SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

[“Everything Under the Sun” is an advice column where Sun Life advisors shed light on readers’ most pressing questions, both big and small.]

Dear Teddy,

First off, I must commend you for taking an active role in managing your family’s finances. Your boy should also be proud of you for prioritizing his education. I can just imagine the juggling you do to strike a balance between securing his future and attending to everyday financial commitments. With inflation now at a nine-year high of 6.4%, the price for our long-term goals is also getting steeper.

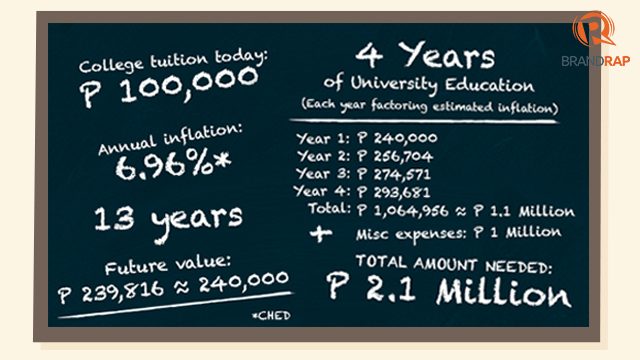

It is every parent’s dream to provide the best education for their kids. The fact of the matter is, Teddy, good education doesn’t come cheap. From the looks of it, tuition fee increase won’t be slowing down anytime soon. In fact, last academic year, the average increase in tuition fees had been at 6.96%; this is just a conservative estimate. With the rising inflation for 2018, we can expect university education to get more pricey.

Don’t fret though. There is a solution to this. You said your son is 4 years old. That’s an ideal age to start preparing since’s he’s still young. In investing for the long-term, time is your greatest leverage. You mentioned that you are not expecting an increase in your salary anytime soon, so that means you’ll have to work with what you have. Clearly, you need to maximize time in preparing for your children’s education.

The educational fund you’ll need largely depends on two things: the school and the chosen course. Tuition fees in top universities are higher, and I.T.-related courses would also be more pricey compared to, say, management courses.

A quick calculation reveals that a P100,000 tuition/year today will be equivalent to approximately P240,000 in 13 years. (This is using the 6.96% increase we discussed above.)

For the next four years, that total tuition fee will reach close P1.1 million. Bear in mind this is just the tuition fee, we have yet to factor in the allowances and other miscellaneous expenses. Add another million, and you get something like P2.1 million as your magic number—just for the education.

The first thing to remember is to secure yourself and your family’s future. For example, a Variable Universal Life (VUL) product with a 10-year limited pay plan can provide insurance coverage, as well as wealth accumulation. The benefit amount should cover your P2.2 million education need so that in the unfortunate event that you won’t be around to see your kid start college, your dreams for them will still happen.

You can leverage on a VUL plan’s cost-efficiency and better returns. Yes, it has an inherent risk since the funds are invested in the stock market, but over the course of a 10-year period, a balanced fund has yielded an average of 9.76%* – higher than both our inflation rate and the tuition fee increase.

Now, you might be thinking: Sounds good, but I might not be able to afford it. Teddy, the most important thing is that you start with the resources you have. It’s better to start with something now, than never start at all!

Take note though that what I’m providing here is just a general view. To properly secure your family’s needs, it is still best to work with a financial advisor.

Remember Teddy, your dreams are bigger than your excuses. And they can’t get any bigger than your kid’s education.

Sincerely,

Kendrick Chua

*Past performance is not indicative of future returns.

Kendrick is a Registered Financial Planner, and has been with Sun Life for the past 12 years. He is also a Chinese language instructor, event host and violinist.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.