SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

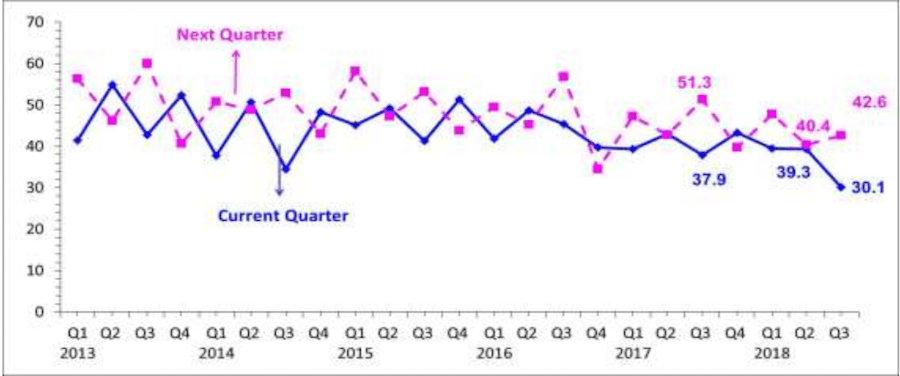

MANILA, Philippines – Businesses’ outlook on the economy for the 3rd quarter of the year dipped to 30.1%, the Business Expectations Survey (BES) of the Bangko Sentral ng Pilipinas (BSP) showed on Thursday, September 6.

The decline was the lowest level since the 1st quarter of 2010.

Respondents of the survey, which were drawn from the country’s top corporations, attributed their weaker sentiment for the quarter to:

- The increasing prices of basic commodities in the global market, augmented by the effects of the Tax Reform for Acceleration and Inclusion (TRAIN) law on prices of domestic goods

- Rising overhead costs and lack of supply of raw materials

- Seasonal factors such as interruption of business activities and lower crop production during the rainy season, slack in consumer demand as households prioritized enrollment expenses, as well as the suspension of commercial fishing in the Davao Gulf from June to August

- Weakening peso

- Stiffer competition

The sentiment of businesses in the Philippines mirrored the less buoyant business outlook in Canada, Chile, Hong Kong, the Netherlands, New Zealand, South Korea, and the US. But it was in contrast to the more bullish views of those in Australia, Brazil, Denmark, Greece, Hungary, and Mexico.

The survey also showed that businesses anticipate inflation to further increase, the peso to depreciate, and interest rates to go up for the current and next quarters.

The wholesale and retail trade sector registered the biggest decline in confidence. Trading firms also cited stiffer competition and effects of weather disturbances as reasons for their less favorable outlook.

Likewise, the services sector turned less upbeat but continued to be favorable for the current quarter.

“Their less optimistic sentiment emanated from the financial intermediation, real estate, and transportation subsectors. The views of firms from these subsectors were generally affected by concerns over high interest rates and the unfolding trade war between the US and China,” the report states.

Meanwhile, industry firms were concerned over “lower export orders, lack of raw materials, annual overhauling of machineries, and closure of high seas in the international waters for fishing activities.”

Construction firms were less upbeat due to fewer construction activities during the rainy season as well as increasing costs of components and maintenance of machinery.

The outlook of importers, domestic-oriented and dual-activity firms for the current quarter was affected largely by lower consumer demand during the rainy season.

Meanwhile, exporters expressed concerns “over the disruption in normal operations, resulting from annual plant overhauling and port congestion issues as well as reduction in export orders.”

However, businesses turned more upbeat for the 4th quarter. Confidence rose to 42.6% from 40.4% in the previous quarter’s survey results, suggesting that “growth may be sustained in the last quarter of 2018.”

The survey was conducted from July 2 to August 29, and involved 1,466 firms surveyed nationwide drawn from the combined list of the Securities and Exchange Commission’s top 7,000 corporations in 2010 and BusinessWorld’s top 1,000 corporations in 2016. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.