SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – The Philippine unit of Japan’s second top automaker Honda Motor Company raised prices for most models following the implementation of new excise tax rates.

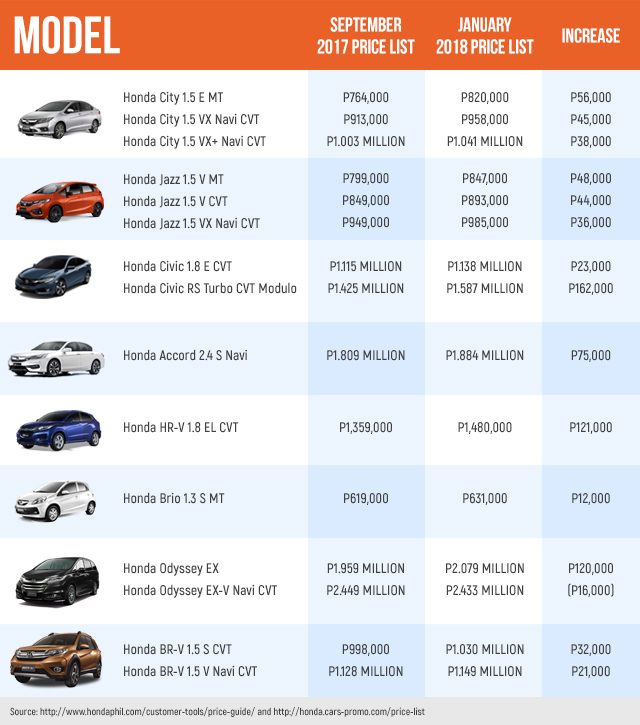

Honda Cars Philippines Incorporated on Wednesday, January 3, posted on its official website an updated price list, reflecting increases for all models below premium levels.

For instance, a Honda City 1.5 E MT vehicle can now be bought at P820,000, which is P56,000 higher than its price last September.

Customers who bought a Honda HR-V 1.8 EL CVT in 2017 will also be glad to know that they were able to save P121,000. From last year’s suggested retail price (SRP) of P1.359 million, the unit is now worth P1.480 million.

Premium models cheaper?

But while most Honda models are priced higher this year than in 2017, some premium models maintained their rates or even decreased a bit.

For instance, the Honda Odyssey EX-V Navi CVT is now at P2.433 million, a P12,000 decline from last year’s P2.449 million.

AutoIndustriya also reported that the leaked 2018 price list of Toyota shows prices dropping for the Land Cruiser – from P272,000 to P350,000 less – and most of the Prado variants – P202,000 less. In contrast, Toyota’s more affordable Vios 1.5G AT is now P26,000 higher than the 2017 SRP.

The newly-implemented auto excise tax rates under the Tax Reform for Acceleration and Inclusion (TRAIN) law were supposed to mainly impact the wealthy who can afford to buy luxury cars. But the new price list of Honda Cars Philippines shows otherwise.

This is because the proposal of the Department of Finance (DOF) for auto excise tax rates was not followed. Under the DOF proposal, vehicles worth more than P2.1 million would be taxed P1.024 million and 120% in excess of the P2.1 million.

But under the Congress-approved TRAIN, vehicles worth between P1.1 million and P4 million will be taxed 20% of the SRP. (READ: [OPINION] How lawmakers gifted themselves with tax cuts on luxury cars) – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.