SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

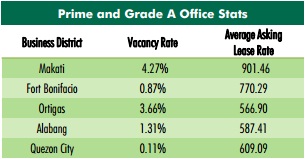

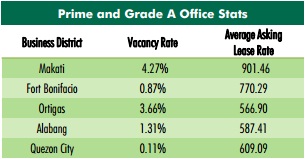

MANILA, Philippines — Multinational and business process outsourcing (BPO) companies moving to prime or Grade-A locations in Metro Manila pulled overall office vacancy rate to 2.51% in the second quarter from 3.21% in the first.

In the latest Metro Manila Marketview, real estate advisory firm CBRE Philippines said the decline in vacancies in the metropolis resulted from majority of BPO firms setting up shops in “reasonably priced locations” and global firms favoring “brisk expansions and cost-sensitivity.”

Read: BPO industry office space to double by 2017, CBRE reports

Prime office spaces in the Makati Central Business District (CBD) continued to attract multinational corporations causing vacancy rate to decline to 4.27% in Q2 from 5.07% in the previous quarter. Below is the performance of the Makati CBD office market:

- BPO firms offering higher-value services had taken up available prime spaces, the strong demand pushing average lease rates up to P1,041.05, a 1.25% quarter-on-quarter growth

- Grade A offices’ vacancy rate slightly increased to 2.83% from 2.44% in the previous quarter. Increased vacancy, however, did not affect average lease rates, which inched up to P783.97

- Two new buildings added office spaces, which may have helped boost average lease rates for Grade A spaces

- Average lease rates for the entire CBD cost P901.46, a 1.26% quarter-on-quarter increase from P890.27

The alternative location to Makati CBD remained to be Fort Bonifacio, where vacancy rate fell to 0.87% in Q2 from 1.01% in Q1. Below is the performance of the Fort Bonifacio office market:

- The migration of cost-sensitive BPO companies enhanced the competition for office space, augmenting the asking lease price to P770.29 in the second quarter from P763.74

- Tightening supply would ease in the remaining quarters with the upcoming turnover of an additional 159,389 square meters of office spaces

Ortigas CBD recorded the highest decline in vacancy rate, with only Robinsons Cyberscape Beta and 45 San Miguel offering additional office spaces in the coming months. Vacancy rate in this CBD plunged to 3.66% from 5.04% in Q1. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.