SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

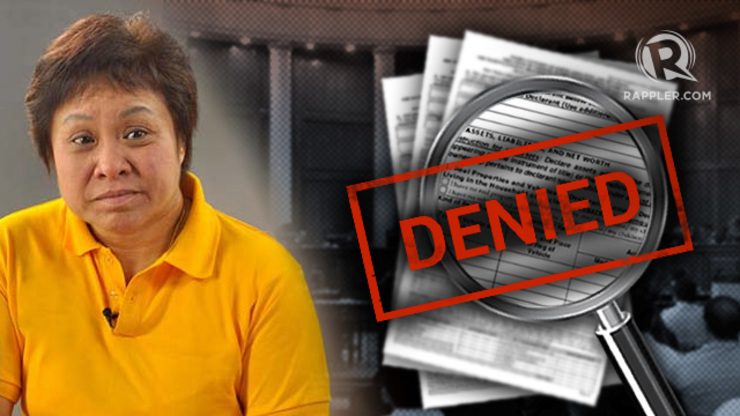

MANILA, Philippines – Citing limitations in the power of the Bureau of Internal Revenue (BIR), the Supreme Court (SC) denied with finality the request of Commissioner Kim Henares to access the Statement of Assets, Liabilities and Net Worth (SALNs) of incumbent justices in 3 different courts.

In its en banc session Tuesday, August 26, the SC issued a resolution junking Henares’ motion for reconsideration in relation to her request for SALNs of justices of the SC, the Court of Appeals (CA), and the Court of Tax Appeals (CTA) for the years 2003 to 2012.

Her request – dated February 10 and received by the SC last March 13 – was “for tax investigation purposes.”

The SC resolved that the information she sought can be accessed after an “assessment of tax deficiency.”

The SC resolved that the BIR’s power to evaluate tax compliance “should never be construed to authorize the conduct of a fishing expedition to hunt for any supposed tax liability.”

The High Court said Henares failed to specify the details of her cited investigation.

“Because fraud is never presumed and must be alleged and proven, the Court found it incredulous that the CIR (Commissioner of Internal Revenue) seems to imply that all the Justices of the SC, the CA and the CTA are being investigated for tax fraud,” read a media briefing sent out by the SC Public Information Office.

Selectivity in requests for SALNs

The SC also “found it curious” why Henares’ request does not cover justices of other courts, including the anti-graft court Sandiganbayan and the first-level courts.

“While the CIR claimed that her interest was to ensure tax compliance by members of the judiciary, she showed no interest to seek the SALNs of the other members of the judiciary,” the SC PIO said.

The SC noted that the 3 courts whose justices she sought investigated have jurisdiction over cases involving the BIR.

In her request, Henares cited the conduct of a probe into an alleged fixer known as “Ma’am Arlene” in the judiciary.

“Ma’am Arlene” allegedly specialize in fixing cases involving big corporations lodged in trial courts in Manila and other major cities.

Limits in the BIR’s power

“The Court noted that the powers bestowed on the CIR are not absolute,” the document further read.

The SC noted that a 3-year limit is imposed for the assessment of internal revenue taxes under Section 203 of the Tax Code.

On the other hand, a 10-year limit is imposed for cases where there are no tax return filed or where there is a false or fraudulent tax return with intent to evade tax.

The SC said “the request is silent as to the facts and the law on which she based her finding of fraud, to justify the application of the 10-year prescriptive period.”

Henares’ request covers a period of 9 years from 2003 to 2012. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.