SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – Despite the uncertainties created by the eurozone crisis, bond markets in emerging countries in Asia, including the Philippines, are growing.

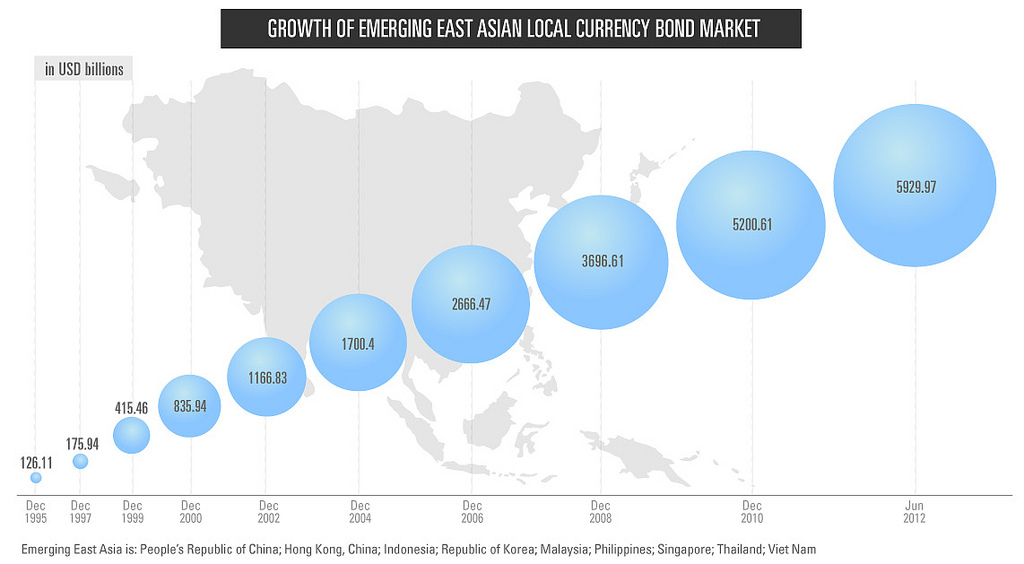

In the latest Asia Bond Monitor report, the ADB said emerging East Asia’s local currency (LCY) bond markets have grown to nearly $6 trillion.

The Manila-based multilateral development bank said in the Philippines, the LCY bond market posted a year-on-year growth of 12.4% to P3.7 trillion or US$87 billion by the end of June.

The ADB said the Philippines had the fastest-growing corporate bond market in the second quarter of the year with the $12 billion market 11.5% bigger than it was at the end of March.

Philippine banks, it said, tapped the bond market to improve their capitalization and liquidity ratios in advance of the adoption of the Basel III regulations on 1 January 2012 with other issuance notably from real estate, telecommunications, tollway operations, and brewer firms.

“Our local currency bond markets are emerging as a safe haven in the midst of the crisis, but we should not be complacent,” ADB Office of Regional Economic Integration Head Iwan J. Azis said.

“Volatile markets can deter long-term investment and hurt the economy by making it costlier for governments and companies to raise funds. Moreover, uncertain market reaction to policy action is undermining the predictability and thus the effectiveness of conventional policymaking,” he added.

Impact of Lehman Brothers

The ADB said that compared to the Eurozone crisis, the Philippine bond market was threatened more by the collapse of Lehman Brothers in 2008.

The collapse of Lehman Brothers in the United States began the US Subprime crisis. It escalated into the Global Financial Crisis (GFC), dubbed the worst crisis since World War II.

The ADB said the 2008/09 Lehman crisis saw government bond yields in the Republic of Korea, Malaysia, and Thailand increase by as much as 2 percentage points, while those in Indonesia rose as much as 9 percentage points and the Philippines by 4 percentage points.

“During the 2008/09 crisis the most significant shock spillovers came from the US high-yield corporate bond market. The most affected markets were those of the Republic of Korea, Malaysia, and the Philippines,” the ADB said. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.