SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – Finance Secretary Carlos Dominguez III downplayed the impact of the ABS-CBN shutdown on investor sentiment, saying that the matter is “strictly” up to Congress.

“We have not seen any direct result of a slowdown in investment because of the ABS-CBN issue,” Dominguez said in a virtual press briefing on Wednesday, July 8.

His statement counters findings of Fitch Solutions Country Risk & Industry Research, which said that the cease and desist orders against the Lopez-run media giant were tantamount to “politicization of telecoms services in the Philippines,” which in turn made potential foreign investors stay away.

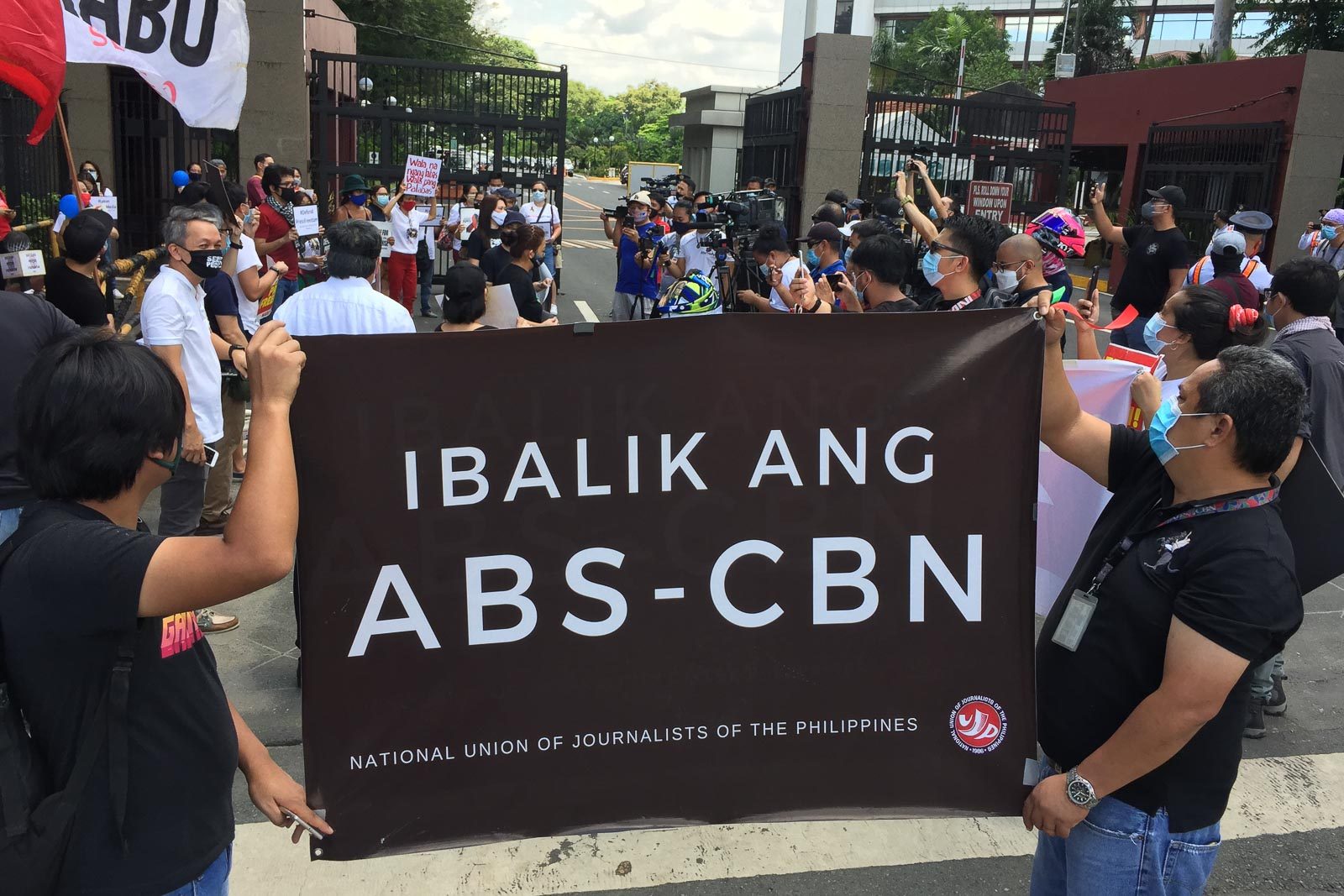

“The forceful termination of ABS-CBN and Sky’s broadcasts are highly politicized, and clearly linked to President Rodrigo Duterte’s opposition toward ABS-CBN,” the Fitch Solutions report said.

“The regulator’s apparent ability to be influenced by the government continues to be a key impediment to foreign investor sentiment, and has also made the telecoms landscape difficult for both new entrants and existing players.” (READ: Scenarios: What happens to ABS-CBN franchise after House panel vote?)

Dominguez said, however, that the slowdown in investments can be attributed to the coronavirus pandemic.

“Most companies around the world, here and abroad, are keeping their money…in case they experience slump in demand or any other problems with their own companies,” he said.

Dominguez went on to point out that the Philippines was able to raise $2.35 billion in a bond sale, around the same time when Congress was deliberating on ABS-CBN’s fate.

“That is an investment in the Philippines, and that happened during this issue with ABS-CBN. I think our bondholders…are very confident in the Philippine economy,” he said.

The Makati Business Club earlier urged Congress to renew the network’s franchise, adding that “equal treatment of all companies – especially by regulators, prosecutors, and lawmakers – will signal that rule of law prevailed, encouraging foreign and local investors at a time when we most need their help to create new jobs.”

Numbers

Foreign direct investments (FDI) saw a contraction in the 1st quarter of 2020, down by 14.2% to $1.7 billion from the $1.9 billion in net inflows in the same period last year.

Data from the Philippine Economic Zone Authority (PEZA) also painted a disappointing picture. From January to May, PEZA investments plunged by almost 32% due to the virus crisis, from P43.2 billion to just P29.5 billion. (READ: PEZA to investors: Please don’t leave Philippines)

Meanwhile, “hot money” or foreign portfolio investments have yielded net outflows of $3.1 billion year-to-date.

ABS-CBN and the economy

While Dominguez brushed off the impact of the ABS-CBN franchise issue on investments, its shutdown would definitely not help lift the economy.

The country’s gross domestic product contracted 0.2% in the 1st quarter due to the coronavirus pandemic, while unemployment soared to its highest at 17.7% in April, which is equivalent to around 7.3 million people with no jobs.

Should ABS-CBN permanently close, it would directly affect around 11,000 workers, as well as dependent industries like advertising and production houses.

It would likewise aggravate the country’s widening budget deficit. The national government is expecting a sharp fall in revenue collections, with thousands of business closures, amid rising costs in funding the pandemic fight.

ABS-CBN, among the top taxpayers in the Philippines, paid P71.5 billion in taxes in the past 17 years.

Dominguez said the expected revenue shortfall would be covered by loans, but noted that government borrowing remains “very conservative.” – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.