SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

How do the various taxes affect the food that I eat? For instance, if I were involved in food processing, what would be the taxes that I would pay?

There are several steps before your food is served in front of you. Mainly, there is production, processing, and distribution. Each stage requires the payment of different taxes. During the production phase, raw materials are generally subject to value-added tax (VAT) except for agricultural and marine products (raw materials for food production) which are VAT-exempt. But income payments of top withholding agents made to suppliers of agricultural products are taxed through expanded withholding tax.

During the second phase, several taxes are imposed indirectly due to either the equipment or the company’s taxes. The excise tax on fuel (due to energy consumption) and VAT affect the usage and purchase of these food manufacturing equipment. For the company’s taxes, there is either VAT or percentage tax and, of course, income tax.

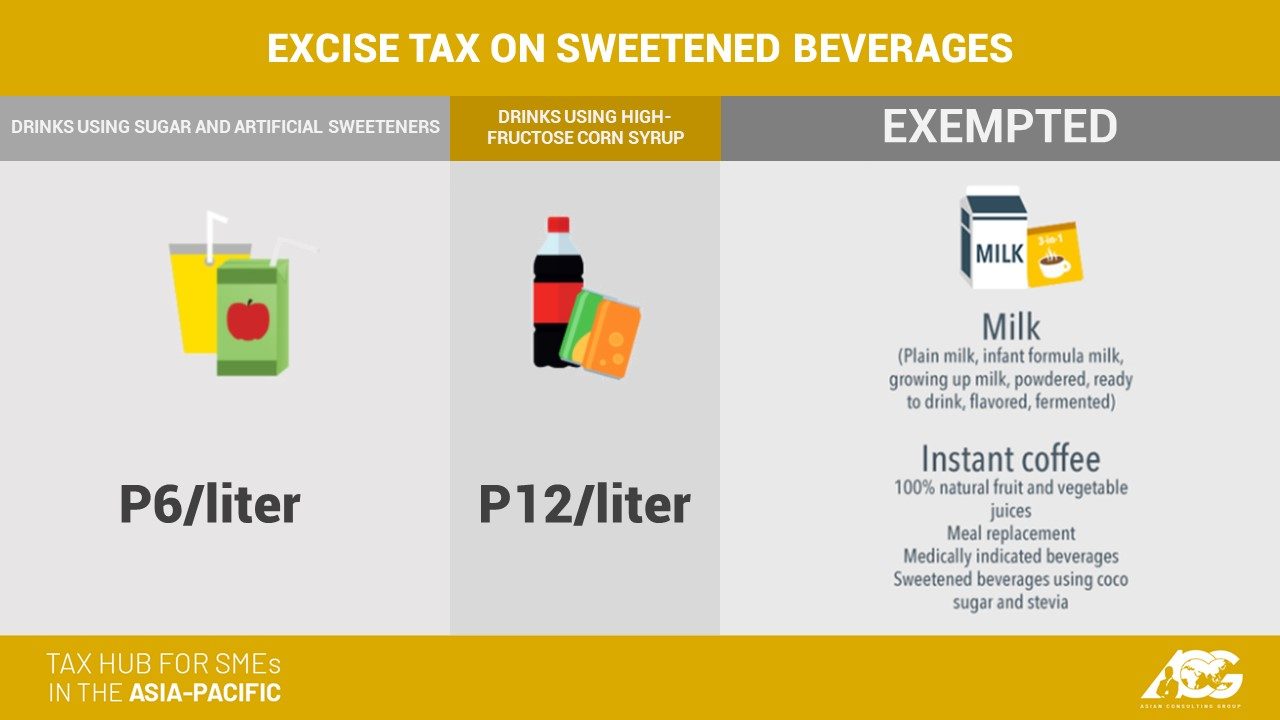

If the product is a sugar-sweetened beverage, the excise tax will need to be paid before it can be distributed (see below).

For the distribution phase, only the recent excise tax on fuel affects the food manufacturing process.

Once it is delivered to wholesalers, retailers, and even the food service industry, it will be subject to VAT for sale of goods.

When do these taxes need to be paid? What are the forms to be used?

Expanded withholding tax needs to be paid using Bureau of Internal Revenue (BIR) Form No. 1601E on or before the 10th day of the following month. For payments to suppliers of agricultural products, the Alphanumeric Tax Code would be WI 610 for individuals and WC 610 for corporations.

The excise tax on fuel should already be paid by the suppliers of the fuel products and would no longer need further action on the part of the food manufacturer. However, for manufacturers of sugar-sweetened beverages, they will need to follow the instructions laid out by Revenue Regulations No. 20-2018.

VAT needs to be paid using BIR Form Nos. 2500Q and 2550M, while percentage tax uses BIR Form No. 2551Q. Income tax is paid using BIR Form No. 1702.

These forms and deadlines are the causes of confusion and, inevitably, penalties. While these penalties are often very little, they could also increase exponentially due to the nature of the BIR’s penalties. This problem can easily be fixed by learning about taxes.

As the Philippines’ First Tax Hub, the Asian Consulting Group offers regular tax seminars, tax consultations, and tax coaching sessions to all interested taxpayers. To learn more about how we can help you, you can reach us via consult@acg.ph or call us at (02) 622-7720. – Rappler.com

Mon Abrea, popularly known as the Philippine Tax Whiz, is one of the 2017 Outstanding Persons of the World, a Move Awards 2016 Digital Mover, one of the 2015 The Outstanding Young Men of the Philippines (TOYM), an Asia CEO Young Leader of the Year, and founding president of the Asian Consulting Group (ACG) as well as the Center for Strategic Reforms of the Philippines (CSR Philippines). You may email him at consult@acg.ph or visit www.acg.ph for tax-related concerns.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.