SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – If the Philippines aims to sustain the high economic growth it posted in 2012, then ways to stem the appreciation of the peso should be put in place.

In its latest edition of Market Call released on Wednesday, February 20, the FMIC and UA&P Capital Markets Research Center joined a growing call on the government to watch out for the impact of a strong currency.

The center stressed that the appreciation of the peso is the single biggest threat to attaining long-term economic growth for the Philippines.

The strong peso poses a ‘serious threat’ to exports, remittances Overseas Filipino Worker (OFW) remittances, and the Business Process Outsourcing (BPO) industry. The 3 sectors collectively comprise 80% of the Philippine economy.

“Despite the double-edged nature of the peso appreciation, we remain upbeat about the economy for the near-term,” Market Call stated.

“There’s a fly in the ointment for the long-term sustainability of the growth, which is the peso’s appreciating trend. This is because it puts exports, business process outsourcing industry, and OFW remittances under serious threat,” it added.

BSP intervention

Market Call stated that the Bangko Sentral ng Pilipinas (BSP) has ‘often intervened’ to prevent the peso from breaching the P40 to the dollar level. Breaching this exchange level could significantly lower the peso incomes of OFWs, exporters, and the BPO industry.

This is one of the key reasons why the BSP incurred a P78.4 billion-worth net loss as of October 2012. Market Call stated that of this amount, some P41.4 billion was spent on dollar purchasing.

But even with the intervention of the BSP, the peso continued to appreciate. Market Call stated that the actual daily exchange rate is below the 200-day and 30-day moving averages (MAs).

“Standard & Poor’s (S&P) credit upgrade of the Philippines from BB+ ‘stable’ to BB+ ‘positive’ provides a favorable setting for the Philippine peso. The 13X record high of the PSEi in January alone also lifted the value of the peso,” Market Call stated.

“The weaker-than-expected US housing data and the uncertain recovery in the Eurozone further strengthened the stance of peso against the greenback,” it added.

However, the think tank said it is confident that the BSP will be active in tempering peso appreciation. It said that in January, the Central Bank announced that it will consider dollar-borrowing to tame the peso’s appreciation.

Overall, Market Call stated that economic growth in the first quarter will remain strong and could even be stronger than the 6.8% Gross Domestic Product (GDP) growth posted in the 4th quarter.

This will be fueled by government spending focused on infrastructure, as well as heightened election-related spending in the first quarter or the January-to-March period, and part of the second quarter or the April-to-June period.

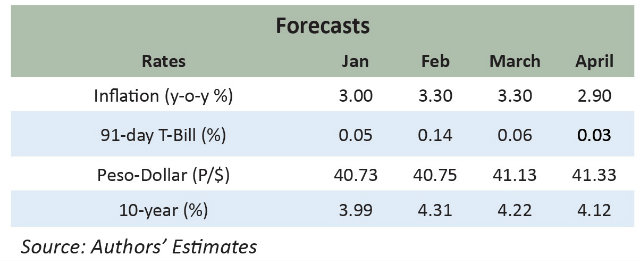

“Stable food prices as a consequence of better harvests and less devastating typhoons will offset the slight temporary upswing in crude oil prices and bring inflation rates for Q1 (first quarter) in the low 3% level, and back to below 3% in Q2 (second quarter),” it added. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.