to her officials, and personnel of the BIR, the power to grant, bestow, cancel, revoke or deny the tax exemption granted by the Constitution.”

In setting the deadline and expiry for tax exemption certificates and subjecting these to review, Henares effectively usurped legislative powers and set aside the Constitution. The memo means that “only the Commissioner of Internal Revenue, not even the courts of law, will have the power to grant, bestow, cancel, revoke or deny the tax exemption granted by law,” the motion for reconsideration said.

The school asked the court to reconsider the TRO, to avoid “an illegal, stressful, abusive and harassing scenario” from happening. It claimed “irreparable injury” if the BIR memo is not set aside, since it would be tantamount to losing its tax-exempt status.

The BIR, in its counter-reply, argued that St Paul College is not exposed to irreparable injury since the school “could just comply by submitting the necessary documents required.” The school too “could appeal for any deficiency taxes or penalties” that may be imposed if it fails to comply. In the instant case, it is the government, on the contrary, that is exposed to irreparable injury if the TRO is issued, the BIR said.

Status quo

In his resolution, Makati RTC Branch 42 Judge Maximo De Leon sided with St Paul College. “Accordingly, issuance of a TRO is justified to preserve the status quo,” the resolution said.

The judge directed the BIR to appear in court on January 8 “to show cause why no preliminary injunction should be issued.”

A TRO is valid for only 15 days. After the lapse of 15 days, St Paul College will have to secure a preliminary injunction to preserve the status quo while the case is pending. If it wins the case, the court will issue a permanent injunction on the memo. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.