SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

The deadline for income tax return (ITR) filing is fast approaching. How do I file my returns? Can I already do it online? What about payment?

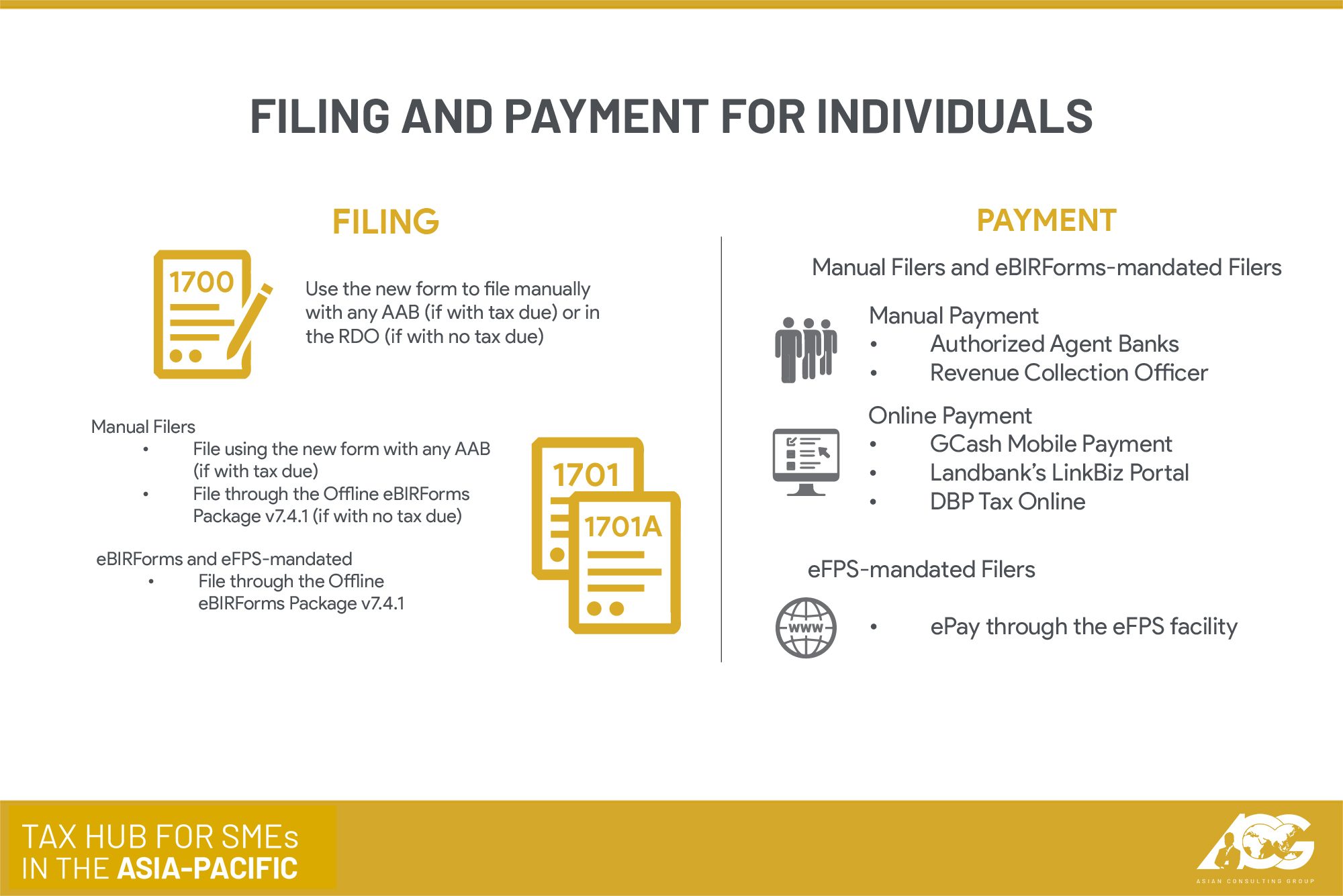

There are 3 options for filing open to all taxpayers – manual, eBIRForms, and Electronic Filing and Payment System (eFPS).

With manual filing, the taxpayer has to print the form, fill it out, and submit it in person to the Bureau of Internal Revenue (BIR).

The next method of filing is through the eBIRForms. Through this platform, the tax return can already be submitted to the BIR online.

The last method of filing is the BIR’s eFPS, which is mostly used by those mandated to do so. However, ordinary taxpayers can apply with the BIR to use eFPS. As indicated by its name, using eFPS means the taxpayer can already file and pay his or her returns online.

Certain taxpayers, despite being mandated to use eFPS or eBIRForms, also have the option to file manually (for instance, senior citizens and persons with disabilities).

As for payment, manual and eBIRForms filers have the option to either:

- pay manually (to authorized agent banks or the revenue collection officer)

- pay online (via GCash Mobile Payment, LandBank’s LinkBiz Portal, and DBP Tax Online)

eFPS filers, on the other hand, need to pay via the eFPS facility.

Does the same apply for the new ITR forms? What are the workaround procedures if the new BIR form is not available via a specific platform?

The BIR has released a list of methods for the filing and payment of ITRs. This also includes the workaround procedures for the new ITR forms. For instance, individuals can file through the following methods:

For corporations, generally, the old form can still be used for filing, except only in very specific cases. To learn more, you can visit the Facebook page of the Center for Strategic Reforms of the Philippines. You may also ask your questions in the pinned post by using the hashtag #April15Challenge!

You can also share this video and help CSR Philippines promote the importance of ITR filing. Those interested can also attend free ITR helpdesks on April 12 and 15 by registering at tinyurl.com/ACGTaxHubTalks.

For more questions, you can reach us at consult@acg.ph or (02) 622-7720. – Rappler.com

Mon Abrea, popularly known as the Philippine Tax Whiz, is one of the 2017 Outstanding Persons of the World, a Move Awards 2016 Digital Mover, one of the 2015 The Outstanding Young Men of the Philippines (TOYM), an Asia CEO Young Leader of the Year, and founding president of the Asian Consulting Group (ACG) as well as the Center for Strategic Reforms of the Philippines (CSR Philippines). Assisting him in his column is JM Miñano, communications associate of ACG. He graduated with a bachelor’s degree in Communication Arts from the University of the Philippines Los Baños.

For inquiries, you may email consult@acg.ph or visit www.acg.ph for tax-related concerns.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.