SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – Money sent home by overseas Filipinos in November 2016 saw the highest growth in over 8 years and a rebound from a month ago, data from the Bangko Sentral ng Pilipinas (BSP) showed.

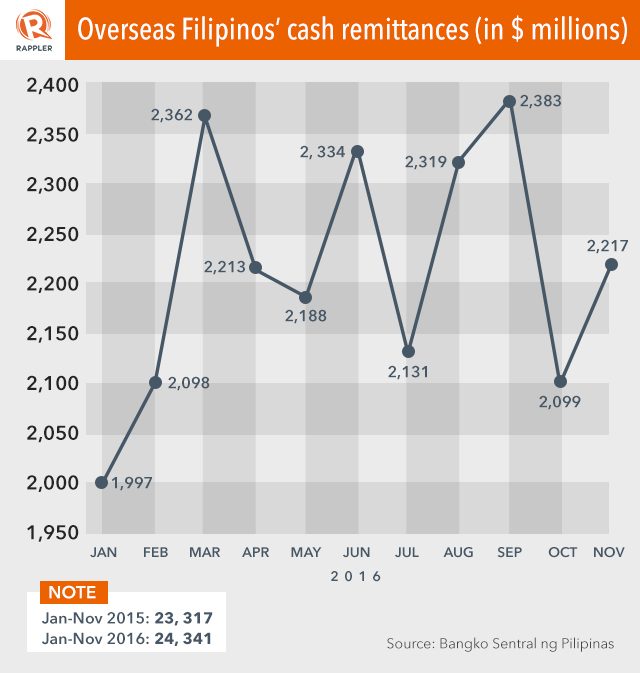

BSP said in a statement on Monday, January 16 that remittances spiked by 18.5% to $2.22 billion in November, the fastest growth since July 2008 and a rebound from the 2.8% decline posted in October 2016.

“This brought the cumulative remittances level for the period January-November 2016 to $26.9 billion, representing a growth of 5.1% year-on-year,” BSP Governor Amando Tetangco Jr said.

The BSP said “improving global economic conditions, particularly in the US, may have contributed to the overall growth in remittances.”

According to Tetangco, the increase in personal remittances was driven largely by the 7.8% expansion in transfers from land-based workers with work contracts of one year or more to reach $20.9 billion. (READ: OFW remittances see highest growth in over two years)

BSP said this offset the 3.6% decline in remittances from sea-based and land-based workers with work contracts of less than one year totaling $5.5 billion.

Bulk from US, Saudi, UAE

Ahead of the holiday season, BSP said cash remittances from overseas Filipinos coursed through banks in November grew by 18.5% to $2.2 billion, with bulk coming from the US, Saudi Arabia, the United Arab Emirates, Singapore, the UK, Japan, Qatar, Kuwait, Hong Kong, and Germany.

This brought the January-November 2016 cash remittances to $24.3 billion, a 5.2% increase from the 2015 level. (READ: Economists expect remittance growth to slow down)

Standard Chartered Bank had said about a third of remittances originate from the US, while 10% are from Saudi Arabia, and 7.8% from the United Arab Emirates.

It added that remittances, business process outsourcing (BPO) receipts, and electronics exports support the country’s current account surplus. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.