SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – The Securities and Exchange Commission (SEC) said it is not taking a hardline stand on Initial Coin Offerings (ICOs) despite ordering businessman Joseph Calata and 3 firms linked to him to stop its ICO of Krop Coins.

“As far as ICOs are concerned because it involves securities or trading of securities, that’s [under the SEC’s jurisdiction], SEC commissioner Emilio Aquino said at a briefing on Monday, January 29.

While noting that new coin offerings are susceptible to volatile price swings as well as fraud, Aquino pointed out that popular crypto-currencies such as Bitcoin and Ethereum have proof of stake and represent investment opportunities for Filipinos.

“We are not ready to come out with a direct ban on crypto currencies… Despite all this, you have to be extra careful about how the investors in this new space are protected. That’s where we are coming from,” he added.

Aquino also pointed out that regulatory agencies all over the world are struggling to keep abreast of ICOs noting that there were over 2,000 ICOs all over the world and that only the State of New York has regulations in place governing them.

“We have to be extra careful and have really hands-on involvement especially at this stage. Later on, 10 years from now, we’ll probably know how it works but as s it is now we are really just starting,” he added.

“We can’t say right now whether it will be a memo circular but I would like to believe it will be a separate set of regulations,” he added.

Blocking Krop coins

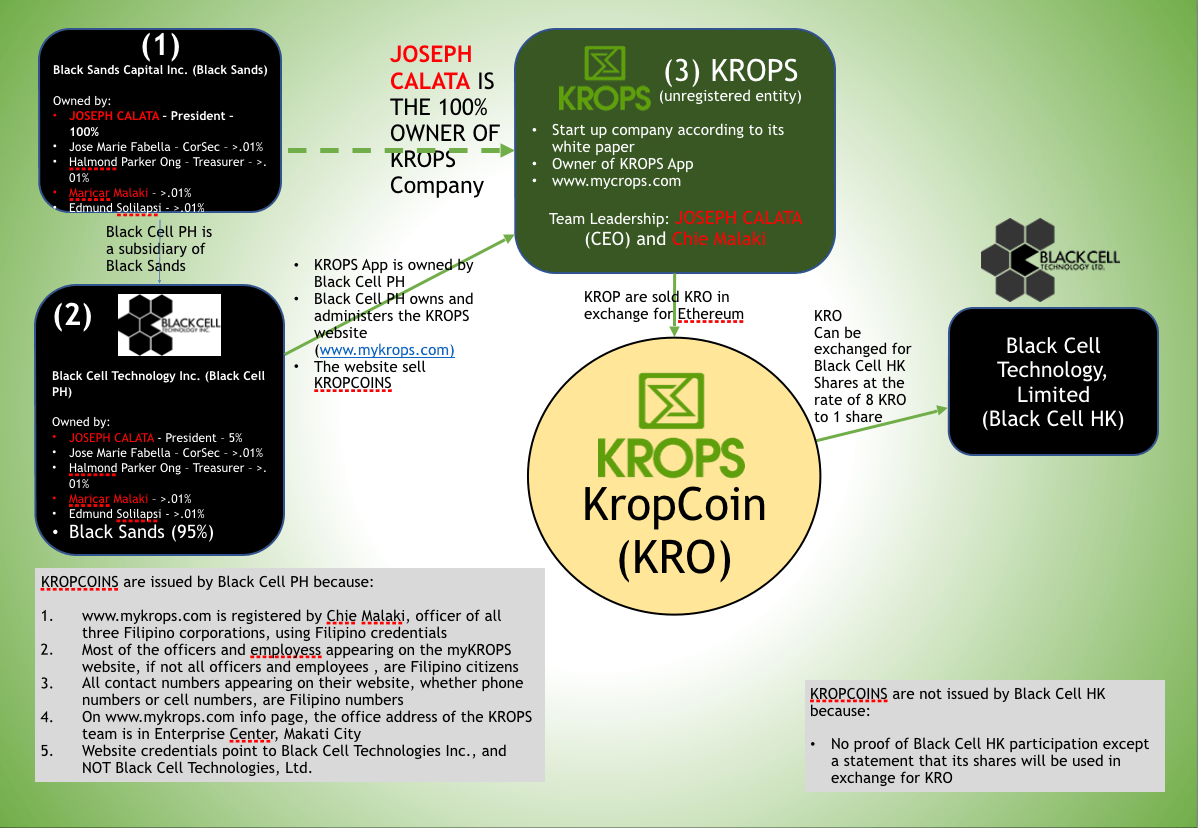

The SEC last week issued a cease and desist order to Calata-led startup KROPS to stop it from offering Krop Coins on the basis that it was not registered with the SEC.

“There are actually transactions based on their own admissions in the white paper [submitted to the SEC] so we had to act. In short, there are actual offers of securities,” Aquino explained.

Calata meanwhile has argued that it is incorporated in Hong Kong as a private enterprise and that is beyond the jurisdiction of the SEC. (READ: Calata plans to convert shares to cryptocurrency amid delisting)

The KROPS website also carries a message from Calata noting that “the firm has sold 2.4 million tokens out of 6.4 million offered coins since our recent launch”.

Aquino maintained however that the offering is illegal since it was not registered with the SEC.

The SEC commissioner further added the team behind KROPS – Black Cell PH – will have 5 days to sit down with the SEC if they want to get the cease and desist order lifted. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.