SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

I am an employee who started working in my current company in November 2018. Before that, I was employed in a different company until October 2018. Do I need to file an income tax return (ITR) this coming April 15?

Yes. Having two employers within the same year – whether successive or concurrent – will disqualify you from substituted filing. Normally, substituted filing is what exempts employees from personally filing their income tax returns.

Section 51-A of the Tax Code clearly defines what substituted filing is and who are qualified to avail of it. The only ones qualified for substituted filing are individuals:

- who receive purely compensation income, regardless of amount

- who only has one employer within the calendar year

- whose income tax has been withheld correctly by the employer

For those that do qualify for substituted filing, Bureau of Internal Revenue (BIR) Form No. 2316 given by your employer counts as your ITR.

How do I file an ITR for employees? Which form should I use?

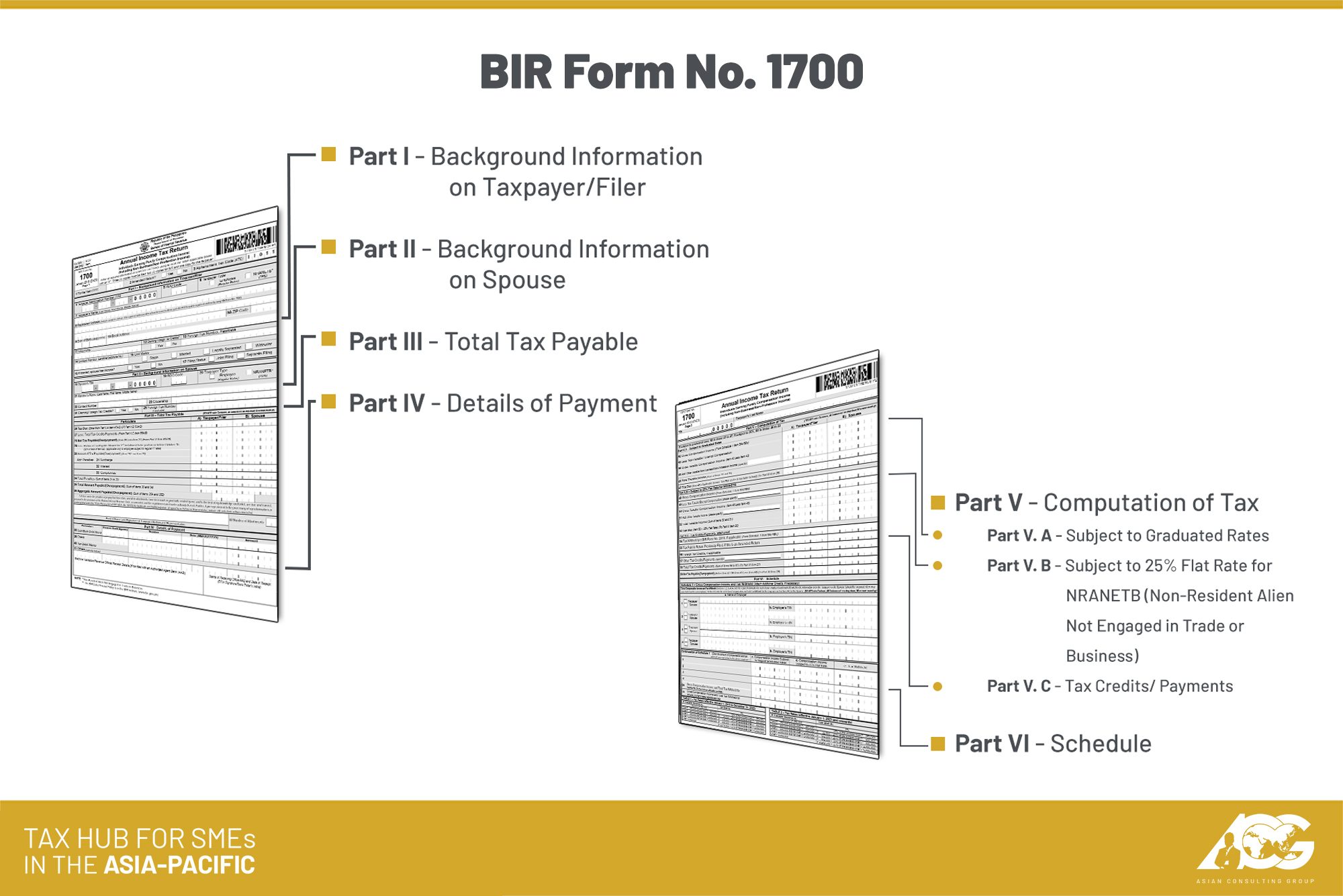

The BIR has released the updated annual ITR form for employees under Revenue Memorandum Circular No. 19-2019. The new form is now only 2 pages long compared to the previous version’s 4 pages. It features the changes brought by the Tax Reform for Acceleration and Inclusion law such as for income tax rates and exemptions.

The form can be divided into 6 parts.

The new BIR Form No. 1700 can only be filed manually since it’s not available via eFPS or eBIRForms. To file manually, the taxpayer only needs to download the PDF version of the form from the BIR website and completely fill out the applicable fields.

If there are any tax dues, then it must be paid at authorized agent banks (AABs) or, if there are no AABs, the revenue collection officer.

With only one month to go, taxpayers need to prepare their tax returns now. If there are any deficiencies or errors, then they can be addressed immediately. On March 22, the Tax Whiz Academy will be holding an ITR Helpdesk at its monthly Tax Hub Talks. After the helpdesk, there will also be a talk about ITR filing, starting a business, and the ease of doing business. Those interested can register now at tinyurl.com/ACGTaxHubTalks. – Rappler.com

Mon Abrea, popularly known as the Philippine Tax Whiz, is one of the 2017 Outstanding Persons of the World, a Move Awards 2016 Digital Mover, one of the 2015 The Outstanding Young Men of the Philippines (TOYM), an Asia CEO Young Leader of the Year, and founding president of the Asian Consulting Group (ACG) as well as the Center for Strategic Reforms of the Philippines (CSR Philippines). Assisting him in his column is JM Miñano, communications associate of ACG. He graduated with a bachelor’s degree in Communication Arts from the University of the Philippines Los Baños.

For inquiries, you may email consult@acg.ph or visit www.acg.ph for tax-related concerns.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.